Proud dad, trying to follow the golden rule. IBD-Senior Market Strategist. Prior = O'Neil Capital Mgmt-SVP/PM, PM for a private fund. Ideas ≠ advice

Keeping Austin Weird, TX

Joined January 2012

- Tweets 87,712

- Following 370

- Followers 44,935

- Likes 157,265

Pinned Tweet

Most folks would NEVER share these stories...but I'm not "most folks"😉

A deeply personal journey of how I've dealt with FEAR!

Including the ONLY time I ever said NO to Bill!

I hope this helps YOU deal with your fears in life🍀

Webby Rambles On #11

To make it easier to unsubscribe…🤣piped.video/@webby5150?si=9f…

So far my Webby Rambles On new FUNdamental Series is a MASSIVE success🤣🤣🤣

U2 can unsubscribe to my YouTube channel “Webby5150”

In case you missed it…

My take on the current market👇🍀

I'm guessing this is the only stock market show that discussed @MylesKennedy's GREAT new album "The Art of Letting Go"...but I could be wrong😉🤘

The Myles Kennedy part is at the end, around 1:11:00

@IBDinvestors @IBD_JNielsen

What makes a stock go up more than 515.50%

Clue…it’s NOT the chart!🤔😉👇

The FUNdamental Series continues…

Webby Rambles On tackles….

Annual Earnings Per Share

I hope it helps🍀

WRO #45 Quarterly Earnings, a Fundamentals Series piped.video/SaftlgULsAA?si=aZw9… via @YouTube

The FUNdamental Series continues…

Webby Rambles On tackles….

Annual Earnings Per Share

I hope it helps🍀

WRO #45 Quarterly Earnings, a Fundamentals Series piped.video/SaftlgULsAA?si=aZw9… via @YouTube

My take on the current market👇🍀

I'm guessing this is the only stock market show that discussed @MylesKennedy's GREAT new album "The Art of Letting Go"...but I could be wrong😉🤘

The Myles Kennedy part is at the end, around 1:11:00

@IBDinvestors @IBD_JNielsen

Going LIVE RIGHT NOW!

@IBDinvestors @IBD_JNielsen

Stock Market Today with @IBD_JNielsen and @mwebster1971: Is the 50-day bounce an opportunity? Intuitive Surgical, Marriott, Carpenter Tech in focus $ISRG $MAR $CRS

piped.video/watch?v=26xatIiM…

Prepping for IBD Live. It's a great time to be on with market weakness, as this is where opportunities appear. I'll be with my good friends @mwebster1971 and @SaitoChung See you there. @IBDinvestors

Sleep deprived? 👇 piped.video/@webby5150?si=iv…

FUNdamentals drive a stocks longer term move…not the technicals

Quarterly EPS, the 2nd in the new Webby Rambles On FUNdamentals Series drops Saturday!

ICYMI👇

WRO #44 Sales Growth, FUNdamental Series piped.video/Qt-vsBmF6k8?si=k4Mf… via @YouTube

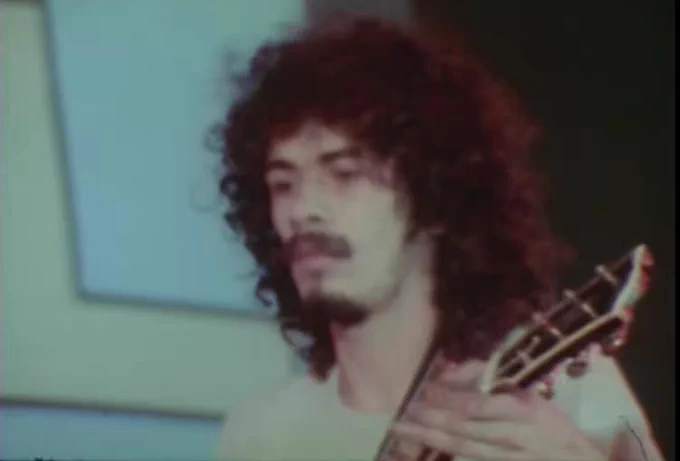

Wolfie making it look easy🤘

When Mammoth comes to your town….GO🔥🔥🔥

When Mammoth doesn’t come to your town…GO ANYWAYS😉

@MammothWVH @WolfVanHalen

Mammoth was even better in Huston than they were in Vegas🤷♂️

Wolfie was On 🔥 🔥🔥 even at The End😉

The entire band is amazing…especially Frank IMHO

@WolfVanHalen @franksidoris @MammothWVH

If you’ve never seen @MylesKennedy LIVE you need to change that ASAP!

He puts on a killer show…looks like he’s having as much fun on stage as the audience is having🤘

Joe puts out great stuff IMHO

@jfahmy

I keep hearing about froth in the market. Is there froth? Yes, but it’s mostly in certain growth stocks that are non-profitable and trading on potential (such as nuclear and quantum computing). A few comments:

1) The market corrects this froth on its own. Many of these stocks are 10-50% off their highs but the market has barely corrected due to sector rotation.

2) Not everyone is in these stocks. Yes, people are watching them, tweeting about them, trading them (long and short), but stop thinking this is the ENTIRE market. Very few market participants are in these names. They are mostly just talking about them.

3) I don’t consider something like $NVDA froth because it just broke out of a one-year consolidation in July (in other words, it has not gone up EVERY DAY for the past two years like some people think it has). Also, they have insane revenue growth (considering their size) and real profits (unlike many of the stocks in the late 90s).

4) If you feel the indexes are frothy because YOU want them to correct: A) We just had a 20% correction earlier this year. Sorry if this doesn’t fit your stupid, miserable narrative that we need a 2–3-year, -50% bear market. Be careful what you wish for because that would mean there’s a bigger problem in the world. B) Don’t focus on what you THINK the market should be doing, focus on what it is ACTUALLY doing. C) The market is barely correcting because earnings are growing, the Fed is cutting rates (Don’t fight the Fed), and the seasonality is strong.

5) Like Paul Tudor Jones said, you “adapt, evolve, compete, or die.” The key word is ADAPT. You have to adapt to the market environment. I’m not a blind bull. In a bear market, I will be in cash hiding under my bed. For now, I’m going to continue to take advantage of an equity friendly environment and not fight it.

6) If you want to argue these points, I don't care. I'm not here to argue with people all day. I'm not preaching, I'm simply expressing my views. Do what works for you. As long as you're improving and making progress, that's all that matters. Good luck! 🙏

In case you missed it…my first in a new FUNdamentals Series of Webby Rambles On👇

This weekend I’ll release one on quarterly EPS

WRO #44 Sales Growth, FUNdamental Series piped.video/Qt-vsBmF6k8?si=0lQL… via @YouTube