Chief Strategist Simplify Asset Management | PM of top ranked high yield ETF, $CDX. Not investment advice

Places unknown

Joined December 2012

- Tweets 36,756

- Following 1,357

- Followers 214,624

- Likes 22,733

An explanation worth framing. This may very well be the Trump admin calculus.

Upon first witnessing the glory and splendor of the Universe, they casually, whimsically, decided to destroy it, remarking, "It'll have to go." -- Douglas Adams

Michael Green retweeted

Implied correlations, the true "fear index" has seen a steady increase this week.

We shared a thread a few weeks ago explaining why this matters and why it’s a valuable metric to track alongside the $VIX.

James Fishback:Blackstone::The Black Knight:King Arthur piped.video/ZmInkxbvlCs?si=NDus…

Also, we can guarantee places to live by reinstating serfdom. Homelessness solved.

The USNA has been able to maintain continued operations by drawing down operating reserves, but apparently the cafeteria (King's Hall) will run out of food by Thanksgiving. This would shut the academy for an extended period and possibly result in the first cancellation of the Dec 13th Army-Navy football game since 1929. I am skeptical we would allow the circuses to be cancelled; bread is optional in 2025.

Shutdown Risks Turning Into Real Drag

Normally shutdowns don't really matter, but as it drags on for longer the drag from paused wages and reduced staffing is ramping up, creating risk markets are underpricing the impacts ahead.

bobeunlimited.substack.com/p…

ROFLMAO

Think I just freaked out @LizClaman with my nihilistic stock picks of GOOGL, ORCL, and AVGO as the biggest current beneficiaries of the "passive bid." "Aren't you worried about valuations?"

"Valuations are insane! But that helps in a passive dominated world."

For some, there is no redemption. I mean they will literally not get their money back.

His understanding of Bitcoin isn’t accurate, specifically regarding credit creation using Bitcoin as an underlying asset. MicroStrategy (MSTR) is the perfect example, particularly their preferred stock products. STRC, STRK, and STRD are all credit instruments being emulated by many other Bitcoin treasury companies.

The way it works: you issue stock like a bank issues credit via a loan or mortgage. You use the revenue (credit) from the stock sale to buy the underlying asset (Bitcoin for MSTR, or a house for a mortgage), then collateralize the asset like Bitcoin for MSTR and package that collateralized debt as preferred stock. You pay a fixed quarterly or monthly dividend, like a bank receives monthly interest from mortgage payments or an investor receives from a mortgage-backed security. When the underlying asset appreciates, you refinance. Rinse and repeat until you own all the assets. The credit market for Bitcoin will be immense; MicroStrategy is the pioneer, and many will emulate it.

His third point about the monopolistic function of Bitcoin is correct but incomplete. Bitcoin is infinitely divisible (people will strive to own 0.000000001 Bitcoin or denominate in ‘Sats’). If an economy consistently buys more Bitcoin, transacts in Bitcoin, and creates credit with Bitcoin, the percentage ownership of a single whole Bitcoin will decrease, pushing its price higher. Due to its fixed supply, it is inherently deflationary—the opposite of our current fiat system, where dollars are devalued through inflation and new credit creation by banks.

There will always be people at the top of a pyramid, as in everything. Fiat pulls you further down the pyramid; Bitcoin lifts you up. Deflationary currency > inflationary currency.

Treating Bitcoin as a store of value is the perfect non-threatening Trojan horse to acclimate the economy and banks, encouraging them to add it to their balance sheets. Once it becomes a store of value for the people ✅, major institutions ✅, and banks ☑️, it's a small step to using it as everyday transactional currency. It may be the only thing that can save us from inevitable Central Bank Digital Currencies (programmable and controllable currency), which are being piloted in real time in several countries. The BIS openly states so.

Aren't all public equities a byproduct of white colonialism and hence foreign in North American portfolios?

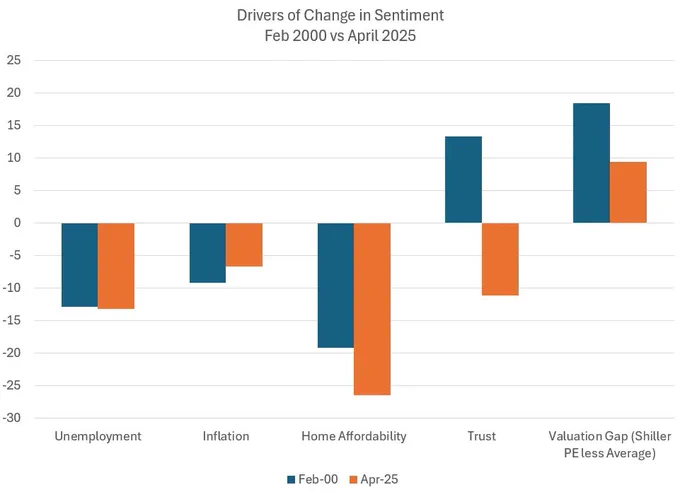

Sentiment is down because trust is down. America needs to restore TRUST -- something Trump is ill-suited for

I genuinely love @KrisAbdelmessih

He is correct. No red-blooded American chooses vanilla.