a defi chain forged to bring dead bags to life via deep liquidity & real yield built by katana foundation, incubated by @0xpolygon x @gsr_io.

Joined October 2020

- Tweets 2,043

- Following 660

- Followers 298,341

- Likes 8,136

bear market? no sign of that here

the blade has chosen you samurai

🔦 Your Weekly ALM Vaults Highlight is in🔦

$vbUSDC / $vbETH – 163.66% APR (3x Points) @steerprotocol

$vbWBTC / $vbETH – 99.30% APR @CharmFinance

$MORPHO / $WETH – 100.33% APR @GammaStrategies

Earn yield across Sushi x @katana ALM vaults. 💧

a product name fit for a samurai

blade pools on @SushiSwap are looking good 👀

⚔️ This is your weekly reminder to take a peek at the new Blade pools on @katana

We're just going to leave this right here 😈

katana ⚔️ retweeted

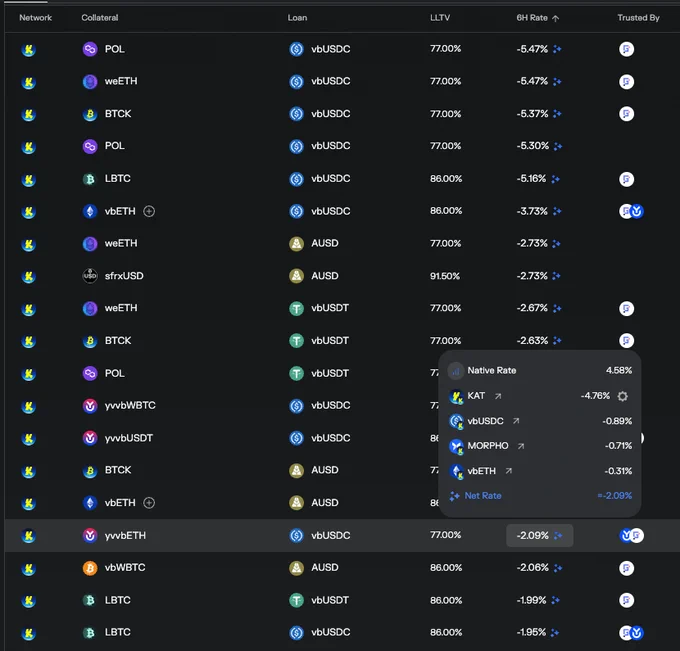

on katana you can earn KAT, MORPHO, USDC, and ETH when you borrow on @MorphoLabs

its beautiful really. and its powered by Vault Bridge.

like LayerZero, but for Bitcoin.

@beyond__tech's Bitcoin L1 interoperability protocol is coming soon to the Katana Dojo.

great thread on the findings in the @dl_research report on katana

vKAT, CoL, vaultbridge, sequencer fees, core apps, and more

this report has it all ⚔️

As much as DeFi needs more liquidity, it needs liquidity that works.

@katana built a chain where every asset earns, circulates, and compounds, forming a productive base for sustained growth.

A glance at our latest report: 🧵

katana ⚔️ retweeted

LIVE at #SmartCon: @katana Insitutonal Lead @mfisher10x and @GSR_io President @Jakob_GSR took the stage to talk about onchain yield

Matthew: “Insitutions trust katana because we focus on making sure protocols have been battle tested and are secure”

Jakob: “We want Katana to be the choice for onchain and offchain yield - to be able to build up opportunities for institutions”

the DeFi UX revolution is happening on katana

projects like @agg_trade are making it easier for users

Introducing AggTrade!

The Hub for all DeFi activity on @katana

Now you can trade, lend, farm yield and view advanced analytics on your portfolio in 1 place.

great thread ⚔️

highlighting how institutions can benefit

from katana's deep concentrated liquidity

and incentives flywheel

CEO of @0xPolygon, @0xMarcB explains how institutions can unlock stablecoin liquidity.

The biggest challenge is that institutions move liquidity in large volumes.

We’ll soon see trillions of dollars entering blockchains.

the research team over at @DefiLlama just released a 30-page report on Katana

Katana is different.

with four primary revenue drivers that flow back to higher yields and deeper liquidity for users.

"where does the yield come from?" - this report from @dl_research dives DEEP 👇

"Do nothing that is of no use."

@katana applies the samurai's rule to DeFi: no wasted motion, no idle capital.

Read our latest report and learn how every layer of Katana's architecture turns liquidity into revenue:

assets.dlnews.com/dlresearch…