Stablecoin Sundays and Tokenization Thursdays Weekly Rollups | Post about Crypto, Fintech, Tradefi | Former Senior Engineering Leader @Paxos

New York, NY

Joined December 2009

- Tweets 2,256

- Following 538

- Followers 1,132

- Likes 527

Pinned Tweet

Tokenization Thrusdays Issue #25: 📊 Nasdaq wants tokenized stocks. Fidelity is tokenizing Treasuries. Franklin Templeton is teaming with Binance. And more. 👇

📈 Binance Partners with Franklin Templeton on Tokenization

Binance and asset manager Franklin Templeton are teaming up to co-develop tokenized asset products. The partnership will leverage blockchain rails to improve settlement speed, collateral mobility, and investor access while staying within national market system protections.

🏛️ Nasdaq Seeks SEC Approval to Trade Tokenized Stocks

Nasdaq has filed a rule-change request with the SEC to allow stocks to be recorded in tokenized form. If approved, it would let investors trade securities like Apple, Google, and Amazon through traditional digital ownership or blockchain-backed tokens, marking a first-of-its-kind move for U.S. exchanges.

💵 Paxos Proposes USDH Stablecoin with PayPal, Venmo, Kraken Integration

Paxos Labs has unveiled a revamped proposal for Hyperliquid’s USDH stablecoin. The plan includes integrations with PayPal, Venmo, and Kraken, offering seamless payments and zero-cost on/off ramps. Paxos also pledged to reinvest all revenue until USDH reaches $1B TVL and cap its take at 5% even after $5B. Validators prepare to vote on September 14.

🤝 Fireblocks and Circle Join Forces to Scale Stablecoin Adoption

Fireblocks announced a strategic collaboration with Circle. Together, they aim to simplify and secure stablecoin adoption for financial institutions. Circle’s global stablecoin network will integrate with Fireblocks’ infrastructure to enable cross-border treasury, payments, and tokenized asset settlement.

🇧🇾 Belarus Pushes Banks Toward Crypto and Tokenization Amid Sanctions

President Alexander Lukashenko has ordered Belarusian banks to accelerate adoption of crypto and tokenization to bypass Western restrictions. Lukashenko highlighted that tokenization can streamline deals and enhance user control, noting $1.7B in crypto payments this year with $3B projected. Similar sanction-driven adoption is being seen in Russia-aligned states such as Kyrgyzstan.

🔒 Fidelity Quietly Launches Tokenized Treasury Fund on Ethereum

Fidelity has introduced the Fidelity Digital Interest Token (FDIT), a tokenized share class of its Treasury money market fund on Ethereum. With over $200M in assets, the launch positions Fidelity against BlackRock’s $7B BUIDL fund.

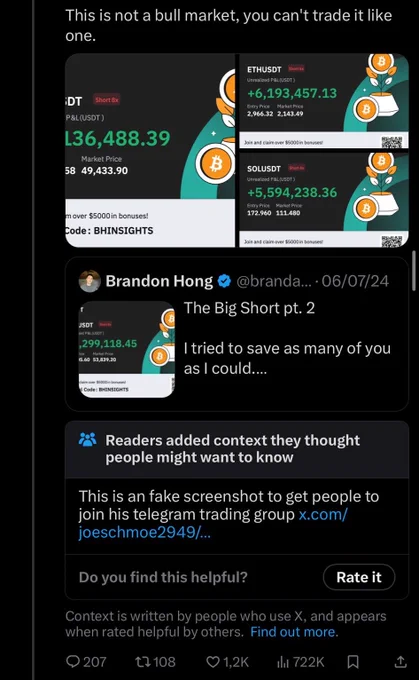

Why do so many accounts believe this larp with a paid group when he got caught faking PNL screenshots before last year?

>Says publicly turned $700K -> $20M

>Zero actual proof of multiple 8 fig positions

>Instead just charts many tickers and comes back to reference winners

Is this supposed to be a flex? Why do they need an offsite at some hotel for almost a week with little sleep to unlock user funds?

Huh?

Just wrapped up my 5th day locked in a hotel room dealing with nonstop calls, endless comments, one meal a day, barely 4 hours of sleep.

Not just me, the whole MEXC customer service, risk control, marketing teams have been grinding nonstop behind the scenes.

We keep our word. More funds are unlocking.

Henryk Sarat retweeted

With today’s Balancer hack, we’re once again seeing chains halt validators to freeze stolen funds.

What they need instead is tools to surgically blacklist exploit addresses immediately, without pausing all transactions.

Henryk Sarat retweeted

Today is the biggest day in Lava’s history.

We’ve raised $200M, our bitcoin-backed line of credit is live globally, and we’re now offering the lowest fixed interest rates in the industry.

Access dollars instantly without selling your bitcoin — at JUST 5%.

Why is @0xMert_ drinking coffee again “Today’s News” on X? wtf?

Henryk Sarat retweeted

More markets. More global reach.🌎

USDG is now listed on @Bullish - trade USDG/USDC and BTC/USDG in eligible regions.

📣 New digital asset listing: @global_dollar $USDG is now available.

Deposit USDG on @solana and trade on Bullish in eligible regions.

◾ USDG/USDC

◾ BTC/USDG

Henryk Sarat retweeted

We just shipped the biggest product update since I started Lava.

And we announced a $17.5M strategic raise.

Now on Lava, anyone can earn 7.5% on USD. Instant deposits and withdrawals. Secured by bitcoin.

It's the new, best risk-adjusted return on USD.

Henryk Sarat retweeted

To be fair, PYUSD was available across both. Not many PSPs dived deep into crypto AND stablecoins as fast PayPal did. They went through the winter.

Worst bankruptcy execution in history. Paying out everyone straight USD at the following 2022 prices:

Bitcoin - $16,871

Ethereum - $1,258

Solana - $16

If they paid people out in the actual tokens that people were owed, people can sell their tokens today for:

Bitcoin - $116,000

Ethereum - $4,500

Solana - $240

The bankruptcy attorneys paid themselves nicely.

Henryk Sarat retweeted

Now that the cat’s out of the bag I’m officially heading Marketing and GTM at @PaxosLabs.

As a marketer, a sudden public bid wasn’t how I imagined bringing the brand to market. But it perfectly captured what drew me here: a team that can mobilize fast, execute under pressure, and rally some of the most trusted names in finance around a shared vision.

Over the past 7 years, I’ve seen this industry from every angle. Surreal highlights like lunch with Warren Buffett, a Blue Origins bid, partnerships with Christie’s and Sotheby’s, managing a $1B ecosystem fund, and growing USDT on with TRON.

And also the flipside: shiny narratives that burned fast, brilliant tech with no users, and strong teams that lost focus.

One lesson has stood out: the products that endure are the ones obsessed with their users delivering trust, utility, and real financial rails.

And the teams worth playing with have a positive-sum mindset one that encourages builders to be builders and is focused on growing the pie for everyone.

I wasn’t looking to join a team but when I met the Paxos and Paxos Labs team it just clicked. They rallied around the idea that DeFi must scale via global distribution channels.

Every business that touches money is on this journey. Stablecoins first, DeFi next. And distribution is the unlock the future of DeFi won’t be won by isolated protocols, but by platforms with trusted user bases, regulatory alignment, and the rails to scale utility globally. Paxos Labs is building exactly for that moment.

@Paxos has quietly powered the backbone of onchain finance for years building for PayPal, Mastercard, Venmo, Nubank, Interactive Brokers, and more with $120B+ track record.

Paxos Labs is the next step: helping enterprises move beyond issuance into full onchain financial experiences from branded stablecoin creation, to yield on stablecoins, to integrating compliant money markets and beyond.

Excited to be shaping the story, driving growth, and helping Paxos Labs set the standard for institutional adoption of onchain infrastructure alongside one of the most cracked teams I’ve met: @bhau___ @JunKim83 @ChundaMcCain @0xDuckworth @dashanmccain @0x_carson @mroddy5280 @0xTrojanhorse …and everyone else too busy building.

The future of money is programmable, branded, and global. We’re here to make that future real.

If you’re curious about what we’re building — let’s chat.

We had a rollout plan. The market had other ideas.

Sometimes opportunities show up when least expected, but we pulled out the stops, executed fast, and showed what we can bring to the table.

But we realized that we didn’t get the chance to introduce ourselves. Paxos Labs is the enterprise-grade infrastructure platform powering the next era of onchain finance.

Financial platforms across the world are constrained by legacy financial rails systems that are costly, slow, and limited in scope. As these platforms look to upgrade their underlying infrastructure, they can turn to Paxos Labs to guide them in their blockchain journey, from stablecoins to full onchain market access.

Backed by @Paxos's $120B+ track record in tokenization and regulatory expertise and trusted by enterprises like PayPal, Venmo, Mastercard, Nubank, Interactive Brokers, and more we extend proven infrastructure into a full product suite that unlocks utility, yield, and liquidity for platforms and their users.

With Paxos Labs, enterprises can take the step beyond stablecoin issuance and acceptance to deliver full onchain financial experiences for their users from branded stablecoin creation, to servicing yield on stablecoins, integrating compliant money markets, and more.

Our mission for enterprises is to enable them to own more of their economics, facilitate growth through innovation, and future-proof their business by delivering safe and utility-driven onchain experiences to their end-users.

Building the rails you can rely on, and the products that make them matter.

Paxos Labs is where the future of onchain finance is built, customized, and scaled.

Start your onchain journey with Paxos Labs.

Henryk Sarat retweeted

Now that the cat is out of the bag, I’m excited to officially announce that we’ve been acquired @nucleusearn to lead the newest initiative in the Paxos family, @paxoslabs!

I will be joining as one of the co-founders of the new initiative, alongside @JunKim831 and @bhau___.

My inspiration for working in crypto began when I asked myself why my grandfather, who was a business owner freshly immigrated to the US, wasn’t able to access the same financial rails that I saw were available to so many others around me.

At that moment, the vision for crypto and DeFi instantly clicked for me. The freedom to bring any financial product to life, for anyone in the world, with no barriers to entry was a dream come to life.

With that dream came a conviction, a vision that it was inevitable that the global financial market would eventually settle onchain. And so when the opportunity came knocking to help lead @paxoslabs, it was a no-brainer.

Paxos has been at the forefront of crypto innovation on the global stage for over a decade, working with the largest enterprises in the world to help them take their first step into the crypto ecosystem. With more entering the market by the day, we recognize that the first step will not be enough.

Our goal at Paxos Labs is to support the entire enterprise journey in creating crypto-powered experiences. With Paxos Labs, enterprises can take the step beyond stablecoin issuance and acceptance to deliver full onchain financial experiences for their users. From branded stablecoins to creating compliant money markets, servicing yield on stablecoins, and more, we’ll be there every step of the way.

If you’re interested in learning more about how to empower your enterprise with onchain financial infrastructure or if you’re in crypto ecosystem already and looking to partner with us, please feel free to reach out!

And finally, a massive shoutout to everyone who has been with us on the journey since we started. From my illustrious co-founder @JunKim831 to our earliest investors to the team that has helped make this all happen, I’m eternally grateful to you all and I am looking forward to bringing everyone together on the next step of our journey!

We had a rollout plan. The market had other ideas.

Sometimes opportunities show up when least expected, but we pulled out the stops, executed fast, and showed what we can bring to the table.

But we realized that we didn’t get the chance to introduce ourselves. Paxos Labs is the enterprise-grade infrastructure platform powering the next era of onchain finance.

Financial platforms across the world are constrained by legacy financial rails systems that are costly, slow, and limited in scope. As these platforms look to upgrade their underlying infrastructure, they can turn to Paxos Labs to guide them in their blockchain journey, from stablecoins to full onchain market access.

Backed by @Paxos's $120B+ track record in tokenization and regulatory expertise and trusted by enterprises like PayPal, Venmo, Mastercard, Nubank, Interactive Brokers, and more we extend proven infrastructure into a full product suite that unlocks utility, yield, and liquidity for platforms and their users.

With Paxos Labs, enterprises can take the step beyond stablecoin issuance and acceptance to deliver full onchain financial experiences for their users from branded stablecoin creation, to servicing yield on stablecoins, integrating compliant money markets, and more.

Our mission for enterprises is to enable them to own more of their economics, facilitate growth through innovation, and future-proof their business by delivering safe and utility-driven onchain experiences to their end-users.

Building the rails you can rely on, and the products that make them matter.

Paxos Labs is where the future of onchain finance is built, customized, and scaled.

Start your onchain journey with Paxos Labs.

My partner wasn’t told blood test cost ahead of time. Impossible to get the cost. Surprise bill of $800+. How corrupt is Washington that they still allow this? Everyone in Washington should just be fired and replaced. I doubt that any new elected officials can do a worse job than this.

🚨EVEN @HyperFND DOES NOT WANT NATIVE MARKETS TO WIN THE $USDH TICKER :

What is shown on this screen means that:

Following the recent controversies over the USDH governance vote, Hyperliquid has excluded the team-staked HYPE from the tally, dropping Native Markets’ weight from 75% to 66% and paving the way for a possible Paxos victory.

They're not saying explicitely that they don't wan't Native markets to win, but they mean it. And i'm following the same ideas.

If you want to stand against Native Markets MAFIA and save the USDH ticker, we need to give it to @Paxos which are the only competitor left, what to do before it's too late z (EVERY VOTE COUNTS) :

1. Unstake your hypes (from hypercore or from kinetiq cause they are neutral and your hypes votes won't count)

2. Stake them to a validator that votes for paxos, here is the list :

- @0xHyperBeat

- @B__Harvest

- Purrposeful x @HyBridgeHL x @PiPonHL

- @validaoxyz

- @ChorusOne

🚨BOYCOTT THOSE VALIDATORS :

- @nansen_a & @hypurr_co

- @HypurrScan

- Hyperstake

- @hypurrcorea

- @flowdesk_co

- @rekt_gang

- @IMCTrading

- @PierTwo_com

- @infinitefieldx

- Alphasticks

DO NOT KEEP YOUR STAKE ON @kinetiq_xyz FOR NOW, THEY ARE VOTING FOR THE WINNER AND THE REST IS ON HYPERLIQUID FOUNDATION, WHICH WON'T VOTE, THIS REPRESENT ALMOST 50% OF THE STAKED SUPPLY NOT VOTING.

Counting on everyone guys.

Hyperliquid.

This is a call to all hyperliquid community :

Native markets is going to win the USDH ticker and it's EXTREMELY bearish for @HyperliquidX. (it's not too late)

Here is why 👇

1. ONLY 50% FOR THE ASSISTANCE FUND AND 50% FOR MARKETING (while ethena and paxos proposed 95% for hyperliquid.

2. “Stripe/Bridge” dependency & perceived conflicts of interest :

Native proposes to issue USDH via Bridge (infra owned by Stripe), while Stripe is pushing Tempo, its own blockchain, and controls Privy (wallet infra). Aligning the network’s “money” with a potential competitor undermines the chain’s sovereignty (and makes censorship/blacklisting easier).

3. Paxos and Ethena had put forward a very big roadmap to make USDH a huge stablecoin compared to Native Market who doesn't seem to realy care about HL's future

4. New team, 0 seriousness on their side, 1600 words for their proposition for 6600 for ethena (LMAO)

5. “Home team advantage” vs. “track record”

Native claims being “Hyperliquid-native”, but Paxos brings compliance and industrial history, and Ethena has crypto-native traction. Early support from large validators for Native reinforced the perception of an internal bias.

6 “vendor lock-in” and censorship

Handing issuance and orchestration to a single provider (Bridge/Stripe) is worrying : if policy shifts (US regulation, Stripe/Tempo business priorities), Hyperliquid could face address freezes, blacklists, or integration friction.

7. Voting process felt “tailor-made” and too rushed

Announcement Sept 5, proposals due Sept 10, intents Sept 11, final vote Sept 14 (a very tight timeline). Native filed a proposal under 90 minutes after the announcement, prompting suspicions of informal advance notice; other teams said they lacked time.

ANYWAY, even though they claim being "natives", nothing's interesting in their proposition :

What was supposed to be a show of strength for Hyperliquid, seeing all these giants fight to issue its stablecoin, has become a sign of weakness.

A weakness tied to fear of governance, potential insiders, and a lack of understanding of the stakes.

Excessive “alignment” has already killed ecosystems, like that of the Cosmos Hub.

We don't want hyperliquid to fail like others did.

Now here is what you can do 👇:

Right now @Paxos is standing at second place far from @ethena_labs so it's the only one that can take the place of Native markets, so i suggest we all place our Hype to stake to paxos voters which are :

@0xHyperBeat

@B__Harvest

- Purrposeful x @HyBridgeHL x @PiPonHL

@validaoxyz

@ChorusOne

This is not too late, if validators see that they are loosing stakers, they might change their mind too.

If you are staking to one of those validators, remove your stake, it takes one click, shame on them :

- @nansen_a & @hypurr_co

- @HypurrScan

- Hyperstake

- @hypurrcorea

- @flowdesk_co

- @rekt_gang

- @IMCTrading

- @PierTwo_com

- @infinitefieldx

- Alphasticks

DO NOT KEEP YOUR STAKE ON @kinetiq_xyz FOR NOW, THEY ARE VOTING FOR THE WINNER AND THE REST IS ON HYPERLIQUID FOUNDATION, WHICH WON'T VOTE, THIS REPRESENT ALMOST 50% OF THE STAKED SUPPLY NOT VOTING.

Don't let the mafia win, not again.

Hyperliquid.

PLEASE REPOST THIS TO MAKE PEOPLE HEARD.

Credits to @JoestarCrypto from which I took inspiration for many parts of my post.

This is a call to all hyperliquid community :

REMOVE YOUR STAKE FROM Native markets voters and @kinetiq_xyz because they are voting for the winners.

If Native Markets wins $USDH ticker, this is bearish for hyperliquid.

You can stake to :

@0xHyperBeat (paxos)

@asxn_r (ethena)

@B__Harvest (paxos)

- Purrposeful x hybridge x PiP (paxos)

@imperator_co (ethena)

@validaoxyz (paxos)

(to me the best option is paxos)

SHAME ON THE VALIDATORS THAT DOESNT LISTEN TO COMMUNITY :

SHAME ON @nansen_ai & @hypurr_co

SHAME ON @HypurrScan

SHAME ON Hyperstake

SHAME ON @hypurrcorea

SHAME ON @flowdesk_co

SHAME ON @rekt_gang

SHAME ON @IMCTrading

SHAME ON @PierTwo_com

SHAME ON Alphaticks

SHAME ON @infinitefieldx

Community wants @Paxos or @ethena_labs ,Not Native markets

EVERY VOTE COUNT.

"There are no allocations for private investors, centralised exchanges, or market makers."

MAKE YOUR VOICE HEARD, REALLOCATE YOUR STAKES.

If native markets represent @HyperliquidX's USDH, it will be a great loss for Hyperliquid.

It's not too late.

Will do a post later to give more details of why it's bearish for hyperliquid.

Main PayPal account tweeting this is pretty crazy.

The Hyperliquid community should be proud that they will be going mainstream.

Hyperliquid.

We're all in. Let's expand the Hyperliquid community together across our broad network of 400M+ PayPal and @Venmo accounts!