This account is for knowledge purpose Never Ever do Intraday and F&O as 90% lose Money t.me/+O7x-yoQv2GRhZTBl Telegram channel link for premium views

Joined May 2021

- Tweets 1,611

- Following 202

- Followers 124

- Likes 2,656

Wealth Creator retweeted

In ancient Egypt, silver was rarer than gold — they called it “white gold.”

While gold symbolized the flesh of the gods, silver represented their bones.

Its rarity and celestial shine made it even more precious than gold itself.

#Silver

Wealth Creator retweeted

The crash has been coming for 15 years according to you.

Top grifter of all time.

Wealth Creator retweeted

CRASH COMING: Why I am buying not selling.

My target price for Gold is $27k. I got this price from friend Jim Rickards….and I own two goldmines.

I began buying gold in 1971….the year Nixon took gold from the US Dollar.

Nixon violated Greshams Law, which states “When fake money enters the system….real money goes into hiding.”

My target price for Bitcoin is $250 k in 2026.

Silver $100 in 2026. I own silver mines and I know new silver is scarce.

Ethereum $60. I got this from Tom Lee. Ethereum is block chain for Stable coins. This means Ethereum follows METCALFS law…. The law of NET WORKS.

LESSON: I follow the laws of money, Gresham and Metcalf’s laws.

Unfortunately the US Treasury and Fed break the laws. They print fake money to pay their bills. If you and I did what the Fed and Treasury are doing…. We would be in jail for breaking the laws.

Today the USA is the biggest debtor nation in history and why I have been warning “Savers are losers.”

That is why I keep buying gold, silver, Bitcoin, and Ethereum even when they crash.

Take care. Massive riches ahead.

Wealth Creator retweeted

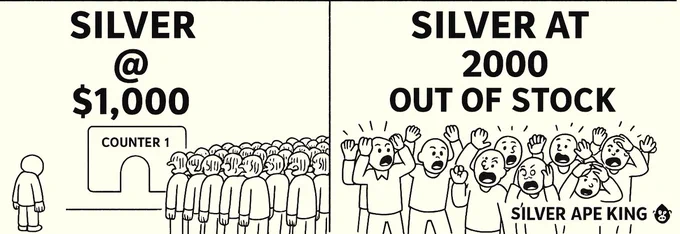

It was another week of #silver testing $48 support. The #backwardation remains. It’s a #RedFlag telling us there is insufficient supply to meet the needs of companies using physical metal to operate their business - solar, electronics, jewellery, etc. A normal market can only return with 1) falling #demand but that's not happening because companies needing silver are not going to stop operating, or 2) higher #supply but mines can’t meaningfully increase production in the short-term nor can physical metal be conjured ‘out of thin air’. Therefore, to increase supply so businesses can keep operating, higher prices are needed to entice holders of physical silver to exchange it for fiat currency (not a good choice to make when silver is backward dated & undervalued at these prices). So expect higher prices eventually but probably more testing of $48 this week, which I expect will hold like it did at $28, the last resistance level. This $28 price held silver back for nearly 5 years. When silver finally broke above $28 in Apr 2024, it traded sideways for 5 months. In Sep 2024 silver finally hurdled & stayed above $28 on its run exceeding $48 (red line on the chart). It's now traded above $48 for a month, dissipating a lot of spec interest that had built up. Given that anything is possible, silver may trade sideways for more weeks (months?) just like it did after breaking the $28 level. Or it may trade lower if the supply/demand equation is resolved at lower prices, which appears a low probability. So I remain long-term bullish.

Wealth Creator retweeted

🥈 SILVER SPOT PRICE

💵 $48.93 USD/oz

📈 24h: +1.63%

📅 Nov 09, 2025 • 12:02 AM ET

#Silver #SilverPrice #XAG #SilverSpot #Investing #Commodities #PreciousMetals

Wealth Creator retweeted

Michael Oliver on why he sees #silver at $100–200/oz within two quarters.

I just finished the interview with Michael Oliver (@Oliver_MSA).

I love the guy, great analysis as always.

"Where #silver could be in 6 month? Well over $100 or maybe $200"

THE INTERVIEW WILL BE OUT TOMORROW!

Wealth Creator retweeted

Wealth Creator retweeted

Global military demand for silver is estimated at 10–50 million ounces per year, used in missiles, radar, satellites, and advanced communications systems. As modern warfare becomes more tech-driven, silver’s strategic value keeps rising. (Source: CPM Group, 2024) #Silver

Wealth Creator retweeted

This is a daily chart of spot gold. My next price target for gold is $4.9k (could overshoot to $5k) , which could be achieved in two legs.

First target for gold $4.6k and silver $64 (gold to silver ratio (GTS) immediate support is at 75).

Second target $4.9k gold, $85 silver price (GTS immediate next support 57).

Metals should slowly start moving higher starting from the next week as I would like to see gold at $4.6k and silver $64 before the end of the year...

This post is not an investment advice!

Wealth Creator retweeted

At a gold/silver ratio of 83:1, silver sits at $48. Drop it to 50:1 and silver hits $79.8. At 16:1 $249. The math is simple: when the ratio normalizes, silver surges.

Made possible by @SilverElMining

#Silver #silversqueeze

Wealth Creator retweeted

EACH OUNCE OF #SILVER BOUGHT IS A SHOT AT THE DEATH STAR.

Wealth Creator retweeted

#Silver the most noble of precious metal resources carries the very current of civilization. Yet, as we consume vast amounts in our next step into our 4th technological industrial revolution, the day may come when silver fades from our grasp. Still inscribed in the periodic table, but vanished from the Earth. The first element to disappear not by alchemy, but by our own digital advancement.

Wealth Creator retweeted

Silver just got listed as a critical mineral. The metal that powers tech, energy, and defense now officially in short supply. ⚡

#Silver #silversqueeze