Crypto Enthusiasts | Web3 | Content Writer | Powered by @arichain_ | Contributor @donutbrowser @42space

Joined October 2024

- Tweets 7,755

- Following 1,419

- Followers 6,774

- Likes 8,084

Pinned Tweet

and here’s the next step ⬇⬇⬇

with @KAIO_xyz real-world assets become programmable and interoperable on-chain

capital isn’t just sitting idle it can be issued, transferred, and composed across compliant strategies

every tokenized fund opens doors for cross-chain capital flows, transparent issuance, and automated yield

the full power shows when positions are active and integrated that’s when rewards and efficiency multiply

this is where real-world assets don’t just exist on-chain, they behave like liquid logic, ready for builders to orchestrate

so builders you know

RWAs aren’t new but composability is

@KAIO_xyz turns tokenized funds into DeFi primitives

capital can lend borrow and compound without custody walls

> asset interoperability

> transparent issuance

> yield that moves freely

this isn’t wrapping it’s rebuilding

the frontier where real assets become liquid logic

sweet 🟥 .ari retweeted

and here’s the next step ⬇⬇⬇

with @KAIO_xyz real-world assets become programmable and interoperable on-chain

capital isn’t just sitting idle it can be issued, transferred, and composed across compliant strategies

every tokenized fund opens doors for cross-chain capital flows, transparent issuance, and automated yield

the full power shows when positions are active and integrated that’s when rewards and efficiency multiply

this is where real-world assets don’t just exist on-chain, they behave like liquid logic, ready for builders to orchestrate

so builders you know

RWAs aren’t new but composability is

@KAIO_xyz turns tokenized funds into DeFi primitives

capital can lend borrow and compound without custody walls

> asset interoperability

> transparent issuance

> yield that moves freely

this isn’t wrapping it’s rebuilding

the frontier where real assets become liquid logic

sweet 🟥 .ari retweeted

heyy gm, check out something exciting i want to share with you !!

that is you can lend and borrow on @LayerBankFi

Lending and borrowing just got juicer on LayerBank

By using LayerBank money markets you can massively multiply your L.Points while enjoying the capital efficiency provided by the protocol

It also gives early users a chance to participate before the network grows and attract more activity

Both lending and borrowing positions can earn rewards

but the benefit only becomes fully visible when positions are active

and those rewards will then join your earned balance

GM ☀️ GM

DeFi began as a movement to make finance open and fair but scattered liquidity and complex systems made it inefficient LayerBank steps in to solve that by building a unified, multi-chain ecosystem where capital flows freely and productively

Through its cross-chain structure, users can lend, borrow, and reallocate assets seamlessly across Ethereum, Linea, Rootstock, and other EVM networks no more fragmentation just borderless liquidity under user control

At the heart of this system is the LAB token, designed to represent real participation, not speculation with yield boosters, buybacks, and revenue sharing, LayerBank aligns incentives between the protocol and its community turning every user into a stakeholder

The new Leverage Looping Vaults extend that vision further, allowing recursive yield strategies that connect on-chain liquidity with real-world performance. It’s DeFi evolving from passive yield to productive finance.

With $55M+ in TVL and a completed MoveBit audit, LayerBank stands as more than another DeFi app it’s a secure, scalable infrastructure shaping how the next generation manages capital: efficient, decentralized, and truly global

@LayerBankFi @cookiedotfun #LayerBankFi #DeFi #DeFiInnovation

so builders you know

RWAs aren’t new but composability is

@KAIO_xyz turns tokenized funds into DeFi primitives

capital can lend borrow and compound without custody walls

> asset interoperability

> transparent issuance

> yield that moves freely

this isn’t wrapping it’s rebuilding

the frontier where real assets become liquid logic

sweet 🟥 .ari retweeted

GM ☀️ GM

DeFi began as a movement to make finance open and fair but scattered liquidity and complex systems made it inefficient LayerBank steps in to solve that by building a unified, multi-chain ecosystem where capital flows freely and productively

Through its cross-chain structure, users can lend, borrow, and reallocate assets seamlessly across Ethereum, Linea, Rootstock, and other EVM networks no more fragmentation just borderless liquidity under user control

At the heart of this system is the LAB token, designed to represent real participation, not speculation with yield boosters, buybacks, and revenue sharing, LayerBank aligns incentives between the protocol and its community turning every user into a stakeholder

The new Leverage Looping Vaults extend that vision further, allowing recursive yield strategies that connect on-chain liquidity with real-world performance. It’s DeFi evolving from passive yield to productive finance.

With $55M+ in TVL and a completed MoveBit audit, LayerBank stands as more than another DeFi app it’s a secure, scalable infrastructure shaping how the next generation manages capital: efficient, decentralized, and truly global

@LayerBankFi @cookiedotfun #LayerBankFi #DeFi #DeFiInnovation

Good morning CTs ☀️

Traditional finance was built on intermediaries institutions that hold, move, and control your money. Blockchain flips that model by letting individuals manage assets directly through code. Among the protocols shaping this shift in capital freedom is @LayerBankFi

LayerBank simplifies liquidity movement across chains.

Instead of locking assets separately on each network, users can lend or borrow seamlessly between Ethereum, Linea, Rootstock, and other EVM ecosystems. It teaches one clear principle: true liquidity is borderless

At the center of this system stands the LAB token designed not merely as a speculative asset, but as a utility that reflects real participation.

Revenue sharing, buybacks, and yield boosters turn holding into involvement showing how tokenomics can align incentives between protocol and community

LayerBank’s next leap is bridging DeFi and real-world assets through its Leverage Looping Vaults. This marks a step toward understanding how blockchain infrastructure can integrate tangible financial value not just digital liquidity

With over $55M in total value locked and independently audited security, LayerBank represents more than another DeFi product. It’s a live example of how decentralized finance can evolve into a self-sustaining, user-governed economy

#LayerBankFi #cookiedotfun #DeFI

Good morning CTs ☀️

Traditional finance was built on intermediaries institutions that hold, move, and control your money. Blockchain flips that model by letting individuals manage assets directly through code. Among the protocols shaping this shift in capital freedom is @LayerBankFi

LayerBank simplifies liquidity movement across chains.

Instead of locking assets separately on each network, users can lend or borrow seamlessly between Ethereum, Linea, Rootstock, and other EVM ecosystems. It teaches one clear principle: true liquidity is borderless

At the center of this system stands the LAB token designed not merely as a speculative asset, but as a utility that reflects real participation.

Revenue sharing, buybacks, and yield boosters turn holding into involvement showing how tokenomics can align incentives between protocol and community

LayerBank’s next leap is bridging DeFi and real-world assets through its Leverage Looping Vaults. This marks a step toward understanding how blockchain infrastructure can integrate tangible financial value not just digital liquidity

With over $55M in total value locked and independently audited security, LayerBank represents more than another DeFi product. It’s a live example of how decentralized finance can evolve into a self-sustaining, user-governed economy

#LayerBankFi #cookiedotfun #DeFI

so builders, you know

control isn’t about limits it’s about precision.

LayerBank opens the Isolated Markets this week

bringing single-asset risk vaults designed for adaptive yield.

> isolate exposure

> optimize capital routes

> compound without contagion

this isn’t a restriction it’s refinement the season where precision becomes power

@LayerBankFi #LayerBankFi

#cookiedotfun

so builders, you know

control isn’t about limits it’s about precision.

LayerBank opens the Isolated Markets this week

bringing single-asset risk vaults designed for adaptive yield.

> isolate exposure

> optimize capital routes

> compound without contagion

this isn’t a restriction it’s refinement the season where precision becomes power

@LayerBankFi #LayerBankFi

#cookiedotfun

so builders, you know

every cycle ends where real momentum begins.

LayerBank launches the Final Season next week

with 70×–99× multipliers live for early movers.

> short window to deposit

> earn from the start

> compounding points at max velocity

this isn’t just a close it’s a culmination of momentum the season where capital meets movement

@cookiedotfun @LayerBankFi #LayerBankFi #cookiedotfun

sweet 🟥 .ari retweeted

so builders, you know

every cycle ends where real momentum begins.

LayerBank launches the Final Season next week

with 70×–99× multipliers live for early movers.

> short window to deposit

> earn from the start

> compounding points at max velocity

this isn’t just a close it’s a culmination of momentum the season where capital meets movement

@cookiedotfun @LayerBankFi #LayerBankFi #cookiedotfun

sweet 🟥 .ari retweeted

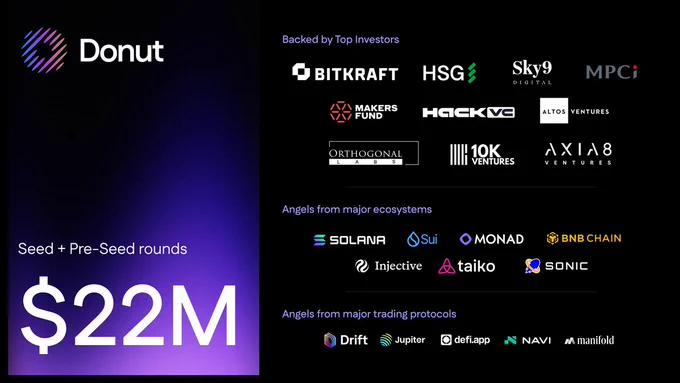

For the last 6 months, we’ve prototyped Donut, with 100,000+ visionaries on the waitlist to co-create the interface for the financial internet.

Today, we're excited to announce that We raised $22M to build the world's first agentic crypto browser for trading.

Money doesn’t sleep. Keep it growing.

(1/15)

gm builders, Bitcoin shouldn’t just sit in your wallet it should work for you.

@LayerBankFi launches automated $mBTC ∞ $rBTC looping on @rootstock_io

$53K $RBTC incentives over 4 weeks

Fully automated, zero slippage

1.79% real-world BTC yield → 6.6x+ leveraged exposure via @MidasRWA

Secured by Rootstock (80% of BTC hashpower, 1:1 PowPeg parity), your BTC now earns across chains efficiently, safely, and continuously.

This is BTC-Fi done right productive, composable, future-ready. Your Bitcoin, working harder than ever

We’re excited to launch automated $mBTC ∞ $rBTC looping on @rootstock_io — backed by $53K $RBTC incentives over the next 4 weeks.

With LayerBank, you can now amplify @MidasRWA 1.79% real-world BTC yield into 6.6x+ leveraged exposure, fully automated and with zero slippage — all secured by Rootstock, Bitcoin’s most secure sidechain.

app.layerbank.finance/earn?n…

去中心化金融走到今天,最难的不是创新,而是「落地」。

很多协议喊“更聪明的金融”,但最后却成了“更复杂的操作”。

直到我重新看到

@LayerBankFi

,才发现它其实在做一件更基础也更大胆的事:

让链上资产像现实银行账户样好用。

🔹从 DeFi 到 SmartFi

LayerBank 的核心不在于“借贷”,而在于“连接”。

它打通十几条主流链,把孤立的资金池编织成张流动网络,

资金能自由穿梭、自动增益,让链上资产真正“动”起来。

这意味着,不论你在 EVM、BTC、还是 Move 生态,

都能在同个界面里完成存取、抵押、收益。

这不是跨链的终点,而是金融可组合性的起点。

🔹收益逻辑的革新

传统 DeFi 追求 APY,LayerBank 追求“效率”。

它的策略模块能根据市场动态自动循环仓位,

把被动收益变成主动增长。

真实世界资产(RWA)与 BTC 的结合,更让收益来源更稳、更长久。

🔹体验决定扩散

今年的多次 UI 升级让 LayerBank 不再是“专家专属工具”。

键操作、自动化策略、可视化仓位管理,

让新用户也能轻松上手、降低试错成本。

这才是 DeFi 普及的关键步。

🔹社区与协议的共振

从 $ULAB 激励、L.Points 活动到治理机制开放,

LayerBank 的生态不只是用户在“用”,

更是起“建”。

社区与协议的边界正在变得模糊,

这就是 Web3 最纯粹的力量。

🔹结语

如果说 Aave 代表了 DeFi 的初代逻辑:

“让加密资产产生收益”,

那 LayerBank 的愿景更进步 让任何资产都能跨链、高效、自动地发挥价值。

这不是更好的 DeFi,

而是种新型的金融语言。

@cookiedotfun

#LayerBankFi #DeFi

GLayerBank — just dropping by to say:

$ULAB powers the product. Simple

Competition in DeFi has never been about who launches first,

but about who builds systems that truly scale. @LayerBankFi

understands this better than most.

LayerBank redefines lending by making liquidity modular and composable assets can move freely across Ethereum, Linea, Rootstock, and more, without complex bridging or fragmentation.

This design doesn’t just connect markets; it connects capital efficiency itself. Each pool can adapt to changing conditions in real-time, balancing yields and risks automatically.

For users, that means:

→ One account, multi-chain liquidity.

→ Lower borrowing costs through optimized routing.

→ Seamless leverage and automated yield loops.

For builders, it means:

→ Open architecture to plug new strategies or RWA modules.

→ Real-time transparency through on-chain accounting.

Its latest “Leverage Looping Vaults” are the next frontier combining DeFi-native leverage with real-world yield sources.

LayerBank isn’t trying to out-yield DeFi. It’s re-engineering how yield itself is created. That’s how the future of on-chain finance will be built layer by layer.

GM ☘️ GM CT

I’ve been checking out @LayerBankFi lately and it’s doing something wild in DeFi

⇛ what is LayerBank?

It’s a decentralized money market protocol built for the multi-chain era where your assets don’t just sit, they earn, you borrow across chains, and liquidity flows free.

⇛ how it works?

• Supply assets, get interest (you receive lTokens representing your share)

• Use your collateral to borrow other assets, across supported networks

• Designed for omni-chain: “bridgeless” access across EVM networks & more

• Governed by $LAB (native token) with boosting, revenue-sharing and a token model built for long-term growth

------------------------------

Basically, LayerBank isn’t just another lending protocol it’s building the rails for finance that runs across chains as smoothly as your ideas.

sweet 🟥 .ari retweeted

GM ☘️ GM CT

I’ve been checking out @LayerBankFi lately and it’s doing something wild in DeFi

⇛ what is LayerBank?

It’s a decentralized money market protocol built for the multi-chain era where your assets don’t just sit, they earn, you borrow across chains, and liquidity flows free.

⇛ how it works?

• Supply assets, get interest (you receive lTokens representing your share)

• Use your collateral to borrow other assets, across supported networks

• Designed for omni-chain: “bridgeless” access across EVM networks & more

• Governed by $LAB (native token) with boosting, revenue-sharing and a token model built for long-term growth

------------------------------

Basically, LayerBank isn’t just another lending protocol it’s building the rails for finance that runs across chains as smoothly as your ideas.

Liquid restaking? Now it’s a thing

@ekoxofficial eXETH keeps your $ETH moving while stacking rewards

@snowball_money runs AI-powered strategies to grow your yield faster

Because innovation grows together

Camp links 👇

🔹 pad.chaingpt.org/pools/snowb…

🔹 pad.chaingpt.org/pools/ekox

#ChainGPT $CGPT #Snowball $SNOWAI #EKOX $EKOX

Every transaction starts with intent, and with @snowball_cip, that intent flows seamlessly from name to network.

No addresses. No friction. Just identity-driven payments.

Your name is now your payment rail.

Explore how it works 👇

sweet 🟥 .ari retweeted

most people still see lending protocols as a place to borrow and chase yield

but the real innovation isn’t the yield it’s how liquidity actually moves

that’s where @LayerBankFi hits different

they’re building a unified layer where 17+ networks share the same money market

you can lend on one chain, borrow on another, even loop yield across networks without juggling bridges or fees

it feels less like defi juggling and more like capital freedom

think of it as connecting blockchains like cities under one economy

liquidity just flows, borders fade, risk gets smarter

and maybe that’s where the next wave of defi is heading not bigger yields, just better design

#cookiedotfun

bro let’s Introducing the @LayerBankFi the Unified Cross-Chain Money Market 🌐

SO you know LayerBank launching a next-gen lending protocol that unifies liquidity across 17+ EVM and non-EVM chains

it’s built to make capital efficient, borderless, and composable

so what you need to know?

basically they’re building an omni-chain money market where you can lend, borrow, and loop across multiple networks in one place

---

➥ Key Features of it

> omni-chain first one UX across 17+ chains

> capital efficiency looping vaults & eMode risk frameworks

real-world yield RWA income on-chain

> transparent & permissionless governed by $ULAB holders

lTokens interest-bearing tokens tracking yield in real time

---

➥ Why I like it?

> most lending protocols stop at multi-chain

> LayerBank goes omni-chain true unified liquidity

> efficient, transparent, and built for the future of DeFi

so if you’re building or borrowing across chains

then LayerBank is the one to watch 👀