GoldGreenGuru retweeted

During my presentation yesterday I mentioned silver could move to $100 in a few days or weeks, after the market learns about physical silver shortages ..

"SCRAP my call for $60 #SILVER, we're headed to $100 to $200 in the next couple quarters"

- Michael Oliver

👉 Bookmark this chart, you’ll want to remember it.

GoldGreenGuru retweeted

Analysts at Bank of America & Societe Generale see #GoldPrices reaching US$5,000/oz in 2026.

Its rally has been driven by multiple factors, including geopolitical uncertainties, expectations of U.S. interest rate cuts, strong central bank buying, and robust ETF inflows.

Learn more:👉 theglobeandmail.com/investin…

#GoldPrice

GoldGreenGuru retweeted

THE GREAT PHYSICAL SILVER CONSPIRACY!!

I had Grok run an Analysis on the Silver Survey low balling the amount of Silver used in PV Solar for the past 10 years.... Conclusion: The Silver Institute has systematically under reported PV silver demand by 50–150% annually, with a cumulative shortfall of nearly 1 billion troy ounces over the decade. Real-world manufacturing data shows silver use is ~1.8× higher than officially acknowledged.

grok.com/share/bGVnYWN5_9967…

GoldGreenGuru retweeted

Silver just got listed as a critical mineral. The metal that powers tech, energy, and defense now officially in short supply. ⚡

#Silver #silversqueeze

GoldGreenGuru retweeted

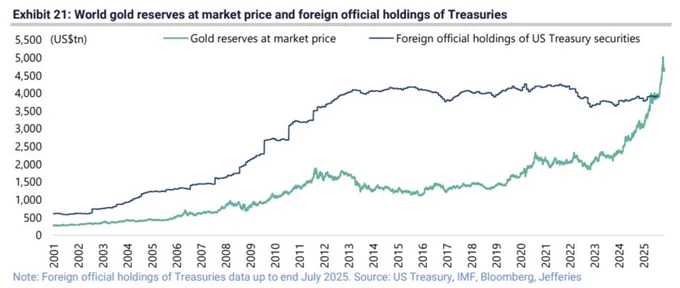

🚨 #GOLD IS NOW THE LARGEST WORLD RESERVE ASSET.

THE WORLD’S APEX MONEY.

ALL THAT’S LEFT IS FOR EVERYONE TO UNDERSTAND THIS. IT WILL TAKE SOME PAIN. BUT THEY’LL GET THERE.

GoldGreenGuru retweeted

Silver’s about to make headlines again. ⚡️ Back in 1980, there was plenty of above-ground supply — today, it’s a whole new world. With global demand surging and real estate in a massive bubble, the setup for silver’s next breakout is unlike anything we’ve seen before.

Watch now 👉 hubs.la/Q03Sf9m10

#Silver #Gold #PreciousMetals #Investing #WealthProtection

GoldGreenGuru retweeted

Silver Stage Set for Delivery Meltdown: Keith Neumeyer Dissects COMEX, LBMA CRISIS!

Watch now: piped.video/CPt4_2qN5DE

#silver #gold #economy #finance #money #dollar #usd @DanielaCambone @keith_neumeyer

GoldGreenGuru retweeted

Silver's official addition to the U.S. critical mineral list signals a major shift in government policy.

This elevates silver from a traditional precious metal to a strategic industrial asset.

It is essential for national security, advanced technology, and clean energy.

-Defense

-Data Centers

-AI

-Solar

-EVs

-Hydrogen fuel cells

-Nuclear control rods

For physical #silver investors, this reclassification brings profound implications for supply, demand, and long-term price supports.

From precious to critical. The USA has added #silver to the list of critical minerals that it deems vital to America’s economy & national security🔗@KitcoNewsNOW kitco.com/news/article/2025-…

@FMSilverCorp @FirstMintLLC @keith_neumeyer $AG #TripleDigitSilver #GotSilver #BuyPhysical

GoldGreenGuru retweeted

#XAUUSD #GOLD

From a technical perspective, gold still faces slight downward pressure. Unless the price can sustain a hold above $4006, any rebound may attract sellers. A break below $3980 could trigger new downward momentum, targeting $3965; while holding above $4000 may lead to a brief consolidation before potentially falling again. 🎯

GoldGreenGuru retweeted

📣📣WHAT'S DIFFERENT IN GOLD AND SILVER THIS TIME ❓️❓️

This is a great video breaking down what is going on in the Precious Metals market @MilesFranklinCo

We have been here before but have we❓️

A lot has changed and we see Countries and major banks flooding into Gold and Silver and taking Physical possession of the asset.

Which kills the paper market illusion.

THE JIG IS UP

GoldGreenGuru retweeted

History suggests gold has yet to peak, inflation could drive the next leg up – AJ Bell’s Mould

“Sceptics who still view #gold as a barbarous relic, a useless lump with no yield or even an asset that currently has a cost of ownership of 4% thanks to lost interest on cash will all be nodding as the metal slips back from last month’s new peak, but this slide may not mean its surge is over. Both of the 1971-1980 and 2001-10 bull runs featured several retreats which did not ultimately nullify or prevent major gains.” ...

>> Read the full story at Kitco:

kitco.com/news/article/2025-…

GoldGreenGuru retweeted

The silver market traded 276 million paper ounces yesterday. The comex had 335 deliveries and the LBMA had 200. Do we breach $50 next two days? Do they naked short another billion ounces to bring price down $2? What happens if they have to cover? You don’t hold enough physical!!

GoldGreenGuru retweeted

🧵 THREAD:

U.S. Declares Copper & Silver CRITICAL 🚨

This just changed everything for commodities and real assets. 👇

GoldGreenGuru retweeted

Nations around the world begin to build strategic reserves, demand for strategic materials and commodities will double or more. When preparing for an arms race, you set aside one pound for every pound you consume, and if your supply is threatened, such as with heavy rare earths, you set aside even more.

GoldGreenGuru retweeted

From the first synthesis experiments to mainstream retail adoption, lab-grown diamonds have evolved from scientific curiosity to one of the world's fastest growing industries. Following DMCC's second Lab-Grown Diamond Symposium in Dubai, discover its unique insights and expert perspectives - and how foresight and innovation continue to shape the future of LGD trade. Explore the Future of Trade: Lab-Grown Diamonds Edition: futureoftrade.com/lab-grown-…

#FutureOfTrade #DMCC #LabGrownDiamonds #GlobalTrade #Innovation

GoldGreenGuru retweeted

#Silver has blasted through long-term resistance after climbing within a well-formed ascending channel.

The breakout triggered a sharp vertical rally, taking the price near the $50 zone.

Momentum remains strong, and a break above $55 would fuel the next move higher.

GoldGreenGuru retweeted

The key objectives of the new China tax rules on #Gold is to funnel all #Gold buying Chinese domestic liquidity through the Shanghai Gold Exchange (SGE) and the Shanghai Futures Exchange (SHFE).

This will in turn give SGE the ammunition to further drain the LBMA of its physical #Gold and potentially give SGE global pricing power.

GoldGreenGuru retweeted

We’re entering a phase where liquidity pressure is tightening across markets — similar to what happened before GFC.

For now, silver trades in sync with risk assets, as margin pressure and deleveraging dominate.

But as the sell-off matures and the system shifts from liquidity scarcity to capital scarcity, the dynamic changes.

That’s when monetary metals decouple —

they stop trading as “risk” and start repricing as reserve collateral and store of value.

Expect #silver to remain sideways-to-down while risk unwinds —

then to emerge as one of the few assets that can absorb the capital fleeing for collateral

GoldGreenGuru retweeted

History doesn’t repeat, but it rhymes. And right now, gold’s melody sounds familiar.

Sean Russo has spent longer studying gold cycles than we have spent alive.

What he sees now feels familiar: a weakening dollar combined with gold outperforming equities, and investors still underweight the sector.

We unpack the charts that reveal human psychology, why miners chase the wrong moment, and how history is quietly repeating now.

YouTube → piped.video/l-8aDiR5UtM

Spotify → open.spotify.com/episode/70z…

GoldGreenGuru retweeted

Gold’s Flashing Warning: The End Is Nigh For Fiat

'In nominal terms fiat money might appear stable, but in real terms it is decaying. Each Dollar, Euro or Yen buys less productive output each year, and the illusion of strength persists only because every major currency is falling together. #Gold's relative price exposes that truth as it measures not inflation, but trust'.

eurasiareview.com/05112025-g…