#PhD(s) @UT_Dallas|#Research & #DataScientist|Founder; @ErdsiOrg, @RUsersKumasiGh|Ex-Prz @nahsagofficial/@MelssaKnust|@TidiFoundation|@CohesF|#OldSaint|Awards🏅

Texas, USA

Joined September 2018

- Tweets 6,747

- Following 3,292

- Followers 3,544

- Likes 19,314

Pinned Tweet

Fast forward with over 2-years intensive research in @SASLab_KNUST and over 30-peer review publications in top journals, amazing that I’ve started my PhD in Molecular and Cellular Biology 🧬 with focuses on immunology at @UT_Dallas. Hoping to develop more competitive skills🔜

Congratulations to Ebenezer Senu, for being selected as the 2021 Global Graduate Fellow

(fb.watch/9LJZoIOq6x/)

Ebenezer recently graduated from the Medical Laboratory Technology of KNUST in Kumasi, Ghana ranking in First Class Honors, with a Bachelor of Science Degree

#Awards

We train individuals on research and data science with free webinars. Only 229 followers now. Help us grow

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

𝙒𝙚'𝙧𝙚 𝙝𝙞𝙧𝙞𝙣𝙜 𝙣𝙚𝙬 𝙛𝙖𝙘𝙪𝙡𝙩𝙮 𝙢𝙚𝙢𝙗𝙚𝙧𝙨!

Links below because twitter/x is weird.

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

This chart explains why 90% of people never get rich.

Wealth doesn’t come from saving harder. It comes from owning things that grow while you sleep.

Most people spend their entire lives buying things that lose value.

A car that drops 30% the moment it leaves the lot.

A house that eats cash every year in taxes and maintenance.

A “safe” savings account that quietly bleeds to inflation.

That’s why this chart hits so deep because it exposes the real divide.

At the bottom, people’s net worth is packed into cars and homes.

It feels like progress, but it’s not compounding.

It just sits there.

Climb higher up the wealth ladder, and the chart flips.

The more money people have, the less they keep in stuff. Their wealth is in ownership stocks, private companies, real estate, and assets that spin off cash while they sleep.

That’s the quiet truth nobody wants to hear:

- Wealth grows slow, then all at once.

- It’s boring for a long time.

- Years of “nothing happening.”

Then one day, compounding kicks in and everything starts to move fast.

Most people never make it there.

They pull out too early, chase a trend, or get bored when it doesn’t move fast enough.

They give up in year nine of a ten-year game.

If you want to get rich, stop trying to look rich.

Own things that make money, not things that impress people.

Hold them long enough for the curve to bend in your favor.

Because the moment your money starts earning more than you do that’s when wealth stops being a goal, and starts being gravity.

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

Fat storage in the body relies on specialized structures called lipid droplets. In a new Science study, researchers identified the microprotein adipogenin as a regulator of adipocyte lipid droplet size, revealing a key mechanism in lipid homeostasis.

Learn more in this week's issue: scim.ag/47FPKoj

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

We are looking for Ph.D. fellows!

Bloomberg will fund research and mentor outstanding graduate students across a wide range of Computer Science and AI topics.

If you want to be considered, please apply by December 14.

Link with information and application details below 👇

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

I might get a "talk" from my professor for posting this.

1. quillbot.com — Paraphrase and reduce plagiarism in essays

2. gamma.app — Create a presentation in 60 seconds

3. socratic.org — Snap a pic to get homework answers instantly

4. perplexity.ai — Get direct answers to your questions

5. stealthwriter.ai — Fly under the professor's radar

6. kuse.ai — TL;DR summaries for any webpage

7. otter.ai — Get lecture notes automatically

8. chatpdf.com — Make any PDF tell you its key points

9. mybib.com — Citation generator

10. elicit.org — Your literature review assistant

[ Save this list 🔖]

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

COME WORK WITH ME!!!

Very exciting open faculty position at MIT, with ecosystem and biodiversity modeling as a focus!

@WILDLABSNET @ABCGlobalCenter @imageomics #AIforConservation @cv4ecology @CV4E_ICCV

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

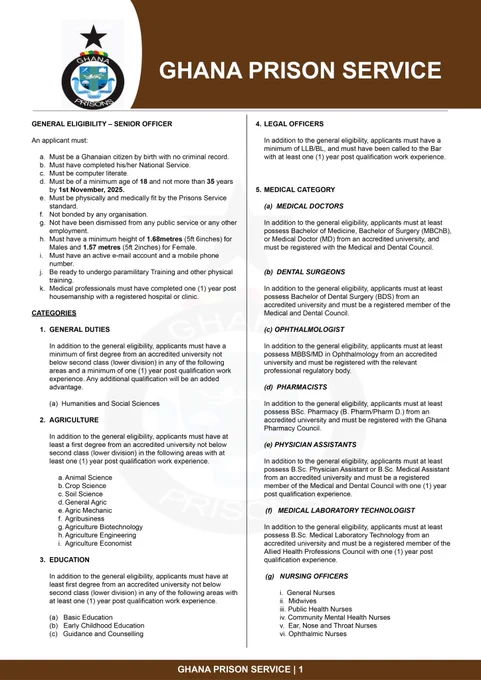

Join Ghana's Security Services!

The Ministry of the Interior invites qualified Ghanaians to apply for recruitment into the Ghana Police, Ghana Prisons, Ghana Fire and Ghana Immigration Services.

Serve your nation with pride and build a career in uniform.

2/4

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

Fully-funded PhD studentship alert! 📢

Want to explore the psychology behind why we accept or reject alternative proteins? This project uses psychobiological approaches to understand consumer choice.

Apply now. Details here: [warwick.ac.uk/fac/cross_fac/…] @AstonPeach @BPSOfficial

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

We are currently looking for a postdoc (organic synthesis) to start winter 2026 or sooner @Meanwell_Lab #ChemPostdoc #ChemTwitter. Email meanwell@ualberta.ca with your CV and research summary. Only successful candidates will be contacted.

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

We are looking for: PhD Student (starting as Research Assistant) and Postdoctoral Researcher in Stem Cell Biology and Mechanobiology. Please RT💕

🔗 About our lab: renew.science/principal_inve…

🎓 PhD position: jobportal.ku.dk/phd/?show=15…

🧪 Postdoc position: jobportal.ku.dk/videnskabeli…

£ben$enu™️, MLS📚🔝🇬🇭🇺🇸 retweeted

🚨We're hiring @warwickecon. We have 2 AP positions, looking especially in Macro & Devo. Secondary fields like enviro & experimental econ are a plus. Link here: econjobmarket.org/positions/…

Don't forget to also fill in the Warwick form as explained in the post.

#EconTwitter