Exploring the blockchain universe. Crypto believer | Decentralization advocate | Trust in code.

Rize, Türkiye

Joined October 2023

- Tweets 14,673

- Following 305

- Followers 3,222

- Likes 13,325

Until we actually see:

the balance sheet turning up clearly,

rate cuts alongside that,

and deficits staying large,

this remains a setup, not a guarantee.

But if all three line up,

then yes, easing into this kind of market

is exactly the environment where the biggest bubbles and the biggest gains are created.

That’s the core of the thesis.

So the thesis here is simple and conditional:

The Fed has not announced QE.

It has signalled that reserve growth is possible and likely at some point.

If that signal turns into actual balance sheet expansion in this macro backdrop, history says:

→ risk assets can experience a very strong final upside phase

→ especially AI, growth, commodities, gold, and Bitcoin.

The risk comes later:

If balance sheet expansion becomes large and fiscal deficits stay high,

inflation can re-accelerate.

At that point, the central bank is forced to:

slow purchases

raise rates again

or at least stop cutting

That’s when the bubble usually ends.

But that is not the starting point.

The starting point is usually very bullish.

There is also a timing lag.

When liquidity increases:

financial assets react quickly

consumer-price inflation reacts with a delay

So there is often a 6–12 month window where:

stocks, crypto, and commodities perform well

central banks still argue that inflation is manageable

This window is what traders often ride as the melt up, even though fundamentally it’s a fragile phase.

On top of that, you have the asset choice logic:

A 10y Treasury gives you a fixed yield (say ~4%).

Gold gives 0%.

Bitcoin gives 0%.

But if the expected inflation rate and money creation go up, the real return on bonds falls, while the relative appeal of scarce assets rises.

This is why gold and BTC often rally when people believe money printing is coming back.

Mechanically, if the Fed starts adding reserves in size:

Bank reserves rise

Funding stress in money markets falls

Real yields tend to drift lower

Valuation multiples on long-duration assets (tech, AI, growth, Bitcoin) usually expand

That is not opinion.

We have already seen that pattern in prior QE phases.

This is where the bubble thesis comes from.

A bubble does not need a crash first.

A bubble needs:

cheap money

strong sentiment

and a good story (right now that’s AI, productivity, etc.)

Adding liquidity in that context tends to inflate prices further rather than normalise them.

What makes this even more important is the starting point.

Today:

Equity valuations are already elevated.

AI / tech multiples are high.

Private credit and capital markets are still active.

Credit spreads are tight, not stressed.

So if liquidity is added here, it is not fixing a broken market.

It is feeding a market that is already expensive.

That difference matters.

QE into a crisis = support.

QE into a strong market = amplifier.

If the balance sheet starts increasing while financial conditions are already easy, you are no longer just stabilising the system.

You are pushing an existing uptrend further.

Now the thesis:

If the Fed ends QT and starts net adding reserves in an environment where:

stocks are near highs

unemployment is low

inflation is above target

fiscal deficits are large

...then that is a classic late-cycle liquidity phase, and historically it has been very bullish for asset prices.

Most people ignored the most important line from Powell.

He said that "at a certain point, you’ll want reserves to start gradually growing to keep up with the size of the banking system and the size of the economy."

That is not an official QE announcement.

But it does open the door for balance sheet expansion again.

༄Ĕ𝐥𝐌𝗂𝗿ᾰ🥀 retweeted

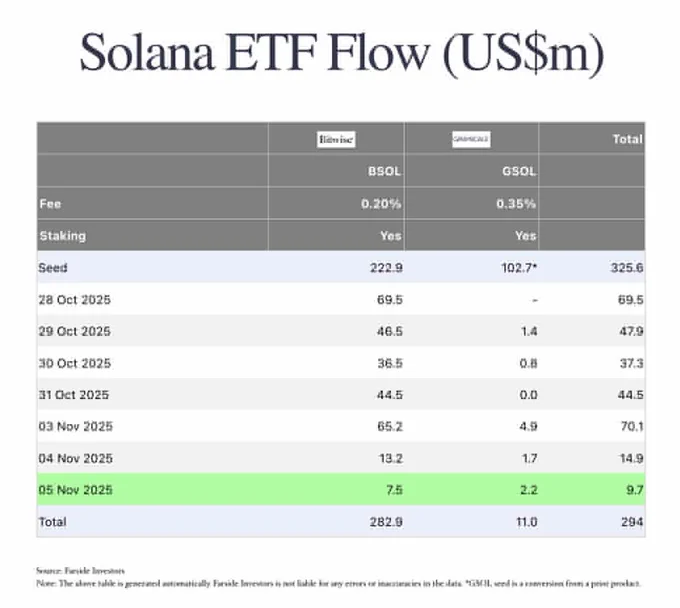

Spot Solana ETF is pulling steady inflows, while Bitcoin and Ethereum continue to see outflows.

Clear signal of shifting market preference and growing conviction behind Solana’s momentum.

If this flow trend holds, it could force broader repositioning in the market.

$BST is redefining real estate!

With over $200M already tokenized and Vera Capital joining forces to unlock $1B more, Blocksquare is pushing the #RWA revolution forward.

Real estate meets crypto — for real.

#Blocksquare #DeFi

Tokenization is transforming the future of real estate!

By integrating blockchain into the traditional capital stack, property ownership becomes more liquid, transparent, and accessible than ever before.

🔹 Investors gain fractional access to prime assets

🔹 Owners unlock previously trapped value in the #RWA space

The bridge between #DeFi and #RealEstate is here — and it’s powered by $BST.

Tokenization adds a new slice to the traditional capital stack, with the potential to change how we invest in #RealEstate

Not only does it provide opportunities for investors, it also allows property owners to free up capital in a traditionally illiquid #RWA market.

$BST #DeFi