专注于发掘市场新项目宣发/TG:@songdongye1,Jucoin: jucoin.de/zh-CN/accounts/reg…

Hongkong

Joined September 2022

- Tweets 22,370

- Following 1,818

- Followers 22,799

- Likes 21,303

Pinned Tweet

为什么BiyaPay是你的炒币炒股神器?用USDT一键搞定一切!

今天给大家安利一个超级实用的App —— BiyaPay!如果你像我一样,既爱炒币,又想试试炒股,但又怕资金转来转去麻烦,那@BIYAPAYOFFICIAL 绝对是你的救星!

核心就是:用USDT直接炒币+炒股,一举两得,零门槛起步。下面我来详细说说为什么选它!

1. USDT直投全球股票,炒股超简单!

• 直接用USDT 1:1 等额兑换成USD,然后注入股票交易账户。

• 支持美股、港股交易,链上资金无缝衔接证券市场。

• 0开户门槛!不用搞离岸银行那些复杂手续,秒到账,轻量化投资体验。

• 相比传统券商,出入金成本降低超90%,7×24小时实时调拨资金。炒股随时想进就进,想出就出!

在BiyaPay就可以实现手里拿着USDT,不用卖币换法币,就能直接买苹果、腾讯股票。太方便了!

2. 炒币功能强大,合约现货全覆盖!

• 支持200+数字货币和30+法币兑换,包括比特币、ETH等热门币。

• 上线永续合约交易,用USDT做保证金,最高100倍杠杆,玩BTC、ETH合约超刺激。

• Maker零手续费机制!挂单交易零成本,大幅降低费用。

• 现货交易界面直观,新手也能轻松上手。既能炒币增值,又能用收益直接转炒股。

我实测过,兑换速度快,汇款当日到,当日汇。本地化清算节点确保一切顺滑。

3. 出金不冻卡,资金安全第一!

• 合法提现路径:USDT提到BiyaPay,1:1换美元,再提到境外银行卡(Wise、香港、新加坡等),最后汇回内地。透明合规,避免冻卡风险。

• 资金流动清晰,避免OTC那些不明来源的麻烦。

• 平台覆盖190个国家,50万用户,已在美国、加拿大、新西兰等地布局合规牌照。全球市场加持,用着放心!

用BiyaPay出金,虽然有手续费和汇损,但这是为了资金合法化的小代价。相比被冻卡的麻烦,值了!

4. 一站式多资产钱包,场景全覆盖

• 国际汇款、美港股交易、券商出入金、数字货币现货/合约,全都支持。

• 作为多功能平台,不仅是工具,还能让你的资金增值。炒币赚了直接投股,炒股赚了再转币,循环玩转!

总之,BiyaPay让我从单纯炒币升级到炒币+炒股的境界,资金利用率max!我认为BiyaPay非常值得试试。下载App,注册体验一下,绝对不会后悔。

官方推特:@BIYAPAYOFFICIAL

BiyaPay官网:cn.biyapay.com/

BiyaPay注册链接:biyapay.com/re/65067084

#BiyaPay

11 月 7 日@vooi_io 的单日累计交易量突破了 3.62 亿美元大关,这是最近几周的新高!

今天我来给大家说说VOOI的历史走势,从 2024 年中到 2025 年 11 月的增长轨迹,大家请看VOOI是如何一步一步走向高点的!

• 起始阶段(2024 年 7 月 - 12 月):交易量起步较低,每天在 0-2000 万美元之间波动。有一些小幅 spikes(如 8-9 月达到约 1 亿美元),但整体保持低位,显示平台处于早期积累用户阶段。

• 2025 年上半年(1 月 - 6 月):交易量仍相对平稳,低谷期居多,每天多在 5000 万美元以下。偶有小幅回升,但未见爆发性增长。

• 2025 年下半年加速(7 月 - 11 月):从 7 月开始,交易量逐步攀升,9 月出现明显上涨( spikes 达 1 亿美元以上)。10 月进一步放大, spikes 接近 2 亿美元。11 月进入高潮,11 月 7 日单日交易量达到 3.62 亿美元的峰值。根据 DefiLlama 数据,这反映了近期强劲势头:过去 24 小时 3.62 亿美元,7 天 14.11 亿美元,30 天 45.56 亿美元。

从近零起步,到 2025 年底爆发式增长,交易量增长了数十倍。累计交易量已超 159 亿美元,显示平台从边缘化到主流化的转变。

我觉得 VOOI 的增长看起来很扎实,尤其在 2025 年下半年,这种爆炸式上涨不是巧合——DeFi 市场整体回暖,加上 VOOI 的聚合器模式,吸引了更多交易者。单日 3.62 亿的 ATH 证明了其流动性改善和用户粘性增强。如果能维持这种势头,结合 Telegram Mini App 等创新,VOOI 有潜力成为永续合约领域的领跑者。

#Vooi

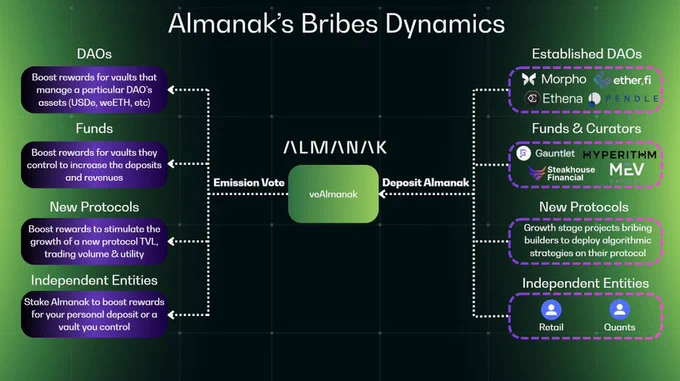

参与一个项目的前提,你需要去了解这个项目!所以今天我将根据@almanak 的白皮书内容给大家说说Almanak的核心目标和愿景。话不多说,咱们直奔主题!

首先我们说说Almanak的使命!

Almanak的使命是民主化金融智能访问,让个人用户在AI主导的金融系统中有效竞争。DeFi市场越来越复杂,信息爆炸、技术加速、执行难题让散户处于劣势,而机构却占尽便宜。Almanak通过AI代理平台解决这些痛点,提供非托管、安全、许可less的工具,让用户像机构一样构建、训练和部署高级策略。

关键原则包括:

• 抽象复杂性:统一处理300+区块链和4000+ DeFi协议的碎片化。

• 金融智能:用AI发现和优化机会。

• 隐私保护:策略私有,使用TEE(可信执行环境)守护你的“alpha”。

• 许可less & 非托管:遵循DeFi精神,“Not your keys, not your coins”。

• 安全第一:结合链上/链下最佳实践,避免欺诈。

白皮书直言:"Almanak的以代理为中心的平台直接解决了这些差异,使用户能够通过机构级的AI代理构建、训练和部署先进的财务策略。"

然后我们说说Almanak的愿景!

Almanak不止是工具,更是革命化金融参与**的先锋!他们梦想创建一个AI驱动的去中心化生态,让个人用户与机构平等竞争,吸引数百万新人入场。平台融合策略基础设施与AI代理群,实现从idea到部署的全流程自动化。

愿景亮点:

• 平等竞争:散户也能用AI生成盈利策略,超越传统局限。

• 全球扩展:从DeFi扩展到现实资产、退休账户,甚至中心化交易所集成。

• 未来展望:通过AI加速策略开发(每秒50-100行代码,处理万亿字节数据),让金融更智能、更包容。

白皮书结尾强调:“我们的愿景不仅仅是将获取金融情报的途径民主化。我们的目标是让数百万用户进入去中心化的金融市场,改变个人参与这些生态系统并从中受益的方式。”

最后我们说说Almanak的具体目标!

项目目标聚焦于构建代理中心平台,用AI Swarm(18个代理分成3队:策略团队、Alpha搜索团队、优化团队)帮助用户:

• idea与创建:AI处理编码和推理,快速原型策略。

• 评估与优化:回测数千配置,在分叉链环境中模拟。

• 部署与监控:安全执行,隐私保护。

• 激励机制:通过Almanak Token奖励策略创建者和流动性提供者,推动社区治理。

路线图分三阶段:从公测(Phase 1)到TVL达2500万美元并TGE(Phase 2),再到全球零售用户入场和移动App(Phase 3)。最终目标:提供工具让用户优化收益、管理组合,实现财务自由!

希望这些内容能帮你们更加并更快的了解Almanak这个项目,咱们不打没有准备的仗!

#Almanak

这次@useTria 促销活动太火了!

超过4500人申请了超6670万美元的额度!

申请金额超出了原本金额的66倍!

可以说这次Tria在@legiondotcc 的社区轮促销完成的非常完美!

已经申请额度的朋友记得在这两天之内查看一下你的邮箱,以免错过24小时的有效参与时间!

我越来越期待Tria TGE的表现了!

#Tria

We’re humbled.

Tria’s Community Round drew 4500+ applications, $66.7M+ in requests and a 6,671% oversubscription.

Thanks to every believer who applied.

Allocation emails will be sent in the next 24-48 hours. You’ll have 24 hours to confirm allocation and deposit.

Not available to residents of the U.K. or the U.S.

LayerEdge要给TRON网络安装一道“安全门”?

今天看到@layeredge 宣布于TRON达成合作,要为波场高吞吐量生态系统引入锚定比特币链的安全机制。简单说,LayerEdge的验证网络会实时检查TRON链的状态,然后把结果锚定到比特币的PoW安全层。这就像给TRON网络加了道额外的安全门。

说实话我挺好看这次合作的!

虽然TRON在dApp和DeFi上就速度飞快,但快速链的安全总是痛点。现在借比特币的PoW加持,独立验证又不影响性能,简直聪明。这能让TRON对大机构更有吸引力,推动Web3生态更壮大。

这次合作对TRON用户也是一大福音!

• 交易更安全,不用老担心黑客或链崩溃——staking、交易、NFT操作都更安心。

• 开发者也能建更靠谱、可扩展的应用,促进跨链互动。

总的来说,这会加速采用率,让大家玩得更开心。期待后续发展!

@justinsuntron @trondao #TRONEcoStar

USDT on TRON:从线上到街头,真正改变生活!

USDT在TRON网络上的全球采用率正一路飙升!60%的转账金额低于1000美元这说明人们在用它解决日常问题:支付、汇款和资金获取。南非只是一个典型例子,那里的USDT正悄然融入超市和街头小店,成为“安静的金融革命”——就像Tether视频系列中展示的那样。

1. 生活场景中的实际应用:USDT如何落地日常

大家可以想象一下这些真实场景,就能感受到USDT在TRON上的价值。它不只是数字资产,而是帮人省钱、省时、省力的工具,尤其在新兴市场。

• 超市购物支付:在南非的Pick n Pay超市,你买了面包、牛奶和蔬菜,到收银台时,不用现金或信用卡,直接打开手机钱包(如TRON支持的app),扫描二维码,用USDT支付。视频里就展示了这种场景:顾客用手机完成交易,店员确认后瞬间到账。费用低到几乎忽略,比刷卡快多了,尤其适合小额消费,避免了汇率波动带来的麻烦。

• 跨境汇款救急:一个在海外打工的菲律宾人,想给家乡家人寄生活费。传统银行汇款可能要等几天,还扣掉高额手续费。用USDT on TRON,他直接转账到家人的TRON钱包,几秒钟内到手。这种低于1000美元的转账占了大头,正好匹配汇款需求——特别是在非洲或拉美,很多人没有银行账户,但有手机,就能接收资金。

• 街头小贩交易:在巴西或印度的街头市场,小贩卖水果或手工艺品。顾客用USDT支付,避免携带现金的风险。TRON网络的快速确认,让交易像刷微信支付一样顺滑。视频中,南非本地人提到,这让“数字美元”从线上走到线下,帮小生意人扩大了客户群。

这些场景不是科幻,而是已经在发生。USDT on TRON让钱流动得更自由,尤其对那些传统金融触及不到的人群。

2. 数字美元的革新:颠覆传统金融的痛点

USDT作为锚定美元的稳定币,本质上是“数字美元”,它对传统金融体系的冲击是革命性的。传统银行体系往往官僚、低效、高成本,而USDT带来的是去中心化变革。

• 降低成本与速度提升:传统汇款如Western Union,手续费可能高达5-10%,还要等几天。USDT转账费用低廉,即时到账。这直接挑战了银行的中介地位,让资金转移从“奢侈”变成“日常”。

• 包容性金融的突破:全球有17亿人没有银行账户,但大多数有智能手机。USDT让这些人也能参与全球经济——存钱、借贷、投资,不用开账户或证明身份。南非的例子就证明了:在通胀高企的国家,USDT提供美元稳定性,避免本地货币贬值风险。

• 透明与安全升级:区块链记录每笔交易,不可篡改,比传统系统更防欺诈。同时,它打破了地理壁垒:不管你在非洲还是亚洲,都能无缝接入美元经济。这不是取代银行,而是补齐短板,推动金融从精英化转向大众化。

总的来说,数字美元像USDT这样的工具,正在重塑金融规则,让权力从大机构转移到个人手中。

3. TRON网络:普惠金融的全球基石

TRON正成为普惠金融的关键基础设施,就像高速公路支撑交通一样。它不是炒作,而是实实在在的底层支持,推动USDT等稳定币在全球落地。

• 高效与低成本的核心:TRON处理能力强,手续费低,这让它完美适合小额、高频转账。南非只是冰山一角——从拉美到亚洲,TRON支撑了海量USDT流动,帮助新兴经济体接入全球金融。

• 全球包容的作用:在发展中国家,TRON网络让无银行人群也能用上金融服务。视频系列强调,它像“安静革命”一样,悄然改变社区:从支付到储蓄,都更公平。TRON的去中心化设计,确保了可靠性和扩展性,成为连接数字与现实的桥梁。

• 未来潜力无限:随着采用率攀升,TRON不只运载USDT,还支持DeFi、NFT等生态。它在普惠进程中,像水电一样不可或缺,推动经济平等——尤其在非洲这样的地区,哪里传统基础设施薄弱,TRON就填补空白。

总之,USDT on TRON的崛起,标志着金融新时代的到来。它不只是技术,而是真正帮人过上更好生活的工具。

@justinsuntron @trondao #TRONEcoStar

可以说, @vooi_io 的每一次升级都极大地提升了用户体验。以 VOOI V2 的最新版本为例,与之前的版本相比,简直是一次飞跃!

跨链交易极其便捷:过去交易永续合约和RWA时,需要在不同的链之间跳转、使用桥接器、更换钱包,非常麻烦。现在V2采用链抽象技术,一个账户即可完成全链操作,无需桥接,也无需支付gas费。零售新手也能轻松上手,不再受技术门槛的限制。

CEX级用户界面:UI/UX全面优化,路径和导航更加流畅,尤其是在移动终端上。新增的ScrollArea组件使手机滑动体验如同观看短视频般流畅。交易数据来自Hyperliquid和Orderly,速度更快,执行更稳定,无卡顿现象。

高级订单功能解锁:限价单、止盈止损、限价止损等专业工具现已直接上线。过去,DeFi 缺乏这些功能,容易错失良机;现在,它能像中心化交易所 (CEX) 一样精细地控制资金流向,风险管理也更加完善。

零 Gas 费,真正人性化:DeFi 的最大痛点就是 Gas 费。现在 V2 版本内置了免 Gas 费执行功能,开仓和平仓即刻完成,省钱省时,尤其适合频繁交易的用户。

可以说,VOOI V2 的发布标志着 VOOI 正式成为首个 DEX 聚合器。未来的 V3 版本必将更加强大,让我们共同期待!

#Vooi

💰 $JST 价值深度解析!为什么这个TRON上的DeFi宝石被严重低估?

今天来聊聊 $JST ,这个在JUST网络上闪耀的代币。作为TRON生态的核心DeFi玩家, $JST 不只是个治理token,它驱动着整个JustStable和JustLend DAO平台,让用户能轻松借贷、质押和赚取收益。但在当前市场,它的价格和潜力完全不对等——严重被低估了!

首先,JUST网络的基础实力:

• JustLend是借贷协议,TVL稳定增长。

• 还有Grants DAO,已分配超1.8亿美元资金,支持生态项目开发。这不光是烧钱,而是真金白银注入创新,推动整个网络扩张。

• 亮点: $JST 在多米尼加共和国被授予法定数字货币地位(从2022年起生效),这给它加了层合规buff,在全球DeFi中脱颖而出。

$JST 的代币经济学:通缩模式启动!

最劲爆的更新是最近的回购销毁计划。就在2025年10月,JustLend DAO完成了首轮JST回购和销毁:

• 用1770万美元(协议储备的30%)回购并销毁了5.6亿JST,相当于总供应的5.66%!

• 总计划提取超5900万美元用于长期回购销毁,不是一次性噱头,而是基于协议收入的可持续机制。

结果?流通供应从99亿直接缩减,通缩压力上行,推动价格长期上涨。不同于那些补贴式买回,这套机制是真·价值回馈持有者。

为什么低估?

• DeFi增长红利:TRON DeFi TVL今年已超100亿刀, $JST 作为核心受益者,却只占市值一小角。相比其他DeFi token,它的P/E比低得离谱。

• 通缩+治理双buff:销毁机制让持有者直接受益,加上JST用于支付利息、维护费和投票,实用性拉满。未来多链扩展和合作伙伴(如比特币、ETH跨链资产)会放大效用。

总的来说, $JST 不是炒作热点,而是被埋没的价值股。回购销毁刚启动,Grants DAO火力全开,TRON生态如日中天, $JST 不会让我们失望的!

@justinsuntron @DeFi_JUST #TRONEcoStar

现在的offchain资金分配者们在玩“烫手山芋”游戏:互相吹大TVL,隐藏风险,偷偷收割费用,最后让用户来背锅。

而@almanak 现在正在做的就是让任何人都可以变成自己的基金经理,全透明、多链策略,还带AI实时适应。不再是黑箱操作——只需一个提示,就能生成可审计、可验证的策略。

我认为这正是我们需要的DeFi进化。赋能用户甩掉中间人,自己掌控财务命运!

现在可以申请人工智能战略构建器:almanakai.typeform.com/early…

参与候补白名单,你就可以成为自己的基金经理!

#Almanak

The Kitchen is now called the Strategy Builder, Cooks are now Builders /\

We invite everyone to see our very own CTO @0xLars_ showcase the power of the Strategy Builder, as we prepare to whitelist all waitlist applicants.

There is still an hour left before the end of the @useTria community round promotion application!

This is your last chance to get the initial token!

You can choose FDV 100M or 200M. You get the same tokens, but the unlocking methods are different!

Application: legion.cc/app/invest

Hurry up and apply for your quota. This is the last time!

#Tria

FINAL CALL

The Tria Legion community round ends in 3 hours.

Get your application in, or you will miss out.

legion.cc/tria

Not available to residents of the U.K. or the U.S.

一文带你探索 AINFT 代理框架的四大核心组件!

在人工智能快速发展的时代,构建高效、智能的代理系统已成为开发者们的核心需求。AINFT 代理框架(AINFT Agent Framework)作为一款创新工具,正以其模块化和可扩展性脱颖而出。今天,我们就来一文带你深入探索这个多代理系统(MAS)框架,了解它如何帮助你轻松打造智能AI代理和复杂工作流。

框架概述:模块化与可扩展的核心

AINFT 代理框架是一个模块化、可扩展的系统,专为构建智能AI代理和多代理系统(MAS)工作流而设计。它采用层级架构设计,确保每个组件职责清晰,同时提供强大的开发者工具。

这意味着,无论你是初学者还是资深开发者,都能通过这个框架快速实现从本地到分布式执行的各种场景。框架的核心在于其灵活性,能适应不同规模的项目需求,让AI代理的开发变得高效而直观。

四大核心组件:构建代理的强大支柱

AINFT 代理框架通过四个关键API来实现其功能,每个API都针对特定场景优化,共同形成一个完整的生态。下面我们逐一拆解:

1. CORE API:消息传递与执行基础

CORE API 是框架的基石,它支持消息传递、事件驱动代理,以及本地或分布式执行。这意味着你可以轻松处理代理间的通信,确保系统在复杂环境中稳定运行。无论是单机测试还是大规模部署,这个API都能提供可靠的支持,让你的代理系统像钟表般精准协作。

2. AGENTCHAT API:快速原型开发的利器

如果你需要快速原型化AI代理,AGENTCHAT API 就是你的首选。它提供了一个简化的接口,专注于加速AI代理的构建过程。通过这个API,开发者可以跳过繁琐的底层配置,直接进入原型迭代阶段,极大缩短从idea到实现的周期。适合那些追求速度和效率的项目团队。

3. MAGENTIC API:自动化任务处理专家

MAGENTIC API 专注于自动化web浏览、编码任务和文件处理。它能让代理系统智能地执行重复性工作,比如自动抓取网页数据、生成代码或处理文件流。这不仅提升了效率,还减少了人为错误,特别适用于需要集成外部资源的场景,如数据采集或自动化脚本开发。

4. EXTENSIONS API:扩展与集成无限可能

EXTENSIONS API 是框架的扩展引擎,它支持LLM(大语言模型)集成、代码执行以及自定义工具支持。通过这个API,你可以无缝接入各种外部工具和模型,实现高度个性化的代理系统。无论是添加新功能还是优化现有流程,这个API都为开发者提供了广阔的自定义空间。

AINFT 代理框架不仅仅是一个工具箱,它是一个完整的生态,能帮助你从零构建高效的多代理系统。它的层级设计确保了可维护性,而强大的开发者工具则降低了学习曲线。无论你是从事AI研究、自动化开发还是企业级应用,这个框架都能提供强有力的支持。

@justinsuntron @OfficialAINFT #TRONEcoStar

现在已经是十一月份了,距离VOOI V3 的发布也越来越近了。基于 VOOI V2 目前的表现,我非常期待 V3 的到来!这里我给即将发布的 VOOI V3 提一些小建议,希望@vooi_io 能采纳!

我希望在 VOOI V3 中看到的改变:

• 更多资产整合:扩展到更多风险加权资产(RWA),例如商品期货或新兴加密货币项目。使其成为真正的“一站式”市场。

• 提升移动体验:开发原生应用,支持推送通知和指纹登录。不要让PC用户独享这项功能!

• 高级交易工具:点杠杆调整器、止盈和止损自动化以及风险模拟器,以帮助用户更好地管理仓位。

• 社区治理升级:引入DAO投票机制,允许用户参与决定新功能或费率调整。增加激励措施,例如交易挖矿或忠诚度奖励。

以上问题在VOOI V2版本所缺少的。如果即将发布的V3版本能够解决这些问题,那就更好了!

#Vooi

Today, @vooi_io made some updates. This time, it is mainly for UI/UX and some function optimisation. I specially went to experience the updated functions, and it feels really good. Let me tell you how I feel after experiencing it!

• Activity section of the mobile Pro version: After adding this function, the management of orders is much smoother. In the past, it was quite annoying to switch from time to time, but now I can see the activity record at a glance. The experience is like an upgraded efficiency tool, and it is quite cool to use it on the mobile phone without jamming.

• Navigation and information display improvements: This change is a highlight, and the interface of the Pro version is more intuitive. The information layout is clear and will not feel messy. Especially in transactions, the data can be understood at a glance, which reduces the chance of mistakes. The overall fluency has been significantly improved.

• Bug fix of Light version: Some important bugs have been fixed, and the transaction process is more stable. I used to get stuck or flash back occasionally, but now I‘m trying it, and it feels much smooth.

• Wallet balance consolidation: If there are two CA wallets, this function is super considerate. In the past, I did it manually for a long time, but now I can merge it with one click, which saves time and effort.

In addition, the launch and performance optimisation of the new token are also good. It can be said that the function update of VOOI this time is very practical. It solves the pain points of users and makes it more convenient for users to trade. You can also experience the updated VOOI, which is definitely smoother than before!

#Vooi

New batch of VOOI App updates 🔧

📲 More UI/UX updates to VOOI Pro on your mobile - explore new Activity section, manage your orders seamlessly;

👁️ VOOI Pro navigation and information display were significantly improved;

✨ Important bug fixes to VOOI Light - to deliver smoother trading experience;

🪙 In case two CA wallets were emitted, you can now merge the balances in VOOI Portfolio.

Plus new token listings and performance improvements.

🔗: app.vooi.io

接触并研究@almanak 这个项目也有一段时间了,觉得这个项目还是挺值得参与的!作为一个专注于DeFi优化的平台,它用智能代理来帮用户自动构建策略,实现收益最大化、资产管理和自主交易啥的。

同样,他也是非托管的,用户自己掌控资产,还支持多链无缝交互。这是我非常喜欢的!然后我再说说他的一些个优点!

• 收益优化:不用手动写代码,就能跨链搞定高收益策略,省时省力。

• 风险管理:有实时监控和自动调整功能,帮你避开市场坑。

• 隐私控制:TEE技术保护数据,代码可验证,安全感满分。

可以说Almanak降低了DeFi的门槛,让普通人也能玩转量化级别的操作。未来潜力大,所以非常值得关注!

#Almanak

WEEX 自动赚币功能正式上线!让你的资产自动生息!

朋友们,你们还在为闲置资金发愁吗?WEEX的自动赚币来了!简单、高效、无压力——账户里的所有资产都能坐享收益,不用锁仓、不用复杂操作!

核心亮点,一眼看懂:

• 新用户专享:高息年化100% 收益率!新手福利,赶紧来薅羊毛!

• 全账户资产计息:现货、合约资金统统参与,持有 USDT 即可生息,从0.01 USDT起步,0 门槛入门!

• 一键开启,无锁仓:无需申购赎回,灵活存取,高竞争力利率——不放过任何行情机会!

• 每日自动发放:收益实时到账,财富时刻增值,全程无套路,最大化你的收益!

理财从此零束缚!立即开启 WEEX 自动赚币,让你的资产滚动生息,躺着也能赚钱!

#WEEX理财 #自动赚币 @WeexCn

I have been using @useTria for a while, and I have written a lot of articles here to recommend it to you. Today, let me tell you some of my thoughts on Tria, a new self-custody cryptocurrency bank!

According to my personal understanding, Tria is building a gas-free, cross-chain infrastructure, which allows you to trade, earn profits, and even spend in the real world with cryptocurrencies without seed phrases and high handling fees.

I think the Tria project has the following three advantages:

• Real self-hosting, you can control it yourself, without intermediaries!

• With $12 million in institutional financing, there is capital support behind it.

• The BestPath interoperability engine can solve the pain points of cross-chain jumps.

Importantly, Tria is still in the early stage. For us, this is the best opportunity to participate. I will always participate and build!

#Tria

The most discussed project in the market recently is @useTria !

First, Tria got 12 million US dollars in financing, backed by Polygon, Aptos, Wintermute and other bigwigs. Then there is the community sales directly over-sursud by 3000%+ on Legion, and the demand is bursting! Many people are rushing to buy $TRIA!

Tria is not an ordinary wallet. It is a self-escrow ”new bank“. Support zero gas fee cross-chain transactions, Visa card directly swipes cryptocurrencies in 150+ countries, and 6% cash back.

Tria also integrates AI agents, which can automatically optimise the transaction path and automatically compound the income. Coupled with the cooperation with Cookie, Kaito, Mindo and other platforms, content creators and active users are rewarded, and the community activity is as high as a virus.

This high popularity is not hype, but because it solves the pain points of Web3 - complexity and fragmentation. And it has an important impact on the Web3 market!

At present, the users of Web3 are still around 50 million, mainly because it is too difficult to get started. Tria’s chain abstraction makes the multi-chain world like a whole. Users can spend money, trade and earn profits without understanding technical details. The emergence of Tria will bring more ordinary people in, which is estimated to increase the adoption rate of the whole DeFi. In the future, encryption will no longer be a geek toy, but a daily tool.

Moreover, Tria brings encryption into real life through Visa cards and zkKYC. Buy coffee, transfer money across borders, low fees or even zero fees, and you can also use DeFi income for automatic repayment. This is not only convenient for users, but also stimulates crypto circulation - traditional banks have 117 trillion yuan of idle funds. If some of them flow into Web3, the market size can be doubled.

Now Web3 is like a maze. EVM, Solana and Cosmos play their own games. Tria‘s BestPath AVS uses AI to route the best path, compress the cost by 90%, and settle at the sub-second level.

Tria is not chasing the wind, but building infrastructure. It may change the rules of the game silently like Polygon. Web3 has changed from ”technical show-off“ to ”user-first“, and Tria is the pusher.

#Tria

TRON GreatVoyage-v4.8.1 即将发布:一文带你了解重点更新内容!

2025年11月,TRON社区即将迎来GreatVoyage-v4.8.1版本的发布,这一版本代号为“Democritus”,标志着网络在兼容性、性能和稳定性方面的又一重大飞跃。

根据官方文档,这一更新将引入多项关键优化,不仅能吸引更多开发者加入,还将为现有用户带来更流畅的体验。下面,我们从专业角度剖析这些更新重点,并探讨其对TRON生态的潜在影响,帮助大家更好地理解这一里程碑式升级。

1. ARM平台支持:扩展硬件兼容性,助力边缘计算时代

此次v4.8.1版本的一个亮点是新增对ARM平台的原生支持。这意味着TRON节点可以更轻松地在ARM架构的设备上运行,例如基于ARM处理器的服务器、移动设备或嵌入式系统。传统上,区块链网络多依赖x86架构,但随着云计算和边缘计算的兴起,ARM平台的低功耗和高效率优势日益凸显。

从技术角度看,这一支持将降低节点部署的门槛。开发者无需额外适配或模拟环境,就能直接在Raspberry Pi、AWS Graviton实例或华为鲲鹏服务器上搭建TRON节点。这不仅能减少能源消耗(ARM架构通常比x86更节能),还提升了网络的去中心化程度——更多小型设备参与共识,将分散风险,提高整体韧性。

对于TRON生态来说,这项升级特别有利于DeFi、NFT和Web3应用的扩展。在亚洲和新兴市场,ARM设备普及率高,这一变化将吸引更多草根开发者,推动TRON在移动区块链领域的领先地位。想象一下,未来你的智能手机就能轻松运行TRON轻节点,这将极大促进大众采用。

2. EVM兼容性升级:无缝对接以太坊生态,降低迁移成本

另一个核心升级是EVM的兼容性提升,特别是对“SELFDESTRUCT”指令变更的适配。这一指令在以太坊上海升级中被修改为“SENDALL”,旨在优化合约销毁逻辑,减少潜在的安全隐患和gas消耗。TRON通过兼容这一变更,确保其虚拟机能与最新以太坊标准保持同步。

这项优化解决了跨链开发者的痛点。许多DApp开发者原本因EVM版本差异而犹豫迁移到TRON,现在他们可以直接复用以太坊代码,而无需大幅修改合约逻辑。这将显著降低开发成本,并加速项目从以太坊向TRON的转移。TRON的低手续费和高吞吐量本就具有优势,再加上EVM兼容性的加强,将进一步巩固其作为“以太坊杀手”的定位。

在实际应用中,这一升级对DeFi协议尤为有益。例如,借贷或DEX应用能更安全地处理合约自毁操作,避免历史漏洞。同时,它也为TRON的Layer 2解决方案铺平道路,促进与以太坊的互操作性。总体而言,这不仅仅是技术调整,更是战略布局,帮助TRON抢占更多市场份额。

3. 网络性能与稳定性优化:构建更可靠的区块链基础设施

v4.8.1版本还包含多项针对网络性能和稳定性的优化,包括共识算法细调、内存管理改进以及P2P网络协议增强。这些变化虽不如前两点那么显眼,但从工程视角来看,它们是确保TRON长期可持续发展的基石。

具体而言,优化可能涉及减少区块传播延迟、提升TPS,以及强化对DDoS攻击的防御。通过这些调整,TRON网络的平均确认时间有望进一步缩短,稳定性在高负载场景下得到保障。这对企业级应用至关重要,例如在供应链金融或游戏领域,任何延迟都可能导致用户流失。

这些优化将提升TRON的商业吸引力。相比其他公链,TRON已拥有3.43亿用户和各大活跃生态项目,此次升级将强化其作为高性能平台的形象。开发者社区可以借此机会组织黑客松或教程分享,吸引新人加入。同时,对于投资者而言,这意味着更低的网络风险和更高的回报潜力。

GreatVoyage-v4.8.1的发布不仅是技术层面的进步,更是TRON社区集体智慧的结晶。它通过ARM支持扩展硬件边界、EVM升级桥接生态、性能优化筑牢基础,为区块链行业的下一个十年注入活力。

TRON的愿景是“去中心化互联网”,这一版本正将TRON推向更近的目标。让我们一起见证并推动这一变革!

此次更新详细内容:github.com/tronprotocol/pm/b…

@justinsuntron @trondao #TRONEcoStar

带你见识波场TRON最强理财机制 —— USDD!

• 虚假的理财方式:银行存款

• 真实的理财方式:USDD质押

众所周知,银行的三年定期年化是1.25%,而质押USDD的年化是12%!

按10万元来计算:

• 银行定期存款三年收益是:3750元

• USDD质押一年收益是:12000元

在波场理财一年可抵银行存款十年!

重点来了!在波场质押USDD是随时可以提出的,没有锁仓,随用随取,收益每天自动到账!

真正的理财方式就是年化收益高,收益按时发放,资金灵活取用,而质押USDD就是你理财的最好方式!

@justinsuntron @usddio #TRONEcoStar

I have been using @vooi_io for a long time. I have now found out all the advantages of VOOI, so I want to recommend it to you today! Any of the following functions can be realised in VOOI!

• One-stop access to multi-chain liquidity, seamless transactions without switching.

• The abstract balance on the chain manages assets in a unified way, which is super convenient to operate.

• Integrated signal robot, round-the-clock intelligent trading, not disturbed by emotions.

• Points system + recommendation reward, the more active the transaction, the higher the income.

I think the function of VOOI is very good, and there are also points rewards and incentives, so that I can not only make money through trading, but also get future airdrops!

#Vooi

Recently, I have been studying @vooi_io. I think it is very necessary to recommend it to more people and let more people use VOOI, because I think VOOI is not a simple exchange platform, but an aggregator that focusses on cross-chain perpetual contracts, aiming to solve the problem of blockchain fragmentation.

VOOI is positioned as an unmanaged permanent DEX aggregator, which supports more than 17 blockchain networks and 6 protocols. Through chain abstraction technology, it allows users to seamlessly transact across chains without the need to manually bridge assets. This means that you can access 200+ perpetual and spot markets on the same interface, including popular perp contracts and RWAs.

Compared with traditional DEX such as Uniswap, VOOI focusses more on intent-based transactions. Users only need to express ”what they want to do“, and the system will automatically optimise the execution, such as finding the lowest slippage and the best price.

VOOI is not only a tool, but also an ecosystem that can be linked with platforms such as Substack to provide community updates and educational content.

VOOI represents the future direction of DeFi: from isolated islands to interconnection. Through chain abstraction and aggregation, it makes perpetual transactions more efficient and inclusive.

#Vooi

Recently, I have been studying @vooi_io. I think it is very necessary to recommend it to more people and let more people use VOOI, because I think VOOI is not a simple exchange platform, but an aggregator that focusses on cross-chain perpetual contracts, aiming to solve the problem of blockchain fragmentation.

VOOI is positioned as an unmanaged permanent DEX aggregator, which supports more than 17 blockchain networks and 6 protocols. Through chain abstraction technology, it allows users to seamlessly transact across chains without the need to manually bridge assets. This means that you can access 200+ perpetual and spot markets on the same interface, including popular perp contracts and RWAs.

Compared with traditional DEX such as Uniswap, VOOI focusses more on intent-based transactions. Users only need to express ”what they want to do“, and the system will automatically optimise the execution, such as finding the lowest slippage and the best price.

VOOI is not only a tool, but also an ecosystem that can be linked with platforms such as Substack to provide community updates and educational content.

VOOI represents the future direction of DeFi: from isolated islands to interconnection. Through chain abstraction and aggregation, it makes perpetual transactions more efficient and inclusive.

#Vooi

According to my analysis of the market in the past few days, today I specially predict what the market value of @vooi_io will be about to be TGE! I will predict its TGE market capitalisation in detail from all aspects. So it is very valuable for reference, please have a look!

Key data:

The cumulative trading volume exceeds 14 billion USDT, the monthly trading volume exceeds 3.8 billion USDT, and the daily ATH reaches 320 million USDT.

More than 180,000 users, more than 300 active trading pairs (including encryption, FX, RWA, support 500x leverage).

Relying on the YZi Labs and Echo communities, the community raised $1.25 million in rounds.

At present, Epoch 16 has launched Points Surge and issued 30 million points. It is expected that the latest TGE time will be Epoch 20, which may be earlier.

From these data, it can be seen that VOOi is not an air coin, but a value coin with a real user base! After TGE, the $VOOI token will be used for governance, cost-sharing, staking rewards and community airdrops (including 1.92% supply allocated to Cookie activities, 50% immediate release, and the remaining 6 months of linear unlocking).

Token Economics Analysis:

From the latest communities and documents, the framework can be pieced together. The total supply is 1 billion $VOOI.

Known allocation:

User rewards: 1.92% for points redemption, airdrops and cookie activities (0.8% cSnaps, 1.12% Snaps), 50% is released immediately in TGE.

Private investors: about 5% (based on $1.25 million financing, seed round valuation).

Team/consultant: estimated 15-20%, with lock position.

Liquidity/Ecology: The remaining part is used for LP, marketing and partner rewards (such as a total of 400 million points in the points system are allocated to Beta users)

It is estimated that the circulation of TGE will be about 10%-15%!

Conservative estimate: FDV 1-150 million US dollars. The initial price is 0.1-0.15 USD/piece (10% of circulation = 100 million pieces).

Neutral estimate: FDV $25-50 million. Based on the explosion of trading volume and Points Surge, the probability of pumping after listing is high (83% probability of exceeding $100 million).

Optimistic estimate: FDV $750 million+. If TGE catches up with the bull market and has great CEX support (such as the Recall case).

My personal core forecast: TGE FDV is about $250 million. The reason is that VOOI‘s product maturity is high (more than 15 Epoch, with a daily volume of 6.5 times), strong user stickiness, and chain abstraction is the hot spot in 2025 (refer to LayerZero FDV exceeding 2 billion).

#Vooi

阅读完@almanak 的这篇推文,真的让我对这个项目刮目相看!他们的alUSD作为一个AI优化的流动性策略,不仅在市场波动中稳如泰山,还顺利处理了上千万美元的提款请求。

从这篇推文所表达的内容来看,alUSD完全避免了像xUSD这样的问题资产暴露,全部操作都onchain透明,AI Swarm的设计让系统灵活响应各种条件。哪怕整个TVL都想提现,下个结算周期也能全额兑现,这流动性太强了!

可以看得出,Almanak不光是技术牛,团队的沟通也超级及时专业,避免了市场恐慌。DeFi需要更多这样的项目——安全、可靠,还带点AI黑科技。总之,我超级看好Almanak!

#Almanak

alUSD successfully facilitated another ~$20 million withdrawal, executed smoothly and without issue, demonstrating that alUSD’s liquidity mechanisms are functioning exactly as intended.

Due to temporary liquidity constraints faced by certain allocators, such as MEV Capital and Hyperithm, they needed to withdraw their allocations from alUSD and PT-alUSD (approximately $36 million) to ensure liquidity for their own operations.

As reiterated earlier, alUSD remains fully insulated from any yield-bearing tokens affected by issues with their underlying assets or backing. There is no exposure to mHYPER, xUSD, nor does alUSD allocate to protocols or pools that hold xUSD or related tokens.

Operations continue as normal. We’re proud of the AI Swarm’s collaboratively designed strategy!

The system is operating as designed: flexible, resilient, and responsive under dynamic conditions.

We believe the current market environment reflects a temporary liquidity imbalance rather than a structural credit issue. That said, we recommend all participants remain cautious and avoid allocating into protocols or pools that hold xUSD or related assets until the situation fully stabilizes.

Everything related to alUSD remains fully onchain and transparent, with all the details available in the vault page /\