A cross margin credit protocol with autonomous monetary policy and dynamic risk parameters | powered by @Starknet

Joined October 2021

- Tweets 995

- Following 29

- Followers 3,963

- Likes 825

Pinned Tweet

Today marks 1 year of Opus and $CASH, the first native decentralized stablecoin on @Starknet

When we started, Opus was just an idea: could we really build a decentralized digital bank that adapts to markets and runs on its own?

One year later, here’s what we’ve achieved together:

- Rolled out CASH-USDC LP staking where stakers receive a portion of protocol income, boosted by @Spiko_finance T-bill yield from protocol-owned liquidity

- First protocol to integrate @EkuboProtocol oracle pools as the central price feedback mechanism for CASH, and as a backup price oracle

- CASH market launched on @vesuxyz courtesy of @Alterscope, and integration with $STRK LSTs like @endurfi

- Introduced dynamic income allocation to adapt incentives to market conditions

These milestones are more than features; they’re steps toward a system that balances stability and liquidity without human intervention. Everything stayed fully on-chain and transparent, building trust through code.

Most importantly, none of this would have been possible without you. Our users, partners, and community believed in us early, tested alongside us, and encouraged us to keep building.

Year one was about laying the foundation. Year two will be about scaling, expanding integrations, and proving that decentralized digital banking is not just possible but a reality.

With the BTCfi season ahead, we’re ready to onboard BTC LSTs, unlocking the power to put your $BTC to work and earn real, sustainable yield.

Thank you to everyone who joined our anniversary giveaway campaign. Rewards have been distributed directly to your wallets.

And thank you for being part of this journey with us.

Onward!

We love the gamerz!

8/ Cartridge Controller users can now connect to and use Opus.

The second DeFi protocol integrated by the Controller (after @avnu_fi).

Opus retweeted

tagging the teams building the next wave of BTCFi yield innovation:

@vesuxyz, @trovesfi, @ForgeYields, @endurfi, @EkuboProtocol, @Re7Capital, @Splinefinance, @MidasRWA, @uncapfinance, @OpusMoney, @0DFinance

too many choices tbh

Say bye-bye to tedious steps.

Say hello to One-click solution.

Money making machine is printing, but for how long?

New @OpusMoney LP Staking UI

Just select one stablecoin, we’ll handle the rest.

No need to hop over to @EkuboProtocol to set parameters, we’ve got you covered.

We're quietly farming 41.34% stable yield, hehehe, join us!

🤔

Some tips for the Realm ecosystem project:

Borrow with $LORDS without selling your allocation to fund your expenses!

GGWP

LEZZZGOOOOOW

What’s up, gamers! 🎮

You can now connect to Opus directly with your @cartridge_gg controller.

If you’re deep in the @Starknet gaming ecosystem, it’s time to level up:

Use $LORDS as collateral to borrow $CASH at NEW lower rates and higher LTV.

See you in the Arena.

gg ezclap

Glad to see people finally waking up to the importance of censorship-resistant money.

Decentralized stables aren’t a niche, they’re the antidote.

Diversify your stablecoin with Opus.

p/s: We just lowered our rates, try Opus!

people talking about you cant self custody a stablecoin

bro maker v1 single collateral dai was this in 2017

and now you have liquity

i stood infront of a eth sydney panel in 2018 and told them all theyre fucking retarded because they didnt know about maker single collateral dai and how it was the future

i was alot more hopeful back then

but now u can literally have something better

u can just put a @LiquityProtocol v2 fork directly into a @0xprivacypools and mint real anon cash with unstoppable private eth

but nobody seems to care or be creative

just dont listen to the retards that fud about how we dont have decentralized stables

it was possible in 2017 and its even more possible now

return to crypto native value (god i need to publish this article)

Decentralized stablecoins don't matter unless you're affected.

Diversify your stablecoin portfolio with Opus.

Same theory applies to the @Starknet stablecoin ecosystem.

$USDC fuels value for TradFi, T-bills, and other centralized assets.

But decentralized stables fuel value for $BTC, $ETH, and the broader crypto economy.

1️⃣ $CASH (by Opus): A multi-collateral-backed stablecoin powered by ETH, wBTC, and other crypto assets.

2️⃣ $USDU (by @uncapfinance): A Liquity fork built for BTC collateral.

By holding DeFi-native stables, you’re not just parking liquidity; you’re powering the growth of permissionless finance on Starknet.

DeFi stables create real crypto demand.

They evolve from passive assets into onchain DATs (Demand-Absorbing Tokens) that reinforce the entire ecosystem.

Move $15+ BILLION from TradFi onchain.

All it takes is a 5% shift from CeFi>DeFi stables.

CeFi stables support Wall Street.

DeFi stables support Ethereum.

Swapping into DeFi stables like...

- $BOLD: ETH & LSTs coll

- $crvUSD: BTC/ETH & crypto coll

- $fxUSD: ETH & BTC coll

- $GHO: ETH, BTC & crypto coll

- $USDaf: BOLD & crvUSD coll

creates demand for their crypto backing.

Crypto stables becoming onchain DATs 🤩

👉 Diversify 5% of your stables.

believe in somETHing.

👀 @ethereum , @VitalikButerin , @Consensys , @fundstrat , @SharpLinkGaming

Opus retweeted

while other L2s are copying each other and adding no value and no innovation at all, Starknet is re thinking the whole L2 space

Starknet is getting ahead 👇

they are literally becoming a bridge between the two biggest ecosystems

many things you can already do as a bitcoiner

• BTC ↔ STRK Swaps

you can swap BTC ↔ STRK using Xverse with a single click

Fast with great UX, perfect to onboard bitcoiners

• bridge bitcoin

with trust-minimised bridges, and non custodial so you keep control of your bitcoin. There is no third party custody

protocols like Atomiq Labs or Garden allow you to take your bitcoin (from bitcoin network) and wrap it into WBTC and send it directly on Starknet

other protocols like Lombard Finance allow you to bridge LBTC on Starknet, or Threshold network for direct minting from native BTC onto Starknet

you can also bridge any kind of wrapped bitcoin (WBTC, LBTC, SolvBTC, tBTC) using StarkGate

@rhinofi, launched a zero bridging fees route for wBTC into Starknet so you can plug in and move your bitcoin directly to starknet, free of charge and participate to BTCFi season

and the most recent announcement: Alpen Labs’ which is enabling a bridge where your bitcoins are locked on bitcoin network, and the corresponding bitcoin becomes usable on Starknet but this time not as wrapped bitcoin, but as real bitcoin backed by cryptographic proof.

it’s a bridge without trust assumptions, aligning perfectly with bitcoin’s ethos of self-sovereignty

huge.

• trading runes

Runes are a type of fungible bitcoin native tokens (that can be memecoins, or used for governance, gaming or as stablecoin for example, but many more use cases are possible) that can be bridged directly to starknet, which unlock a lot of new possibilities for rune tokens as they can now access DeFi on Starknet, which was not possible on bitcoin

perfect to bring the degen community on starknet imo !

• rune assests

this one is a bit different from the previous one. But it’s huge imo

asset runes are a new kind of token that live natively on bitcoin blockchain.

their purpose is to bring non-bitcoin assets like USDC on bitcoin network (which did not exist before that) without any wrapper or sidechains.

each Asset Rune is backed 1:1 by the real asset on Starknet so the reserves always match the supply.

soon rune assets will expand to ETH, STRK, RWA etc …

• BTCFi season

bunch of strategies are already live for BTCFi season:

> LP wrapped bitcoin liquidity (LBTC, WBTC, SolvBTC, xsBTC, xBTC, tBTC) on @EkuboProtocol to earn trading fees + STRK incentives with APY up to 30%

> lend wrapped btc (WBTC, tBTC, LBTC, SolvBTC) with 3% APY on @vesuxyz

> borrow stables, wstETH, ETH, STRK against wrapped bitcoin on @vesuxyz

> loop your strategy on vesu: deposit wrapped bitcoin → borrow ETH → lend ETH back on vesu (or elsewhere if the reward is higher) → earn even more rewards 🔁 and get 7-8% APY

> provide liquidity in vesu vaults with 5% APY

> provide liquidity in @Trovesfi’s bitcoin strategies for up to 16% APY

> deposit wrapped bitcoin on @OpusMoney and mint CASH

> provide liquidity on wBTC/tBTC pair with 4.17%

> deposit WBTC and borrow USDU against it on @uncapfinance. You can use USDU across starknet DeFi and participate in BTCFi

> buy USN and stake for sUSN on @noon_capital to earn up to 13%. The yield come from delta neutral strategies (= low risk). USN is tradable on Ekubo rn. Next week you should be able to loop it on vesu for additional rewards and in 1-2 weeks get additional yield with vesu vaults

• bitcoin staking

> stake your wrapped bitcoin (WBTC, LBTC, LBTC, tBTC, SolvBTC) and get rewarded 4.6% for holding your bitcoin!

> liquid staking on Endur to earn addtional yield by using your LST in other DeFi protocol (TrovesFi, Vesu, Ekubo) and earn additional rewards from BTCFi

• use cases beyond DeFi

> real world payments with Lightning network via Braavos (you’re paying using your bitcoin)

> social network, with Nostr. You can tip your favorite creators directly from Starknet, using STRK. Nostr’s community with ≈ 200k trusted users, that can now use Starknet

> fund your cashu wallet directly from starknet to keep your payments private

100+ $EKUBO @EkuboProtocol buybacks now done with $CASH.

Yeah, just a biiiiit higher than wstETH, but that’s progress.🎉

Opus retweeted

Explore the BTCFI landscape on @Starknet 🚀

On @StarknetEspreso today, we run through Starknet’s BTCFi platforms, where Bitcoin transitions from a passive store of value to a yield-bearing, liquidity-powered asset.

100M $STRK from @StarknetFndn up for grabs for builders & users fueling this new wave, from lending with VESU and staking with Endur to swaps and yield aggregation.

Dex: @EkuboProtocol @Splinefinance

Lending Markets: @vesuxyz @OpusMoney

Yield aggregation: @trovesfi @avnu_fi

Staking: @endurfi @0xvoyageronline

Swaps & Bridges: @garden_finance @atomiqlabs starkgate

LPs: @Re7Labs @MidasRWA

#Bitcoin #BTCFI #Blockchain #DeFiRewards

🚀 BTCFi on @Starknet is live!

Not just as a wrapped token, but as a foundation for liquidity, borrowing, and yield across the ecosystem.

Take a look at the protocols participating in BTCFi Season (DEXs, lending markets, bridges, and more)

What this means for you and how to get involved, earn yield, and leverage BTC in DeFi

Stay tuned for more breakdown dropping soon ⚡

@OpusMoney @Splinefinance @vesuxyz @EkuboProtocol @atomiqlabs @garden_finance @hyperlane @XverseApp @LayerZero_Core @BitGo @StargateFinance @StarknetFndn

#Bitcoin #BTCFi #blockchains #DEFİ #Ethereum

The BTCfi Liquid engine 😤😤

4️⃣ Lending / Yield / Stablecoins

Turn your BTC productive 💰

@vesuxyz | @nostrafinance | @FixedLend | @OpusMoney | @endurfi | @trovesfi | @TheTNetwork | @uncapfinance | @ForgeYields

Stake, lend, borrow — and farm the 100M $STRK BTCFi Season incentives.

Never a better time to go long on $LORDS, on the only place that lets you take leverage with $LORDS

Opus.money

1. The Lootverse Microstrategy Proposal + the @LootSurvivor advancement proposal have passed, marking a major shift of the treasury mgmt from its idle state in the past 2 yrs. >200E will be spent in the next 8 months to purchase major loot related assets

loot-dao-site.vercel.app/vot…

Gm gm!

Supply & Borrow Bitcoin to earn BTCfi Rewards!

🔗: app.opus.money/rewards

Dear algorithm,

Show this to everyone who still believes in decentralization and censorship-resistant stablecoins.

Oh, and the base rate? Dirt cheap.

Worried about liquidation? Don’t be.

Opus is built differently, our mechanism partially liquidates ONLY WHEN needed, restoring your LTV without nuking your position.

Try it yourself: app.opus.money

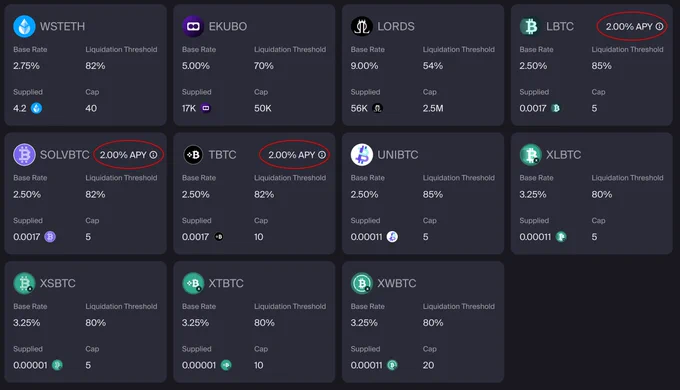

For those who missed it, supplying BTC on @OpusMoney earns you 2% of BTCFi rewards.

Borrow against it? You'll earn even more.

Eligible assets:

- @WrappedBTC ($WBTC)

- @Lombard_Finance ($LBTC)

- @SolvProtocol ($SOLVBTC)

- @TheTNetwork ($tBTC)

Thanks for covering us!

Mix & Match your collateral on Opus, you'll get attractive interest rates, for example:

Borrowing ETH is 2%

Borrowing BTC is 2.5%

Instead of charging 2.5% for your BTC, now you get 2.37% on your collateral in a single trove!

Good rates tbh, good rates!

Here’s everything you need to know to make BIG during BTCFi on Starknet !👇

I. What is BTCFi

starknet kicked off BTCFi Season: a 100M STRK program designed to make Bitcoin productive in DeFi and allow all its users to get juicy APY on their bitcoin

you can lend, borrow, LP, borrow stablecoins against bitcoin and even stake bitcoin to earn some nice rewards.

clearly, with this program starknet became the top chain to put your bitcoin at work

this initiative is planned to last at least 6 months

II. Bitcoin yield opportunities and strategies on Starknet

1. Ekubo

ekubo is the AMM endgame ! It’s built with ultra-concentrated liquidity, singleton design, and tight capital efficiency which makes Ekubo one of the most capital-efficient AMMs in DeFi (so perfect to put your bitcoin at work!)

so, what you can do on ekubo?

• provide wrapped bitcoin liquidity (LBTC, WBTC, SolvBTC, xsBTC, xBTC, tBTC) to earn trading fees + STRK incentives

APY vary from 2.9% to 35% depending on the pair

ekubo is distributing 2,000$+ of reward every single day !

2. Vesu

vesu is a lending protocol on Starknet where users can borrow and lend assets in a non-custodial manner unlike traditional lending protocols, anyone can create a lending pool without needing approval

what you can do on vesu?

• lend wrapped btc (like WBTC, tBTC, LBTC, SolvBTC) to earn interest from borrowers

APY start from 2% until 2.8%

• borrow stablecoins, wstETH, ETH, STRK against wrapped bitcoin

this one is pretty wild imo, because you’re getting rewarded to deposit wrapped bitcoin in exchange of ETH, STRK or stablecoins!

then if you’re a real degen you can loop it:

deposit wrapped bitcoin → borrow ETH → lend ETH back on vesu (or elsewhere if the reward is higher) → earn even more rewards 🔁

this way you can easily get 7-8% APY by depositing wrapped bitcoin on vesu

• wrapped bitcoin vaults

this is a strategy that lets you earn yield on your bitcoin without selling it or taking price risk

here’s how it works:

- you deposit wrapped bitcoin (wBTC, solvBTC, tBTC, LBTC) into the vault

- the vault uses your bitcoin as collateral on vesu to borrow USDC

- that borrowed USDC is then deposited into delta-neutral strategies which are trading strategies that earn yield from funding rates and lending markets, but stay neutral to bitcoin price movements

- you keep your bitcoin exposure and you are earning additional yield (5%) in a market-neutral way

3. Trovesfi

Troves (formerly STRKFarm) is a yield aggregator designed to help users maximize returns on Starknet DeFi

they are providing you the best possible yield farming opportunities, and you have nothing to do

for example, the hyper xtBTC strategy:

- you deposit xtBTC into the vault

- the vault lend your xtBTC to borrow more tBTC

- tBTC is used to buy more xtBTC which increase your exposure to xtBTC without adding more of your own bitcoin

- xtBTC are deposited on vesu and more tBTC are borrowed to loop further

so your initial xtBTC deposit gets magnified through borrowing/looping tBTC → buying more xtBTC → collateralizing → repeat

the vault is managing EVERYTHING for you

so by depositing xtBTC you get a juicy 21.9% APY

and there are several strategies like this one:

4. Opus

basically, opus is a place to borrow, lend, and mint stablecoins (CASH, Starknet’s native stablecoin) using other asset as collateral

to get exposure to BTCFi on opus you can

- deposit wrapped bitcoin as collateral to mint CASH

- Use CASH in other DeFi protocol to gain additional rewards

- earn yields from stablecoin usage / protocol revenue share

5. Spline

spline is a DEX protocol that supports wrapped bitcoin

on spline you can provide liquidity on wBTC/tBTC pair with 4.27% without taking any risk as the price of wBTC and tBTC are the same so you won’t suffer from impermanent loss

simple but efficient with real nice rewards (4.27% on bitcoin is simply huge) !