CEO and Founder of @blacklioncafes. Building the next media empire @blacklionclub

Tokyo-to, Japan

Joined February 2025

- Tweets 6,227

- Following 576

- Followers 322

- Likes 23,220

Hansel Ang retweeted

Again, you cannot really call this a "MAGA Civil War" because the people who started it are not and were never MAGA, never America First.

They supported Jeb!, then Rubio, then Cruz, then DeSantis, then Haley.

Literally anyone not MAGA against @realDonaldTrump.

Hansel Ang retweeted

Indeed, i think the taxes that are pushed by counties, municipalities, school districts, utilities and ad valorem etc down to the home owners is a huge problem and the invisible elephant in the room.

Truly distorts costs/economics for home ownership

Hansel Ang retweeted

I notice that white nationalists and Groypers rarely expose their Pakistani, Bangladeshi and Indonesian allies. You’ll never hear, “Stay away from my country” or “stop masquerading as a white guy.” In other words, they all know who’s on their team.

Hansel Ang retweeted

I disagree @Cernovich

May I respectfully offer a rebuttal from my own experiences 🙏

People today love to wax nostalgic about the good 'ole days of buying a home 'cheap'...

because they never had to endure the economy back then, when homes were 'cheap'. They only see how it all worked out, that the home is now worth multiples more but neglect 'how it got there'.

I am 59.

The first home I bought in the 1992, I had to put down 20% of the home amount and I was paying around 9% interest rate (!!!) and i was underwater in the loan for over a decade.

Further, the generation of home owners that preceded me had 10%+ interest rate on their mortgages

- so the homes 'my generation' was buying from was releasing the prior owners from a huge burden, they thanked us profusely and they would say "free at last" and turn to their loved ones and say "we finally did it"

Refinancing boom didn't become a thing until late late 1990's

- and we were refinancing FROM 9% TO 6%

- then in mid 2000's we refinanced down to around 4%

- then in mid 2010's down to around 3.5%

a 50 year mortgage is a slam dunk, and with a low down payment, WOW 🤩 if i were a first time home owner i would take it so fast your head would spin, you truly can't go wrong.

I think it's inaccurate to look at the duration "you wont pay it off till your 90 years old" because that doesn't anticipate intrinsic appreciation of the underlying asset

- nor the leverage it creates for future investments, nor the opportunities for resale.

(ten years ago if someone borrowed money from a bank to buy bitcoin, it worked out well.

In fact, I borrowed a bunch of money to buy stock in Administaff (now called Insperity $NSP) when it was $2 a share around 2002, it went to $40+.

Only in retrosepct do I 'look smart' from holding that risk.

Debt is not a new invention, nor is it a bad thing.

It's what allows people to improve their economic situation and create generational wealth.

Mortgages and home ownership is what created the American middle class and, i can say with authority from living in NYC and the boroughs, that it is also the immigrant success story.

People come to America:

a. get crappy jobs

b. scrape up money to buy a home (something almost totally unobtainable for most people in the countries they are immigrating from, also most of those cultures they are leaving don't permit/tolerate women to work, so it's also the first time that a woman can become somewhat independent, plan and contribute for a future, have her own friends, pick up her kids from school, etc)

c. They put their kids through school

d. after a decade+ they sell their home to the next generation of immigrants and upper middle

class aspirants

e. Move to the burbs

Lending:

It is also my experience having been a significant investor in one of the largest preferred SBA 7(a) and 504 lenders, that people always anticipate arbitraging their loans.

How can people get wealthy if they are deprived of the opportunities to hold risk, and this mechanism is expressed thru 'debt'.

🚨 After the Great Financial Crisis of mid 2000s

the credit markets got WRECKED and credit worthiness evaluations *excluded* most prospective first time home owners. A lot of the 'lack of home ownership' that we are seeing now, is largely because of that - the problems from the credit markets from the generation before that now doesn't have the liquidity from having a home.

In order to resolve bank's unwillingness to lend, and to stimulate the appetite for lending to risky borrowers and to improve the debt's secondary and tertiary markets, we desperately need 50 year paper.

H/t to our friend @pulte and others for making this possible.

And thank you also Mike, you're awesome

🙏

Hansel Ang retweeted

Story time.

During the 1787 Constitutional Convention, James Madison proposed fastening congressional salaries to the price of wheat, in an effort to prevent legislators from setting their own fixed pay, which he viewed as undoubtedly corrupt.

Unfortunately, the idea was not adopted in the final Constitution, which instead permitted Congress to determine its own pay. (Article I, section 8, clause 18.)

But James Madison didn’t hear no bell and in 1789, would offer up a strong, political safeguard against the very abuses his wheat proposal was meant to stop. In an effort to prevent Congress from granting themselves unlimited pay raises, and pay raises during their term, while ensuring the citizens would have a say in the matter, he would draft a provision in the first version of the Bill of Rights, that read:

“No law, varying the compensation for the services of the Senators and Representatives, shall take effect, until an election of Representatives shall have intervened.”

However, this check and balance to Congresses authority to set its own pay, was never ratified by the states.

Madison‘s proposal would be all but lost to history until 1982, when a man named Gregory Watson wrote an essay suggesting it was still “live” and could be ratified by the remaining states, and he launched the campaign to do just that.

And in 1992, after over 200 years, Madison’s amendment restraining pay raises to Congress became the 27th amendment,

And the 27th amendment is a constitutional safeguard against this, which is why @SenRandPaul voted against it.

Thank you, @POTUS!

If we can’t fund the government, we don’t deserve our paychecks.

That’s common sense to the American people, but unfortunately, common sense is illegal in Washington.

Women at the wheel? Education and Medicine turned woke swamps—DEI dogma over multiplication drills and scalpels. From Tolkien's tired tutors preserving for the next generation to trans-affirming MDs: Empathy's empire, rigor be damned.

Hansel Ang retweeted

Two millennials. Same job. Same salary. Same raises.

Both start at $120K, getting 10% raises every year.

Millennial A: Spends 110% of income. Covers the gap with credit cards at 29%.

Millennial B: Saves 10% of income. Buys Bitcoin compounding at 30%.

After 20 years:

A: –$14,000,000 (bankrupt)

B: +$13,000,000 (financially free)

Wealth gap: $27 million.

Same income. Different behavior.

One compounds against themselves.

The other compounds for themselves.

Debt at 29%. Bitcoin at 30%.

That’s wealth inequality.

That's math.

Hansel Ang retweeted

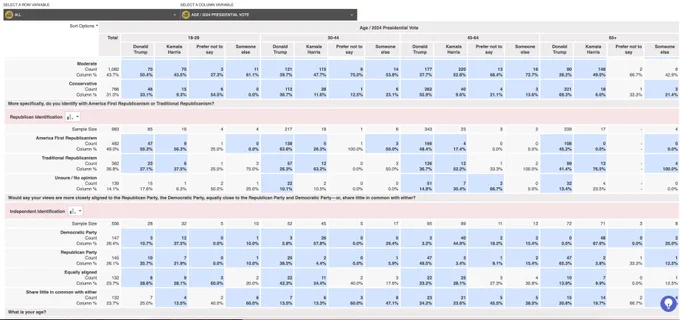

Not only is Gen Z not "conservative" as Con Inc. portrays it and to whatever extend they "represent" it, Gen Z doesn't even like the Republican Party.

That also goes for all the ones who voted for @realDonaldTrump.

Trump made MAGA cool again. Con. Inc. made MAGA boomer again.

And how many lived to tell the tale of it?

Hansel Ang retweeted

Climate alarmism = a Trojan horse for socialism

The home intruder will be haunted by this day forever. #2A saves.

Hansel Ang retweeted

Oh boy.

Woman voting didn’t happen until 1919.

Thomas Jefferson supported universal white male suffrage.

The founding fathers as a whole felt male property owners should vote for what’s best for their families, to guarantee a stake in society, and they left it to the states.

What an embarrassment that Mark Levin has become. The West tried censorship regimen since McCarthy tried purges.

Yet both Communism and National Socialism is back again. Mark needs to put to bed why both ideas are dumb and deadly.

Mark Levin has refused TPUSA’s invitation to debate Tucker Carlson at their upcoming Scottsdale event, calling Carlson a “Nazi promoter.”

Follow: @AFpost

Hansel Ang retweeted

I watched the whole interview today, it is a master class in how to deal with the nonsense.

At 60 yo I still struggle. My new goal is to channel Sidney's energy 100% of the time.

Hansel Ang retweeted

"Elon Musk is not an engineer."

John Carmack: Elon is definitely an engineer. He is deeply involved with technical decisions at SpaceX and Tesla. He doesn’t write code or do CAD today, but he is perfectly capable of doing so.

Robert Zubrin: When I met Elon it was apparent to me that although he had a scientific mind and he understood scientific principles, he did not know anything about rockets. Nothing. That was in 2001, by 2007 he knew everything about rockets – he really knew everything, in detail. You have to put some serious study in to know as much about rockets as he knows now. This doesn't come just from hanging out with people.

Eric Berger: Elon is the chief engineer in name and reality.

Josh Boehm: Elon is both the Chief Executive Officer and Chief Technology Officer of SpaceX, so of course he does more than just some very technical work. He is integrally involved in the actual design and engineering of the rocket, and at least touches every other aspect of the business. Elon is an engineer at heart, and that’s where and how he works best.

Garrett Reisman: He’s obviously skilled at all different functions, but certainly what really drives him and where his passion really is, is his role as Chief Engineer. That’s the part of the job that really plays to his strengths.

Tom Mueller: Elon and the Propulsion department are leading development of the SpaceX engines, particularly Raptor.

Kevin Watson: Elon is brilliant. He’s involved in just about everything. He understands everything. If he asks you a question, you learn very quickly not to go give him a gut reaction. He wants answers that get down to the fundamental laws of physics. One thing he understands really well is the physics of the rockets. He understands that like nobody else. The stuff I have seen him do in his head is crazy. He can get in discussions about flying a satellite and whether we can make the right orbit and deliver Dragon at the same time and solve all these equations in real time. It’s amazing to watch the amount of knowledge he has accumulated over the years.

Hansel Ang retweeted

This is a great question.

It was actually Colonel Lewis Nicola, a senior officer in the Continental Army, who wrote a letter to President Washington on behalf of some dissatisfied officers, arguing that the Articles of Confederation made a republican government unworkable.

In that letter he explicitly urged Washington to accept the title of King of the United States.

Washington rejected the idea immediately and forcefully in his reply the same day, calling it "big with the greatest mischiefs that can befall my Country", rebuking Nicola sharply.

I believe this wasn’t 1782 which was before the Treaty of Paris was even written up.

This is the only known proposal to Washington to become King. (John Adams would propose the title of “his highness”, for President, with no ties to royalty, but that suggestion was quickly rejected by Congress either way).

Washington would serve two terms and leave office and brew whiskey for the next couple years before passing away of an infection in 1799.