Padmanabham retweeted

If you are bothered by today's markets, you are not yet ready to be an investor

Review your strategy and review your risk profile.

Padmanabham retweeted

When you die, they won't remember your car or house.

They will remember who you were. Be a good human, not a good materialist.

Padmanabham retweeted

The problem in our country sadly but true. The wealth revolves in a very few hands. Just an Eg. IPL Matches. Tons of advertisements. Very good sign. But Akshay, Amitabh or Amir. They have enough give a chance to others. It is a view

Padmanabham retweeted

First level review of the Model Portfolio 1

Padmanabham retweeted

Don't be shy of below ever.

~ Old clothes

~ Poor friends

~ Old Parents

~ Simple living

Padmanabham retweeted

If you want to know the value of money, speak to those who don't have it and also to those who have lost it. You need to get rich only once provided you don't do anything foolish.

Padmanabham retweeted

Enjoyed listening to this discussion. Very well moderated by @ashishkila.

piped.video/fnNbuH4yDKs

Padmanabham retweeted

What a surprise, a real estate company, whose revenue depends on people coming to office and not working from home, publishes a survey that says, Work from Home is Bad.

Real estate advisory Knight Frank (India) surveyed 1,600 technology professionals in India and found that 30% of them reported deterioration in productivity and work performance while working from home

livemint.com/news/india/the-…

Padmanabham retweeted

If actors and celebrities are your role models, you need to review your role in the journey of life.

The meaning of life is to find the purpose,

The purpose of life is to give it away.

Padmanabham retweeted

I don't believe in investing thru mutual funds.

~ I'm responsible for my career,

~ I'm responsible for my life,

~ I need to be completely responsible for my investments.

Freedom.

Mutual funds are overrated,

Direct Investing is underrated.

Mutual funds sahi nahin hein.

Padmanabham retweeted

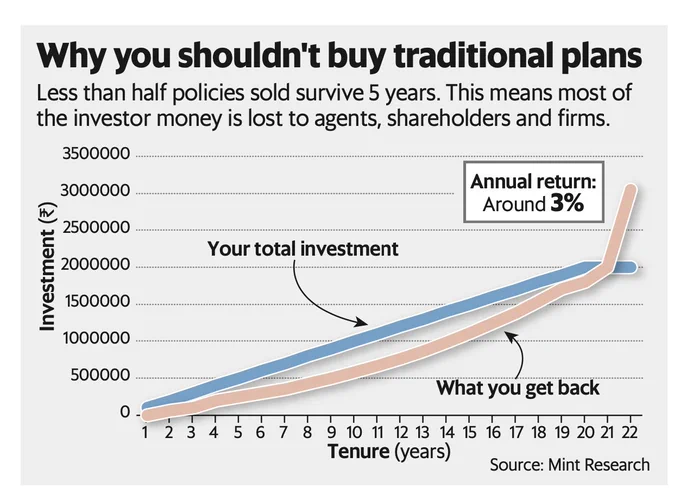

Feel cheated @BajajAllianzLIC

Have been paying premium of Rs 73000 pa for Bajaj Allianz- Investgain Economy plan. Today Co representative calls saying I should move out & invest in other plan of the Co. Shocking that I get just Rs 80k over the investment made in 10 yrs.

Padmanabham retweeted

Yes. Buy term. Buy it online. Fill the form correctly. Buy ONLY if you have income dependants. Don't buy for tax break.

@billapraveenk

Padmanabham retweeted

Why you should NOT buy a bundled life insurance policy

1. Poor life cover

2. Poor returns

3. Built like a trap

4. Agent, company and shareholders profit. You lose.

5. The graph shows what you get back if you stop the policy mid-way.

My column in @livemint

livemint.com/money/personal-…

Padmanabham retweeted

Term Breakdown:

CAGR

CAGR stands for Compounded Annual Growth Rate

CAGR is the compounded growth percentage. If it 10% cagr in profits,

1st yr = 100

2nd yr = 110

3rd yr = 121

It is imp. to look at Sales cagr, PAT cagr among other things before choosing a stock.

Padmanabham retweeted

ALERT : WEBINAR LINK OF MEET FOR UPCOMING IPO OF HAPPIEST MINDS TECHNOLOGIES LTD.

RETWEET and LIKE for maximum awareness.

Virtual Brokers and Analysts Meet today, September 2, 2020, 4:30 pm.

Click the link below to join the webinar:

happiestminds.zoom.us/j/9533…

Passcode: 466746

Padmanabham retweeted

I would encourage you to read my site, where I discuss research, strategy, process etc:

dividendgrowthinvestor.com/2…

Padmanabham retweeted

Lots of people saw trading as a way to “make money from home” at the start of the pandemic. But now, the getting-rich-quick stock fantasy is giving way to a more realistic plan: namely, learning to spot high-confidence trade setups. Let us help - free! ow.ly/rW2050Bf1KB