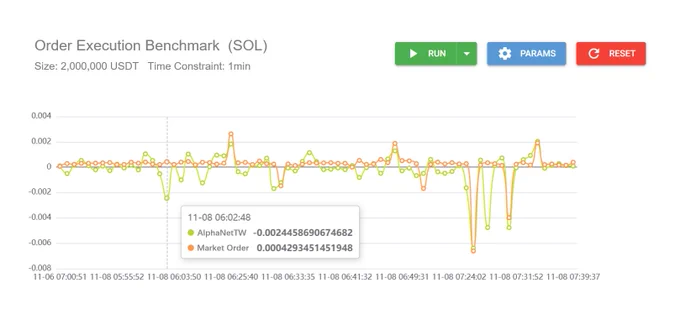

Order execution slippage over time is a much bigger cost than exchange trading fees. Below is a proprietary dynamic TWAP execution algorithm powered by deep reinforcement learning that optimizes execution and often delivers "negative slippage" vs target execution price.

The data below shows a benchmark on SOL of the total execution cost on real-time market price (0 means no cost above target price, +0.002 would indicate 20 bps cost incurred, negative value would indicate "negative slippage")

No exchanges provide robust execution tools for their users, until ....

Nov 8, 2025 · 8:22 AM UTC