All the latest from NIESR, Britain's longest established independent research institute. For our Review, follow @NIESRreview. Find us on BlueSky @niesrorg

London, UK

Joined October 2012

- Tweets 22,871

- Following 2,240

- Followers 16,597

- Likes 5,990

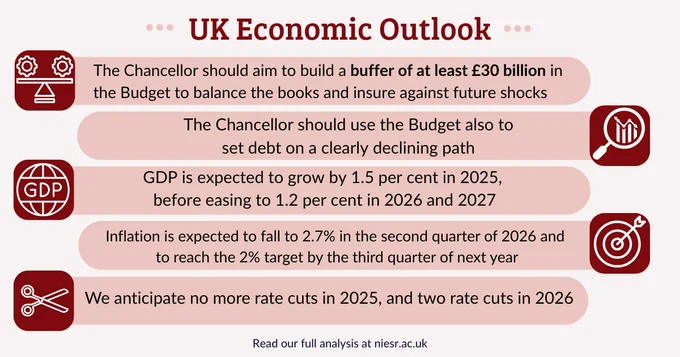

⚡️OUT NOW⚡️ The #Chancellor should use the forthcoming Autumn #Budget to create a bigger fiscal buffer and set #debt on a clearly declining path 📉

Our latest quarterly UK Economic Outlook is published - Access it here 👇

hubs.la/Q03RNhrX0

#WeekendReading 🔖 Our latest quarterly UK Economic Outlook suggesting the #Chancellor should use the forthcoming Autumn #Budget to create a bigger fiscal buffer and set #debt on a clearly declining path📉

Free to access and in HTML for the first time

hubs.la/Q03Sdg0q0

#WeekendReading 🔖 What's the current state of the UK economy? What is the outlook for 2026?⚡️

In our latest #MondayInterview, our @EconSteveM

outlines what the main issues are at the moment and what to expect from the forthcoming #AutumnBudget

⬇️⬇️⬇️

hubs.la/Q03Sd3T40

National Institute of Economic and Social Research retweeted

The #DirectorView is out now📈

In today's 'Dean Trench' Weekly Memo our Director David Aikman examines what the #Chancellor should say in the new MPC remit - and poses 5⃣ critical questions for the Chancellor to consider when writing this year’s letter

hubs.la/Q03S8Qjp0

Now is the time for the Q&A session -

Don't forget from today you can access the full document here - free access 🔓 - and for the first time in HTML as well - Hope you like the change... any feedback just let us know !

13/13 ENDS

@RoyalEconSoc

niesr.ac.uk/reports/economic…

Our @BenEcon33 concludes his presentation emphasizing why it is now the moment to start bringing debt down:

"The sun might not be shining but is better to fix the roof in light drizzle than during a thunderstorm!" ⚡️⛈️

12/n

So how much headroom is needed to run 'sustainable public finances'?

We think a buffer of 1-2% of #GDP is needed - much more than what #Chancellors have left themselves in the last 6 fiscal events

10/n

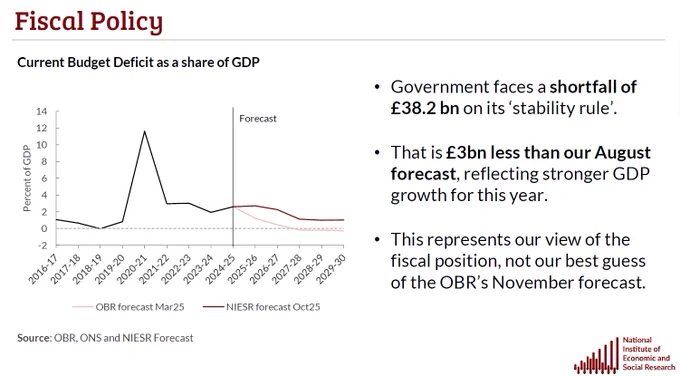

Tuning to #FiscalPolicy, it is now clear that the Government is running a deficit against their fiscal rules

We think it is approx. £38bn, with the second chart here explaining the difference with the latest @OBR_UK projections - Major factor is our view on trend growth that make the deficit number substantially bigger

9/n

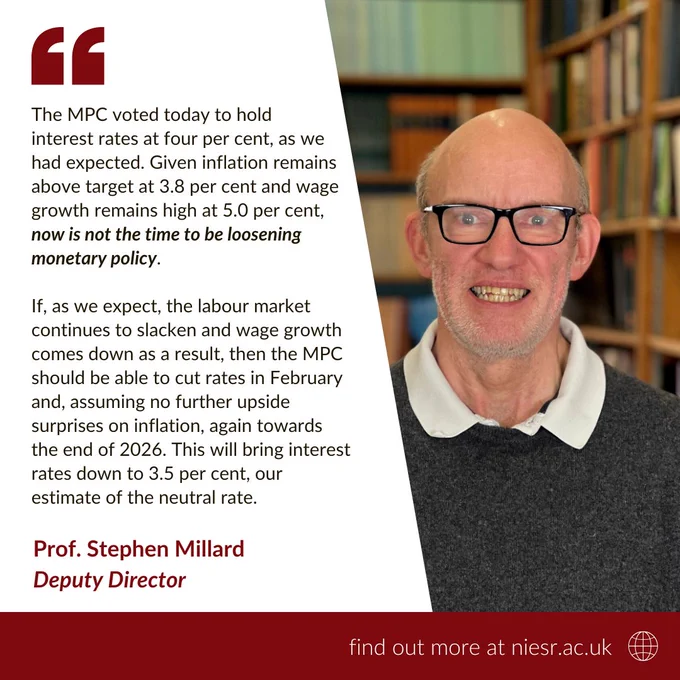

We think #inflation has peaked and will return to 2% target next year, but not before the second half of the year

Given this, we think the Bank of England will cut rates but not before February 2026

"There is no much scope for further cut rates for monetary policy to be effective at the moment"

8/n

#GDP growth revised slightly upwards, but will be falling back next year to what we think is UK trend growth at the moment

7/n

Now over to @BenEcon33 who will be outlining our view of the UK economy and what should happen at the forthcoming #Budget

Here are the main messages 👇

6/n

Other risks lie in the US stock market where some correction might be happening in the near future

5/n

#Tariffs are still a major source of uncertainty and risk

4/n

Tariffs are gradually transmitting to US consumers, though their impact to overall trade might be overstated, as shown by this chart

3/n

Ahmet outlines the main themes - 🌎📈

Global growth is holding relatively well - with advanced economies to grow by 1.7% in 2025 and 1.5% in 2026

Emerging economies are resilient too with forecast growth rates of 4.2% in 2025 and 3.9% in 2026

2/n

And we are live ⚡️ - With our Director David Aikman introducing @KayaAhmetIhsan who will be going through the Global Economy💻

Follow the thread here and don't forget you can access our outlook in full here - and for the first time in HTML too!! 👇👇🧵

1/n

niesr.ac.uk/reports/economic…

🚨LAST CALL 🚨 Less than 2⃣4⃣ hours to our Economic Forum 💻

Join us online at 11am tomorrow to hear all the latest research from us on the UK economy, the upcoming #Budget and the latest #InterestRates decision 📈

Sign up here 👇

hubs.la/Q03R-Bf20

National Institute of Economic and Social Research retweeted

🚨LAST CALL 🚨 Less than 2⃣4⃣ hours to our Economic Forum 💻

Join us online at 11am tomorrow to hear all the latest research from us on the UK economy, the upcoming #Budget and the latest #InterestRates decision 📈

Sign up here 👇

hubs.la/Q03R-Bf20

National Institute of Economic and Social Research retweeted

⚡️Our reaction to the latest #BankOfEngland's MPC decision on #InterestRates is out now⚡️

#UKeconomy

#MonetaryPolicy

#Budget

@RoyalEconSoc