THE INDIAN AWAAZ retweeted

India’s Food Prices Cool Sharply as Global Agricultural Trends Turn Softer - The Indian Awaaz

@theindianawaaz

@CrisilLimited

@WorldBank

@bankofbaroda

#bankofbaroda, #inflation, #food, #agri

share.google/FO8qmAJXTLjPNho…

VD : Bank of Baroda ਵਲੋਂ ਮੇਲੇ ਦਾ ਆਯੋਜਨ, ਕਿਸਾਨਾਂ ਨੂੰ ਕੀਤਾ ਗਿਆ ਜਾਗਰੂਕ

dainiksavera.com/bank-of-bar…

#BankOfBaroda #FarmersFair #DainikSavera #KisanMela #AgriculturalAwareness

DEEPAK AGRAWAL retweeted

Say goodbye to any paperwork!

With Jeevan Pramaan, pensioners can now submit their Life Certificate digitally from home using Face Authentication.

Convenient. Secure. Hassle-free.

To know more, visit: tinyurl.com/jeevanpramaangov

#BankofBaroda #DLCCampaign4 #JeevanPramaan #DigitalLifeCertificate #PensionerServices #ConvenientBanking #FaceAuthentication

An Indian By Religion retweeted

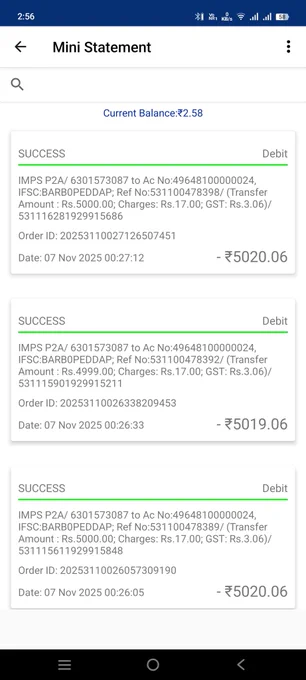

STILL NO ACTION TAKEN .ALSO AMOUNT NOT RETURNED BACK AS ITS NOW APPROX 15 DAYS SINCE THE FRAUDULENT TRANSACTION HAS BEEN EXECUTED.

@bankofbaroda #RBI #Bankofbaroda @RBI @DFS_India #DFS_INDIA @cyberpolice_up #Cybercrimeup @KamleshDixitIps @dgpup

NRI Retirement retweeted

#BankOfBaroda

Bank of Baroda:

Today it has breached all time High.

Let's deep dive. 👇

RETWEET for maximum reach.

Price: ₹291.20

Trend: Strong Uptrend

Timeframe: Weekly

Bank of Baroda is showing powerful bullish momentum on the weekly timeframe.

After a multi-week consolidation phase near ₹235-₹250 levels, the stock has broken out convincingly and is now trading at new highs.

Key Technical Signals:

✅ Breakout above previous swing high – Signals continuation of bullish trend.

✅ Strong volume expansion – Valid breakout supported by institutional activity.

✅ Price > 50 EMA & 200 EMA – Trend alignment + clear bullish structure.

✅ Golden trend structure – 50 EMA above 200 EMA, price strongly riding above moving averages.

✅ Higher Highs & Higher Lows formation intact.

Market Psychology:

This breakout indicates strong confidence in PSU banking space and #BoB is emerging as a sector leader with solid relative strength.

No overhead supply above previous highs leads to momentum acceleration and the sky should be the limit now.

Levels to Watch:

Support Zone₹270 – ₹280

Major Support50EMA ~₹265

Resistance (Psychological)₹300(jesse levermore)

Next Target Levels₹315 / ₹330(if momentum sustains) at least.

A weekly close above ₹300 can open doors for sharp upside as it's a psychological barrier + round number zone.

⚠️ Risk & Strategy

Avoid chasing if it gaps up further — look for pullback towards ₹275-₹280 for better R/R.

Trail stop loss below ₹265 (50 EMA) for swing positions.

Monitor weekly candle strength near resistance.

This is a trending stock — best traded with a trend-following mindset.

Remember the market is bearish, so it can squat anytime.

This is not a buy or sell recommendation, for educational purposes ONLY.

Thank you 😊🙏 for your time 🙏.

We’re delighted to welcome @bankofbaroda as the 𝐏𝐫𝐞𝐬𝐞𝐧𝐭𝐢𝐧𝐠 𝐏𝐚𝐫𝐭𝐧𝐞𝐫 of the 𝐀𝐧𝐝𝐡𝐫𝐚 𝐏𝐫𝐚𝐝𝐞𝐬𝐡 𝐑𝐞𝐢𝐦𝐚𝐠𝐢𝐧𝐢𝐧𝐠 𝐏𝐮𝐛𝐥𝐢𝐜 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐒𝐮𝐦𝐦𝐢𝐭 𝟐𝟎𝟐𝟓!

Register: events.eletsonline.com/apfin…

#BankofBaroda #EletsFinanceSummit | @DRonaldRose

Bank of Baroda is observing Cyber Jaagrookta Diwas. Fraudsters use innocent people to launder money. Don’t become their partner; it’s a punishable crime.

For Cyber Crime-related complaints, call 1930 or visit cybercrime.gov.in

#BankofBaroda #CyberSecurity #CyberJagrooktadiwas #PehchaanCon #DigitalSafety #OnlineProtection

@bankofbaroda @TGTwallet @UPI_NPCI

The 3-transactions showing as successfully transferred Bank account, but #bankofbaroda didn't recieved the funds. And amount debited from my #Wallet, Could you please help us, total 3 transactions screen shot attached below 👇

बैंक ऑफ बड़ौदा ने तो मेरी भतीजी को सीधा करोड़पति से पहले “माइनसपती” बना दिया 😭

अकाउंट बैलेंस: -₹17,80,000

भाई, ये क्या नया EMI प्लान चला रखा है? 🤔💸

@bankofbaroda ज़रा बताइए, ये कौन सी स्कीम है? #BankOfBaroda #BankingFail #FunnyIndia #ViralTweet #CustomerServiceFail

ಈ ಬ್ಯಾಂಕಿನಲ್ಲಿ ₹200,000 ಠೇವಣಿ ಇಟ್ರೆ ₹84,349 ಸ್ಥಿರಬಡ್ಡಿ ಸಿಗುತ್ತೆ

#BankofBaroda #BankofBaroda5yearsfd #BankofBarodafdinterestrate #BankofBarodafdcalculator

zeenews.india.com/kannada/bu…

Baroda BNP Paribas Mutual Fund onboards Yogesh Apte as Head of Digital Business

bestmediainfo.com/mediainfo/…

#DSPMutualFUnd #BankofBaroda

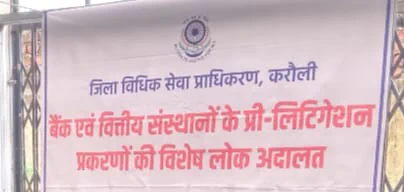

#Karauli : 08 नवम्बर को बैंक ऑफ बड़ौदा की विशेष लोक अदालत का आयोजन

#BankOfBaroda #SpecialLokAdalat #KarouliNews #LegalAid #DebtSettlement #PreLitigation #breakingnews #LatestNews #news21national