nice guy, tries hard, loves the markets

Nashville, TN

Joined November 2024

- Tweets 7,485

- Following 62

- Followers 12,063

- Likes 11,058

Pinned Tweet

Suddenly, you’re 35.

Cute wife, couple of kids, church on Sundays, and still LOVE markets.

Still waking up at 6am, checking your positions.

But it’s different now. You aren’t 19 with no responsibilities, no bills, no family.

You can’t (shouldn’t) do the 0DTE, memecoin, penny stock, leveraged, heavy margin…games.

Huge losses CAN’T happen consistently.

So you make the decision to change it up.

Commons, compounding, deep research, longer time frames, swing trading.

You build disgusting levels of wealth without carrying massive risk daily.

It’s time.

Luc♥️

Suddenly, you're 27.

You make your coffee, rush to work, come home around 7, and you're too tired to do anything except eat, scroll on your phone, and pass out.

Then you wake up, and do it all again.

And when Friday comes, maybe you go out, or maybe you're just too tired. Then, out of nowhere, it hits you.

How did everything pass by so quickly?

You don't even feel 27.

You still feel like that 17 year old kid who thought they had all the time in the world.

But somehow, 10 years just disappeared. And you start missing the past. The feeling of being young, excited, and clueless.

But then you realize, one day, you'll miss this, too.

Being 25, being confused, being tired, but still trying.

So maybe the trick is to slow down a bit and actually live this chapter before it also becomes just another memory.

The point is no matter what age you are, you’ll miss these days. Life gets busy sometimes and it’s always a good time to stop and smell the roses.

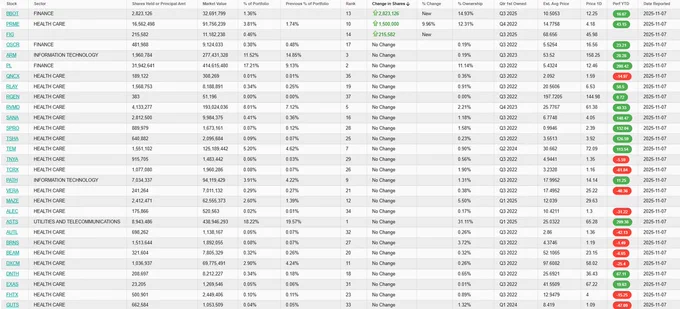

Something’s weird with $FIG.

First, $ADBE tried to acquire them for $20B in '22.

$FIG's market cap today? $22B.

Right around the same level Adobe was willing to pay.

They knew there was upside...and thought $20B was a deal.

But it gets weirder.

On Friday, $FIG saw its highest volume since IPO week.

Over 32M shares traded...yet the price barely moved ($2 range). Noted.

Then there’s the new partnership with OpenAI, showing they’re going all-in on AI (isn’t everyone?!).

Kidding, but also $GOOG just filed its Q3 13F…and added a position in $FIG. Good confidence boost.

They're also expanding globally, opening an a dedicated office in India.

Chart looks *ready*. Tight price range. Unusual volume.

$FIG looks attractive for a swing here at $44.

It’s 2025.

Cars are starting to fly. Wifi anywhere on the planet. Robots delivering food.

The word impossible is becoming redundant.

Agree or not…but humans are at the wheel. Driving everything.

Builders. Entrepreneurs. Businessmen. Creator. Risk-takers. Makers.

Elon. Jensen. Cook. Armstrong. Su. Tenev. Zuck. Kaz.

Leadership decides whether a company lives or dies.

Markets reveal this constantly.

This is a HUGE part of my strategy in markets…it’s *that* important.

You are a taker, not a maker. All you’ve done your whole life is take from the makers of the world.

The zero-sum mindset you have is at the root of so much evil. Once you realize that civilization is not zero-sum and that it is about making far more than one consumes, then it becomes obvious that the path to prosperity for all is just let the makers make.

Regarding Tesla, the reality is that I have been given nothing.

However, if I lead Tesla to become the most valuable company in the world by far and it stays that way for 5 years, shareholders voted to award me 12% of what is built. Anyone who wants to come along for the ride can buy Tesla stock.

If Tesla “merely” becomes a $1.999 trillion dollar company, I get nothing. This is a great deal for shareholders, which is why they voted so overwhelmingly to approve this, for which I am immensely grateful.

And they did so by a margin far more than you won your political seat.

Rubber-banding of price levels.

You have to let *longer timeframe* candles CLOSE.

$NVDA at $183 is a primeee example.

Heavy activity at this level since August...so what'd they do yesterday?

Broke it below, flushed, hit stops at $180, then ripped it into a hammer to close the day.

But it didn't "break the level"...it tested the level and was strongly bought up (aka rubber-banding).

Bullish.

Swing traders...focus on longer timeframe *closes*...daily, weekly, even monthly.

Intraday moves do not concern us.

Luc retweeted

2 weeks ago, you were 30% cash.

You added to your fav stocks on the recent dips.

Deployed 20% of your cash into those.

Great, but now you have 10% cash left, the rest is invested.

On Monday, during the mini-selloff in $SPY, you added to all your fav positions again.

Awesome, but now you are fully invested across positions…no cash for dips.

Today, more dips. Discounts. Things “on sale”.

You start to sweat, as your *now heavy* positions sink lower…and you have no cash for adds.

This is when you have to patient (in BOTH ways).

- patient to add if you see continued short term weakness in $SPY, esp when bullish catalysts are still pending (gov’t hasn’t re-opened)

AND

- patient when you are now bought in to positions & invested (and have low cash %)…you had a thesis, picked great stocks, now just let them work…regardless of short term fluctuations.

Don’t get spooked out of entries you would kill for in a year :)

- Luc

First time ever that Nadella isn't leading $MSFT's day 1 keynote at Ignite.

fwiw...

I love small accounts on X.

Heck, I *am* one.

Ridiculous alpha everywhere.

- ideas, charts, DD

- uncovering catalysts

- deep diving

- studying leadership

- humble + super cool people

I see you. I got your back.

My DMs are always open…let’s win together.

♥️Luc

$1T pay package approved for Elon, cool...

What does that *actually* mean though?

It's roughly 424M shares...potentially worth $1T.

BUT it's tied to VERY ambitious, decade-long milestones.

For Musk to get paid, $TSLA needs to deliver:

• 20 million vehicles

• 10 million FSD subscriptions

• 1 million humanoid robots

• 1 million robotaxis

• Targeting $8.5T market cap (!!!)

If anybody can do it...it'd be this alien.

Sheeeeesh.

You could run 26.2 miles, bike 100 miles, drink a gallon of water daily, get 8 hours of sleep, take your vitamins, eat superfoods daily...

But it's all worthless if your MIND is in chaos.

Stressed. Anxious. Overthinking trades. Hesitant when opportunities are there.

Chaotic mind = bad trading decisions

I quiet my mental chaos by:

- removing myself from the outcome, and just following my trading process + rules

- getting comfortable losing small...always have defined risk

- scaling into winners & cutting losers fast

- not using leverage, margin, or options

- focusing on longer timeframes...daily, weekly, monthly.

The body is the vehicle but the mind is the driver.

$XPEV is China's version the $TSLA "it's not a car company" argument.

Founder He Xiaopeng keeps saying $XPEV's goal is to be a “mobility + AI company,” not just a car manufacturer.

Great trade so far, but I want $30.

Ex-girlfriend calling? Nope, it's just $XPEV.

I am watching $XPEV for an *interesting* catalyst next week & beyond.

- XPENG AI Day ( called “Emergence”)...next week, Nov 5th ’25

- CEO’s massive share buy-in just months ago

- Expanding into eVTOLs, with "mass production" planned for 2026 👀

+ Recent Trump/Xi meeting (warming relations again?)

I LOVE an innovative CEO & company.

$XPEV is now $22.59

I am adding decently heavy here.

Risk is daily close under $109.

Something is up $DIS.

The $COST here is worth it for me.

- holidays + seasonality coming

- attractive to price-conscious consumers

- 35 new locations coming in '26

- insane member retention, 90%+ globally.

Long at $924, risking weekly close under $900, targeting $1050 first.

$COST now $924.

Luc retweeted

Ex-girlfriend calling? Nope, it's just $XPEV.

I am watching $XPEV for an *interesting* catalyst next week & beyond.

- XPENG AI Day ( called “Emergence”)...next week, Nov 5th ’25

- CEO’s massive share buy-in just months ago

- Expanding into eVTOLs, with "mass production" planned for 2026 👀

+ Recent Trump/Xi meeting (warming relations again?)

I LOVE an innovative CEO & company.

$XPEV is now $22.59

1982. The "personal computer" wins Time's Person of the Year.

2025. "AI" has a 36% chance to win Time's Person of the Year...

In 1982, the personal computer sparked a 5-year, 140% rally before the 1987 crash.

Different times, yes...but history can sometimes rhyme.

It’s 11pm.

Wife's asleep in bed.

House quiet.

Your eyes burning from looking at the computer.

There’s millions of dollars in that screen somewhere.

You just have to pull it out.

How though?

You’ve tried everything.

Feels like you’ve been spinning your tires for months now…going nowhere.

Big win, bigger loss…rinse & repeat.

Right when you think you’ve figured things out…

You get smoked, back to square one.

I get it.

This is the hardest game on Earth.

Competing against literal supercomputers.

Someone is always smarter, faster, and has deeper pockets.

So how do you win?

You stop playing the wrong game.

Their game.

Leverage, short term options, margin, high frequency, oversizing.

Those are all trading“products”, literally designed to make the firms money.

You’re not going to outsmart Citadel or out-leverage Wall Street.

Forget their game altogether.

Play our game.

Longer timeframes, higher conviction positions, swing trades based on catalysts, due diligence, big picture ideas for huge % gains.

The goal ISN’T to win the game, it’s to *STAY IN* the game forever.

- Luc

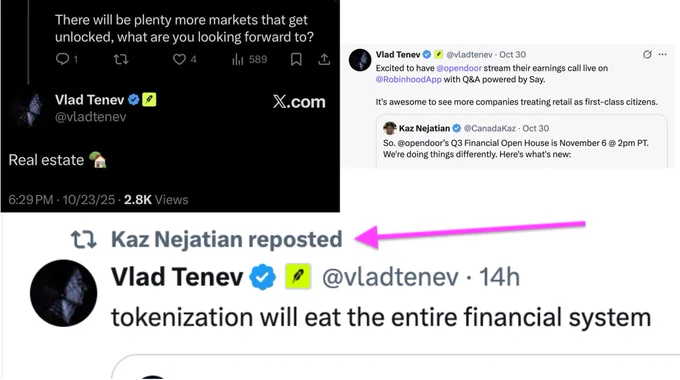

$OPEN'ing this can of worms again before earnings tomorrow.

I continue to increase my position.

$OPEN is knocking on the door of TWO potential *major* partnerships (speculating here).

1) the connection between Sam Altman, Keith Rabois, + Opendoor

- Altman officiated Rabois’ WEDDING in St. Barts in 2018

- Altman invested into Opendoor’s early party round in 2019

- Rabois rejoined Opendoor as chairman of the board in September '25

OpenAI's CEO has some *very close* ties to $OPEN's chairman.

Partnership idea? I think so.

2nd potential collaboration?

Robinhood, $HOOD.

- Vlad Tenev, $HOOD CEO, is "looking forward to real estate being tokenized"

- $OPEN CEO reposts Vlad’s tweet saying “tokenization will eat the financial system”

- Robinhood is literally broadcasting $OPEN's earnings inside its app

Opendoor supplies the real estate + data.

Robinhood brings distribution + tokenization rails?

Idk, but something's cooking with Vlad + Kaz.

Two catalysts this week...

- $OPEN earnings tomorrow after close

- $OPEN CEO speaking at ResiDay on Friday

Price has held well between $7-$9.

I am *very confident* $OPEN can see $10 first, then $15+ with this team, these links + connections, in this industry.

$OPEN now $7.23