islandboi retweeted

$IREN

Cantor Fitzgerald reiterated their "Overweight" recommendation after the earnings call but interestingly lowered their price target from $142 to $136.

islandboi retweeted

$IREN CEO Dan Roberts just now:

"There is appetite from a number of parties in discussing cloud and other well above 200MW."

He was clearly was picking his words with this statement as well.

Bullish.

🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥

islandboi retweeted

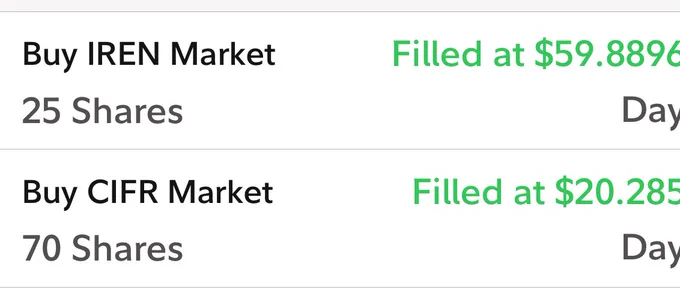

I am an $IREN shareholder now

islandboi retweeted

$IREN targeting $3.4B in AI Cloud ARR by the end of 2026 😳

islandboi retweeted

Me watching people that have no idea what they’re doing selling $IREN this morning. Fair value today is $192-$210 btw

islandboi retweeted

I listened to $IREN Q1 Earnings Call yesterday.

I was surprised to see the company almost overlooking its $BTC revenue. The surprise faded when I read this astonishing quote from Microsoft.

“ [ $IREN is] a fully integrated Al cloud

from data centers to GPU stack combined with their secured power capacity [which] makes them a STRATEGIC PARTNER.”

Jonathan Tinter, President, Business Development and Ventures at $MSFT

islandboi retweeted

IREN is growing aggressively.

140k GPUs and $3.4B ARR by year end 2026.

World class customers like Microsoft.

IREN will be the only scaled up, fully vertically integrated, AI cloud built to serve external customers.

This is an absolute beast in the making.

islandboi retweeted

I’m running numbers tonight (or this weekend) comparing $CIFR to another major player at the same level — and honestly, $CIFR could reach or even surpass their scale within 1–2 years.

Tyler’s already dropped hints — and if you’ve been paying attention, you know what he’s building toward.

Triple digits isn’t a dream. It’s the real story forming. This other company Trades at $500 + 🤯

Disclaimer: If Tyler scales the 56 MW direct-compute pilot, then $CIFR’s upside becomes a whole different story — it would no longer be a fair comparison to companies just offering power, data-center space, or colocation deals to hyperscalers.

So the idea is Even without Direct compute: Triple digits are coming ! 🚀

Do you guys want me to reveal this weekend? If I get 250 + likes (to gauge interest), I will take the time to do this.

$IREN 👇

islandboi retweeted

$IREN Q1 FY26 Operating Loss vs Net Income

The apparent deterioration in operating income this quarter — an operating loss of $76.4 million — is primarily a result of non-cash stock-based compensation (SBC) and related payroll-tax accruals within SG&A, not a deterioration in core operations.

SG&A totaled $138.4 million, of which $72.4 million (52%) reflected SBC expense and $32.8 million (24%) reflected payroll taxes on SBC — together accounting for roughly 76% of total SG&A. Under U.S. GAAP (ASC 718), the fair-value of equity awards such as RSUs is measured at the grant date and recognized over the vesting period, while payroll taxes linked to share price appreciation are remeasured each reporting period, causing volatility when the stock price rises sharply.

The surge in IREN’s share price during the quarter led to a significant increase in both the recognized SBC expense and the associated payroll-tax provision, inflating SG&A despite stable underlying cost structure. Excluding these equity-linked items, core SG&A would have been roughly $33 million, consistent with prior periods and proportionate to revenue of $240 million.

In contrast, the same share-price movement generated a $665 million unrealized fair-value gain on derivative instruments — notably the prepaid forward and capped-call arrangements tied to the company’s convertible notes — under ASC 815, as these liabilities are marked to market through earnings. This accounting asymmetry explains the positive net income of $385 million, despite a GAAP operating loss.

In essence, the quarter’s results illustrate a non-economic divergence:

– Operating income depressed by non-cash, share-price-sensitive SBC and payroll taxes.

– Net income elevated by non-cash fair-value gains on equity-linked hedges.

Both stem from the same underlying driver — share-price appreciation — and therefore do not reflect a change in IREN’s fundamental operating performance or cash generation.

Please share this with anyone who complains about the negative operating income.

islandboi retweeted

$IREN $1000+ ⏰

$IREN today reported its Q1 FY26 results.

Key highlights:

- Targeting $3.4bn in AI Cloud ARR by end of 2026 (expansion to 140k GPUs)

- Secured $9.7bn contract with Microsoft: 5-years, 20% prepayment, $1.9bn ARR contribution

- New multi-year contracts supporting growth to target AI Cloud ARR of >$500m by end of Q1 2026, including with Together AI, Fluidstack and Fireworks AI

@danroberts0101 Co-Founder and Co-CEO of IREN, commented

“IREN continues to execute with discipline, delivering record results this quarter and meaningful progress in our AI Cloud expansion.

We secured several new multi-year contracts, including a landmark partnership with Microsoft, which solidifies IREN’s position as a leading AI Cloud Service Provider and expands our reach into new hyperscale customer segments.

Looking ahead, our announced expansion to 140k GPUs represents only 16% of our 3GW grid-connected power portfolio, providing ample capacity to continue scaling IREN’s AI Cloud platform and drive long-term value creation.”

Press release: irisenergy.gcs-web.com/stati…

$IREN management will host a webcast to discuss these results at 5:00pm ET today, which can be accessed here: edge.media-server.com/mmc/p/…

islandboi retweeted

$IREN

Michael Donavan at Compass Point has reiterated their "Buy" recommendation and updated their price target from $50 to $100.

September: $23

September: $50

November: $105

These price targets are moving FAST - just as fast as the company's ARR!

islandboi retweeted

It’s still early $IREN

islandboi retweeted

$IREN has the most power guaranteed to come online in the next 3 years of any Neocloud

$META said they are spending $600B next 3 years… META’s compute needs are smaller than $AMZN, $GOOG $MSFT. OpenAI said they need $1T in capital

$GOOG co founder Sergey Brin said he’s willing to have Google go bankrupt before he loses AI race

$NVDA CEO said spending will reach $5T next few years

… and you don’t think $IREN will get to $21B ARR (10x stock return) in the next four years? It’s so easy. Hold. Don’t use leverage (it’s not needed). Retire before age 40. This option is available to you if you choose to not be retarded

Bio: former bulge bracket banker and 10 years multi billion HF. Genuinely trying to help the financially illiterate. This is a layup if you are patient. GL to all players (not financial advice, my opinion)

$IREN Press Release Takeaways

1. $3.6B ARR guide uses only 16% of secured power, implying IREN could generate $21B in ARR by 2030 - at 10x ARR, this would put IREN at a $210B market cap, more than 10X from today (will likely need $30-$40B in capital). See below for chart.

2. $3.6B 2026 AI ARR guide - is awesome but a low ball guide that provides plenty of room for beat and raises as Sweetwater Energizes April 2026. I am expecting this to be raised to at least $5.5B by mid April

3. $3.6ARR guide implies stock is trading around 5x 2026 ARR, which is only a .5x premium to CRWV (ie CRWV trades at 4.5x 2026 ARR). However, IREN will be growing ARR MUCH FASTER (1000%s of percent vs. 150% for CRWV), so a higher premium is warranted. CRWV also looks undervalued at just 4.4x 2026 ARR.

4. $10B ARR is going to happen in short order, maybe by mid 2027 (the stock trades at less than 2x 2027 ARR). 8-12x ARR seems appropriate, which would put market cap closer to $80B-$120B by 2027 (implying 340%-560% upside by year end 2026)

5. 2026 revenue including bitcoin mining likely to be closer to $5B

6. OpenAI wants to be in the GPU-as-a-Service Business based on Sam Altman's letter/ tweet today

7. Jim Chanos reminds me of Chuck Rhoades from Billions (a masochist)

8. IREN is going much much higher

@theBTCMiningGuy @bitcoinbutcher1 @mikealfred @Umbisam @StockSavvyShay @FransBakker9812 @Agrippa_Inv @awilkinson @JonahLupton @BillAckman @altcap @munster_gene @fundstrat