How a single year of poor/subdued market performance, dramatically reduce your SIP returns?

This table illustrates this: How a single year of poor market performance reduces the overall longer-term SIP returns (XIRR), even when preceded by four years of exceptional gains.

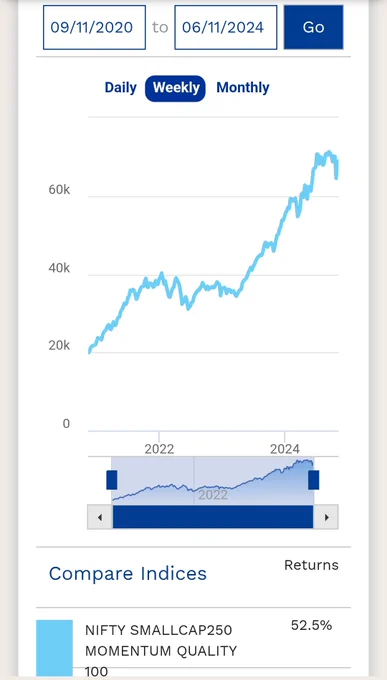

For a monthly SIP of Rs 10,000 in Smallcap funds, the 4-year XIRR from November 2020 to November 2024 (total investment: Rs 4.8 lakh) shows top-3 performers delivering 40.6%, 38.0% and 37.3%.

However, extending the period by just one year to November 2025 (total investment: Rs 6.0 lakh), which captures a subdued (downturn) market, slashes the 5-year XIRR for the same performers to 27.4%, 23.1% and 20.0% respectively. Still great, but not as it was just a year back (and may disappoint new investors who started around 2020).

This erosion occurs because XIRR is highly sensitive to the timing and magnitude of returns in a compounding sequence. So, a recent 12 months of negative or muted performance dilutes the earlier outsized gains disproportionately, as the larger accumulated corpus suffers absolute losses, pulling down the rate proportionally.

Note - Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Disclaimer - The funds/indices shown above are for illustration only. It is not a recommendation to buy/sell/hold. Please get in touch with your investment advisor for customised investment advice based on your risk profile and unique requirements.

Nov 7, 2025 · 6:13 AM UTC