America dictates the terms of the "debt," we choose who gets paid and how much. The GDPmaxxing boomers that kvetch abt it are irrelevant, nobody cares about the debt other than them and Indians (for some reason). In the list of problems we have, the deficit is like 10000000th

The people that care about the "national debt" understand it the same terms as if they had a personal debt. It's more like if you had a personal debt to a bunch of people who have no power over you or the ability to force you to pay it back and are dependent on you

Rare type of vid that you can see is “White guy learns phrases in his GF language :-0” where a white man genuflects towards his genetic deadend woman (typically East Asian, or God forbid Southeast) to say a trite phrase/small talk...awful. Might as well clamp your balls in a vice

Michael Burry apparently put 80% of his entire portfolio shorting Palantir and Nvidia....'AI Is a Nothingburger'-bros....hold the line....our vindication cometh....

Broccoli haired zoomer asked to "work in" with me, he promptly did one set of like 5 reps 1pl8 bench, said "Thanks" then walked away.....

The Illustration of the Siberian War, No. 4. “The Japanese army defeated the German-Austrian Army near Usri”

Under normal amortized loans, you are always paying at least some interest and at least some principal, but there's a weird symmetry point where the total you've paid so far equals that of the loan's entire lifetime interest. It's a derived checkpoint from basic amortization math to find the month when cumulative payments so far equal the loan's total lifetime interest. In a sense, the point at which you have finished paying off your interest and then can start paying off your principal (you are, after this point, still literally paying off interest into the interest account, but it's just illustrative).

The following are under a 30yr vs a 50yr 500k loan at 6.5%

Under a 30 year loan, this occurs during month 202, around 16 years and 10 months into the loan.

(monthly rate r = 6.5%/12 ~= 0.5417%; term n = 360; payment m = p *r / [1 − (1+r)^−n] ~= $3,160.34; lifetime interest ~= 360*m − 500,000 ~= $637,722; crossing month k = n − p/m ~= 201.8 -> month 202)

Under a 50 year loan, this occurs during month 423. That's 35 years into the loan.

(monthly rate r = 6.5%/12 ~= 0.5417%; term n = 600; payment m = p * r / [1 − (1+r)^−n] ~= $2,818.58; lifetime interest ~= 600*m − 500,000 ~= $1,191,151; crossing month k = n − p/m ~= 422.6 -> month 423)

You are chaining yourself to debt not only for 20 more years, but also for nearly DOUBLE the interest. The 50-year stretches your payment schedule so far that interest compounds on interest, by the time you hit the aforementioned "interest parity" point, you've already paid more than the ENTIRE 30-year loan ever would in terms of interest.

the more you learn about the Neanderthals, the more you realize how much they were not the "lesser" species...

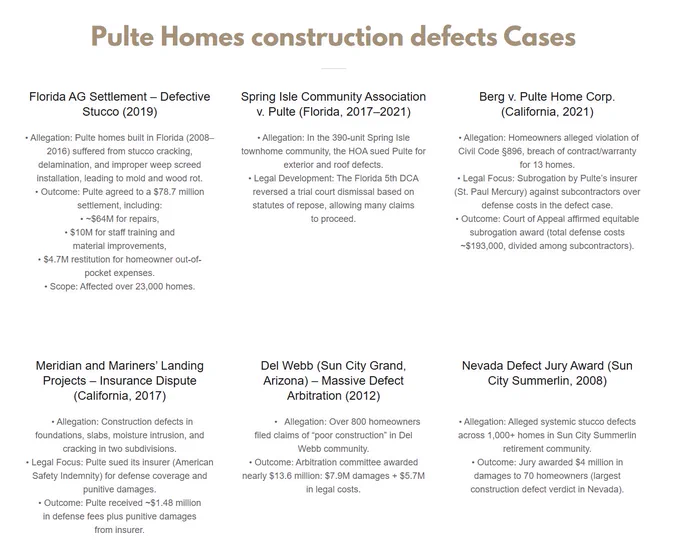

At least the director of the FHFA is a billionaire real estate developer known for building houses of such poor quality there are law firms that specialize in suing him, including multiple class-actions, of which he then sells houses immediately at an average of ~600K per...surely he won't benefit from a 50yr mortgage, right? The same guy proposing this 50yr mortgage is known for using illegal labor on his jobsites? This guy wants what's best for American homebuyers, right?

Imagine Indian land lords and Yiddish lords of the land borrowing against their real estate portfolio at 0% nominal -3% real yield interest rates for 50 years.

Imagine borrowing at -3% against 30m dollars in net value + total cash flow @ 5x leverage for a total 150m and putting that in gold to get a 12% CAGR on 150m. Total full spectrum dominance.

Howie Dewin retweeted

Imagine Indian land lords and Yiddish lords of the land borrowing against their real estate portfolio at 0% nominal -3% real yield interest rates for 50 years.

Imagine borrowing at -3% against 30m dollars in net value + total cash flow @ 5x leverage for a total 150m and putting that in gold to get a 12% CAGR on 150m. Total full spectrum dominance.

What a 50 year mortgage will actually do is enable companies and landlords to maintain higher leverage for longer, preserving interest deductions and freeing up cash to acquire more properties. In effect, they can extract ongoing tax benefits and returns from assets they haven’t yet fully paid for. Lenders already favor those with existing assets/strong credit, which will widen the gap even more since most people are in substantial amounts of debt. This also slows the equity build, so less "skin in the game" required which mitigates risk for the very same companies. You don't solve ANYTHING by throwing more debt at it. This is truly one of the most braindead attempts at "fixing" the housing market I've seen.

What a 50 year mortgage will actually do is enable companies and landlords to maintain higher leverage for longer, preserving interest deductions and freeing up cash to acquire more properties. In effect, they can extract ongoing tax benefits and returns from assets they haven’t yet fully paid for. Lenders already favor those with existing assets/strong credit, which will widen the gap even more since most people are in substantial amounts of debt. This also slows the equity build, so less "skin in the game" required which mitigates risk for the very same companies. You don't solve ANYTHING by throwing more debt at it. This is truly one of the most braindead attempts at "fixing" the housing market I've seen.

Howie Dewin retweeted

One of the stupidest policies I have seen come out of this admin. “Oh the price of housing makes it impossible to purchase a home? Lets just give people who don’t have the money to buy a house credit so they can purchase a house”

50 Year mortgage 150 month car payment buying Taco Bell with Klarna putting your gym membership on your credit card just fuck my shit up Trump just rape me