Data/DeFi Research| Hyperliquid| Aave

Joined November 2016

- Tweets 32,067

- Following 2,696

- Followers 4,629

- Likes 32,919

Pinned Tweet

$Aave has solidified its position as the dominant lending protocol on Ethereum, now accounting for 82% of all outstanding debt on the network. This market share has grown steadily since 2021, reflecting the platform's ability to attract and retain users across multiple market cycles.

The chart below tracks the distribution of outstanding debt across Ethereum lending platforms, effectively showing where users choose to borrow against their collateral. $Aave's expanding share indicates both growing absolute usage and market consolidation around the protocol

$Aave currently serves nearly 1,000 unique borrowers daily, facilitating approximately $25 billion in outstanding loans on Ethereum. The protocol's total value locked stands at roughly $50 billion, with the difference between TVL and debt representing supplied assets that remain available for borrowing.

As a money market protocol, @aave enables users to deposit crypto assets to earn yield while simultaneously allowing others to borrow these assets by posting collateral. This mechanism forms a foundational layer of DeFi infrastructure, enabling leveraged trading, yield farming strategies, and capital efficiency across the ecosystem.

Beyond basic lending and borrowing, $Aave offers features like flash loans (uncollateralized loans that must be repaid within a single transaction) and efficiency mode, which allows higher leverage for correlated assets. These capabilities have made the protocol essential for sophisticated DeFi strategies.

The lending market exemplifies a broader trend of consolidation across crypto verticals, though this represents a flight to quality rather than formal mergers. Users gravitate toward platforms with the deepest liquidity, longest track records, and most robust security practices. The protocols' concentration around Ethereum underscores the network's continued role as the center of DeFi lending and borrowing activity.

$Aave's entrenched position suggests it will likely remain the market leader, though emerging protocols with novel mechanisms or risk parameters may carve out niches.

cc; @StaniKulechov, @lemiscate

if you’ve been hearing about @lute but still not sure what it really is, here’s the thing lute isn’t just another trading app.

it’s a social trading terminal built for onchain markets.

you can see what your friends are buying or selling, call trades, share positions, and even earn rewards for your insights.

instead of trading alone, lute lets you trade together.

it makes the markets more transparent, more interactive, and way more fun.

it’s where the alpha meets the community.

. @xeetdotai

Are you tired of giving away your best trade ideas for free?

. @lute is changing the game by rewarding meaningful contributions!

Post a helpful idea that leads to group success and get compensated directly for the value you create.

Are you tired of giving away your best trade ideas for free?

@lute is changing the game by rewarding meaningful contributions!

Post a helpful idea that leads to group success and get compensated directly for the value you create.

Vicki.hl retweeted

the power to shape the digital world is moving.

from platforms to people. @antix_in is fueling this shift, turning digital twins into your personal canvas for what’s next.

your vision. your identity. your creation.

they’re laying the foundation for the next generation of innovators. your place is here.

claim your creative sovereignty: twin.aige.co

connect with the movement:

telegram: t.me/antix_in

discord: discord.gg/antix

$ANTIX = real utility, not hype.

🌐 Subscription payment, Staking, AIGORA activities + governance voting, activity rewards and IP registration & royalties → all powered by $ANTIX

Get in before our Presale ends 👇token.antix.in/?refcode=ac4d…

Vicki.hl retweeted

honestly, thrive protocol is one of the most underrated projects right now

what they are building is really simple,

• build something valuable

• get funded by top ecosystems within 7 days

easy!

.@thriveprotocol is trusted by leading ecosystems like base, arbitrum, optimism, polygon, metis, and other big names

also, a project like @miranetwork shouldn’t be overlooked, check it out and see amazing things

gg’s guys.

. @aave horizon RWA market has surpassed the $500M milestone, continuing its steady climb and reinforcing the rise of tokenized assets in DeFi.

Up only, use aave..

cc: @lemiscate

Over 28% of Bitcoin’s circulating supply is now held at a loss, nearly a third of holders are underwater.

Historically, these moments often mark local bottoms in bullish cycles, as markets flush out exhausted sellers.

Solana’s TVL and stablecoin supply keep climbing, while new asset listings, perps, and launchpads fuel the momentum.

It’s shaping up to be an ideal setup for the next Solana DeFi wave.

Vicki.hl retweeted

Thrive Protocol: Rethinking Web3 Grant Funding

----------

Overview:

Most current Web3 grant programs scatter funds with little strategy or oversight. @thriveprotocol on the other hand, implements a results-driven model to ensure funding supports real builders and contributors—not opportunists.

----------

What is Thrive?

- A protocol designed to connect leading ecosystems including Hedera, Metis, XION, and Polygon with legitimate builders and contributors.

- Eliminates grant inefficiencies by excluding hype-driven applicants and grant farmers.

----------

Core Mechanism: Proof-of-Value:

- Milestone-Based Funding: Grants are released only when teams achieve predefined milestones.

- Dual Tracking: Progress is monitored both algorithmically and through human review.

- Strict Payout Policy: No value demonstrated means no payout. Simple compliance, zero tolerance for non-performance.

----------

Key Results:

- $12.6M “Anti‑Grant‑Grant” launched with XION.

- Public “Wall of Shame”: Non-performers are transparently listed, promoting accountability.

- $3.6M Thrive Metis: Builders and content creators are compensated strictly based on delivered results.

- Boba Network: $200K distributed through structured, milestone-based rewards.

----------

Why This Approach Matters:

- Web3 needs targeted, efficient funding not more scattershot grants.

→ Thrive ensures capital flows to:

- Builders who deliver tangible results.

- Creators who drive cultural impact.

- Communities that actively participate.

- The model prioritizes accountability and measurable outcomes over promises and hype.

----------

TLDR

Thrive Protocol is rebuilding Web3’s funding foundation with a focus on proof and real coordination. This isn’t traditional grant distribution, it’s a technical framework for sustainable ecosystem growth.

Vicki.hl retweeted

GThrive.

To all builders, traders, and DeFi enthusiasts: Thrive Protocol has adopted a notably distinct approach. With $10 million in DAO-allocated capital, the initiative is dedicated to supporting genuine contributors within DeFi, Real World Assets (RWA), and Artificial Intelligence sectors.

The launch of the thrive(.)xyz beta allows creators to obtain funding based on achieved milestones; in other words, progress and tangible results are prioritized over mere promises.

Additionally, the recent partnership with @hedera represents a significant step, potentially enabling the global scaling of this innovative funding model.

Vicki.hl retweeted

defi was never supposed to feel like a full time job and yet here we are juggling portfolios chasing yields and tracking charts like it’s a 9 to 5.

that’s where @velvet_capital steps in.

with $velvet they’re building automated defi infrastructure that turns complex strategies into simple seamless on chain operations.

whether you’re a fund a protocol or just managing your own bag velvet lets you launch manage and scale yield portfolios with:

> no code tools.

> full transparency.

> institutional grade security.

defi is evolving from chaos to clarity from manual to automated.

this is the era of efficient intelligent and composable finance.

all powered by velvet capital 💜

#defi #velvetcapital #velvet #onchainfinance #web3

this week’s zealy tge sprint #4 has been all about showing what you can do with $antix.

. @antix_in spotlighted its key functions: powering subscriptions, serving as the spending currency on aigora, and earning rewards through staking.

don’t miss your chance to test your knowledge and climb the leaderboard before the sprint ends.

Let's talk about @HoudiniSwap

1. what it is

HoudiniSwap is a non-custodial DEX aggregator built for cross-chain swaps with privacy features.

2. key features

• It enables private transactions by concealing wallet addresses when you send, swap, bridge, or receive assets.

• It supports multiple major chains and aggregates liquidity to optimise swap pricing.

3. token:

The platform’s native token is “LOCK”.

Metrics show TVL around USD $2.58 m, revenue ~$1.54 m annualised; market cap and fully diluted valuation are modest in crypto terms.

4. partnerships & developments:

HoudiniSwap announced a partnership with @Chainflip to optimise native Bitcoin swaps and strengthen routing.

They emphasise compliance, privacy, and functional privacy (i.e., usable anonymity rather than gimmicks).

5. advantages:

• Privacy-centric swapping is its standout: hiding wallet flow is a differentiator in DeFi.

• Cross-chain and aggregation focus gives users access to more assets and better pricing.

6. risks & caveats:

• As with any privacy tool, regulatory risk is elevated: privacy protocols draw extra scrutiny.

• Being smaller in scale (TVL, market cap) means lower liquidity and potentially higher slippage or risk.

7. use-case relevance for you:

• If you trade crypto and prioritise privacy or cross-chain access this could be worth exploring.

• If you’re in a region like Nigeria (where you are) ensure you understand local regulation around privacy tools and crypto usage.

8. what to check before jumping in:

• Check which chains HoudiniSwap supports and how deep liquidity is for your token-pair of interest.

• Review the tokenomics of LOCK: supply, staking, rewards, and how they tie user incentives.

• Confirm how the privacy features work: are they optional, how is anonymity achieved & what tradeoffs exist.

• Look at security audits, smart contract risks, and whether bridges used are trusted (bridges add risk).

9. current status summary:

HoudiniSwap is live, operational, and carving a niche in privacy + cross-chain aggregation.

But it remains relatively small compared to major DEXes and privacy protocols, meaning both opportunity and risk.

cc: @MRBEEFCOMEDY

Vicki.hl retweeted

1. what is real vision (@RealVision):

Real Vision describes itself as a “financial knowledge and education platform” that gives “members the knowledge, tools, and network for their financial journeys.”

It offers in‑depth video interviews, analysis, long‑form content around macroeconomics, markets, crypto, emerging assets.

Started with the founders intention to provide more than bite‑sized headlines: no agenda, no editorial bias, freedom to say what they really think.

2. history & founding:

Real Vision was founded in 2014 by @RaoulGMI known as Raoul Pal and Grant Williams.

It’s based in New York (Chelsea, NYC) according to job listings, though the corporate brochure mentions Cayman Islands location for tax/structural reasons.

Over time it’s grown from video interviews into a broader media platform (podcasts, written content, crypto‑verticals).

3. what they offer / features:

• Video interviews & deep‑dives with influential investors, economists, strategists.

• Specialized verticals: e.g., crypto series (“Real Vision Crypto”).

• Membership/subscription model: access to premium content, archives, tools.

• The stated mission: Knowledge × Tools × Network = Success.

NB: Aimed at serious investors, not just casual market watchers.

4. why people like it / what the vibes are:

• It differentiates vs typical financial media sound‑bites: you get long form, thoughtful, less hype‑driven.

• Good for those wanting to go deeper: macro themes, future of money/crypto, structural shifts.

• Network effect: you see guests and commentators you might not easily access elsewhere.

5. what to watch out for / drawbacks:

• Price: subscription may be higher than casual finance content; you need to justify the depth.

• Volume & noise: deep content means you’ll spend more time than a 5‑minute clip; may not suit everyone.

NB: Not a substitute for doing your own research; content is high‑level, strategic, not always tactical.

6. what kinds of people it’s good for:

• Investors with medium to long‑term horizon interested in macro trends, crypto, alternative assets.

• Professionals who can benefit from deep‑dive interviews rather than headline news.

• Learners who want to elevate their understanding of markets and money beyond basic stock picking.

NB: NOT as ideal if you just want quick trade tips or day trading alerts, this is more structural, big‑picture.

7. how to make the most of it:

• Set aside time for the long‑form content (interviews tend to be 30‑60+ minutes).

• Use the archive: browse past themes (emerging markets, commodities, bitcoin) to build context.

• Cross‑check ideas with your own research: use @RealVision for insight, not sole decision engine.

• Engage with the network: discussions, community, commentary can add value beyond videos

8. what’s new / recent directions:

• They have a growing crypto vertical, indicating the shift to include digital assets more formally.

• Expanding content formats: podcasts, interactive discussions, deeper niche topics.

• Global reach growing: catering to an international audience, not just US/UK finance.

Tldr: If I were to boil it down: @RealVision is high‑end financial media, deeper than surface level, aimed at serious thinkers in markets, macro, crypto, and alternative assets. If you’re willing to invest time and pay for the subscription, you’ll likely get value; if you just want quick updates or trade tips, the fit may be less perfect.

cc: @AndreasSteno, @Jamie1Coutts, @JamesEastonUK

Vicki.hl retweeted

sometimes i look at how fast the digital space is evolving, and it’s clear we’re entering a new era of online identity.

@antix_in is one of the projects leading that shift.

they’re building ai-powered digital humans that are realistic, intelligent, and fully owned on-chain. not just avatars, but digital versions of us that can interact, create, and exist across platforms while we stay in control of our identity and data.

this changes how creators scale, how brands connect, and how we exist online.

it’s early, but the direction is powerful and worth paying attention to. $antix is the ticker

Vicki.hl retweeted

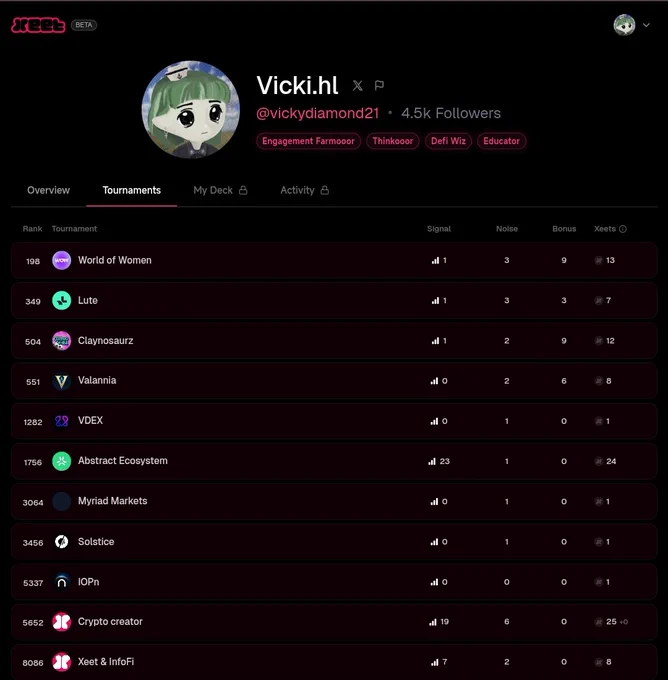

gm ct..

which do you think the reward is worth the time?

• @worldofwomenxyz World of Women is a web3 ecosystem originally launched as an NFT collection celebrating female representation in art-

& culture, and has evolved into a platform dedicated to supporting women builders in tech and culture.

• @lute a high performance on-chain trading terminal that offers fast execution, real time signals, social trading overlays and wallet tracking all built to combine trading, social insights and DeFi with a non-custodial design.

• @ValanniaGame is a medieval fantasy MMO/strategy game built on the Solana blockchain, with 8 races, hero customization, resource gathering, land and castle building, and guild-driven political/territorial gameplay.

Vicki.hl retweeted

the @cookiedotfun estimate we could earn at least $5k from @antix_in creating content.

what’s your expectation from $antix rewards???