Interested in tech, finance, and business.

Joined July 2018

- Tweets 1,250

- Following 1,175

- Followers 57

- Likes 6,874

Deco retweeted

How the West fucked up the rare earths thing:

China doesn’t own most of the planet’s rare earth atoms. Rare earth elements are relatively common in the Earth’s crust — about as abundant as copper or zinc. The difference is that they are usually dispersed at low concentrations, making extraction uneconomic. What gives China its dominance is not geology alone, but a combination of geological luck, historical policy decisions, and industrial strategy.

In the 1980s, Deng Xiaoping’s government identified rare earths as a “strategic resource” and heavily subsidized production, accepting pollution and low margins to dominate global supply. By the late 1990s, Chinese output had become so cheap that Western mines shut down, and investment in exploration elsewhere dried up.

As a result, China didn’t just have the biggest mines — it was the only country still mining and refining at scale.

China built the entire supply chain — from ore to refined oxides to magnet and component manufacturing — while other countries offshored those stages.

Rare earth separation and processing are chemically complex and generate toxic and radioactive waste. Western companies avoided these costs; China tolerated them.

Even when ore is mined in Australia or the U.S., much of it is still sent to China for processing.

Because China has the infrastructure, workforce, and state support, its deposits are economically viable, whereas comparable deposits elsewhere (e.g., in the U.S., Brazil, Vietnam, Greenland, or Canada) remain uneconomic under Western environmental and labor costs.

Since 2015, Beijing has merged dozens of companies into a few giant state-owned groups (e.g. China Northern Rare Earth Group, China Rare Earth Group). This allowed tighter regulation of output and pricing — turning a chaotic low-margin industry into a strategic tool. The result is centralized control of supply and export policy, giving China political leverage as well as industrial dominance.

China’s dominance in “reserves” reflects economic reality, not geological monopoly. The elements exist everywhere, but only China combined rich deposits, permissive regulation, and decades of state-backed investment to make extraction and processing viable at scale.

If other nations build comparable processing capacity and accept the associated costs, the global “reserve” map would change drastically within a decade.

Deco retweeted

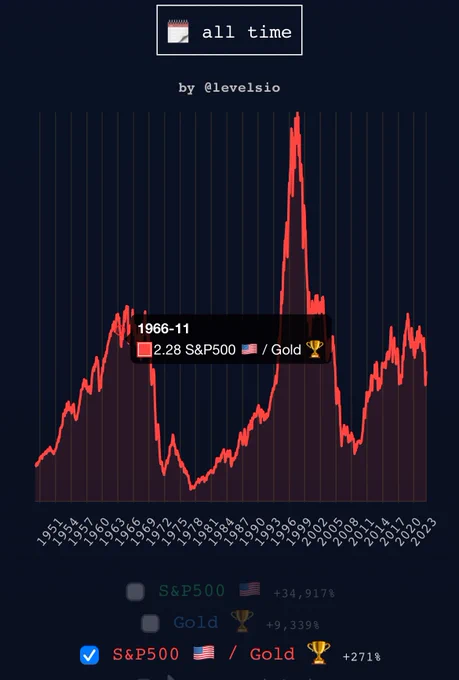

The S&P priced in gold is one of the craziest charts out there: the S&P is lower today than it was in 1966.

Also provides an interesting perspective into how the current equity bubble compares to dot com bubble (in terms of how much it reflects general asset inflation).

augur, a prediction market, was one of the first ICOs in 2015. they distributed tokens via email (now -99% from peak). the team tried unsuccessfully for 3+ years (pre-RPC/wallet APIs) to build a basic webapp on ETH before soft rugging

tech adoption takes longer than you think

Deco retweeted

If you’re new to $ZEC this is all you really need to catch up.

If you’re on the fence, this is all you need to understand.

Study Zcash

Deco retweeted

By community request, you can now long or short $ZEC with up to 5x leverage.

Deco retweeted

Ten years ago this month, before dropping out of university, I gave a presentation on cryptocurrency to the uni's investment society. The three projects I talked about in particular were Bitcoin, Ethereum and Zcash.

Bitcoin was $250

ETH was $0.80

Zcash had yet to launch

I felt that these three projects best captured the fundamental ideology of decentralised finance - and for that reason were most likely to revolutionise the industry. This was met with a lot of scepticism and some laughter.

The third entry on this list has never been as successful or appreciated as the other two, and yet I have always maintained the same belief I held back then. Zcash is a deeply authentic realisation of the cypherpunk ethos that enables the concept of digital cash without compromise. It's built on an extraordinary breakthrough in mathematics and gifts practical freedom through privacy to the entire world; it is liberation through science.

Big month

Here's what happened @Ethena_labs in September:

• USDe & USDtb TVL crossed $16B, with USDe supply hitting $14.5B

• Partnered with @Binance to integrate USDe across entire platform of 280M+ users, $190B+ assets, scaled to $3B USDe in a week

• Ethena launched on @PlasmaFDN as a core dollar asset within their DeFi ecosystem, growing to >$1B in supply in a few days

• USDe listed on @krakenfx, the first US exchange listing

• USDe listed on @CoinoneOfficial the 3rd largest exchange in Korea, the first USDe listing on a Korean exchange

• $ENA was listed on @okx

• USDe and sUSDe went live on Avalanche @avax, USDe/sUSDe integrated on @FolksFinance and @Re

• Launched USDm with @megaeth_labs on our new Ethena Stablecoin-as-a-Service stack

• Launched suiUSDe and USDi with @SuiNetwork on our Stablecoin-as-a-Service stack

• @stablecoin_x raised additional $530M for $ENA accumulation (total: $900M PIPE financing)

• Ethena PT market size grew to $8.73B (300%+ growth in 4 months)

• USDe now supported on @FalconXGlobal and @flowdesk_co across spot, derivatives, and custody

• Strategic investment in and partnership with @BasedOneX

• @YZiLabs expanded investment position in Ethena

• Integrated @LayerZero_Core Ovault for one-click USDe-to-sUSDe staking cross-chain

• USDe, sUSDe, & Ethena PTs added to @aave, @MorphoLabs, @0xfluid & @eulerfinance as part of @arbitrum's DRIP program

• @DeriveXYZ's $DRV token airdropped to sENA stakers

• @ton_blockchain launched dedicated Ethena education hub with interactive course

What did you get done this month?