4zhuu retweeted

L-Theanine literally KILLS cortisol

feeling anxious? tired after eating? irritated for no reason?

that’s high cortisol ruining EVERYTHING…

just 200 mg of L-Theanine lowers cortisol within 3 hours —

backed by clinical studies

this means:

– your mind goes quiet

– stable energy for hours (no crash)

– anxiety melts away within 30–60 minutes

mix it with your morning coffee… your brain literally upgrades.

4zhuu retweeted

WHY I LOVE THE 50-YEAR MORTGAGE:

Here’s the full picture of the 50-year mortgage opportunity, including the extra interest you get "wrecked" by on the 50-year mortgage.

Monthly payments (6% interest, $500k home):

• 30-year: $2,997.75

• 50-year: $2,632.02

• Monthly difference: $365.73

Total interest paid:

• 30-year interest: $579,190.95

• 50-year interest: $1,079,214.38

• Extra interest from choosing 50-year: $500,023.44

So stretching the loan to 50 years means you pay an extra half a million dollars in interest to the bank.

But here’s the twist:

If you take the $365.73 monthly savings and throw it into Bitcoin compounding at 20% for 30 years, you get:

✅ $8,403,654

So the trade-off is basically:

• Pay the bank $500k more,

• But stack $8.4M in Bitcoin.

Even a 20% CAGR on BTC gets you $1m status in about 18 years with that small monthly contribution.

But remember, this is a 50 year mortgage. Instead of 30 years, you keep stacking $365.73 per month into Bitcoin compounding at 20% annually for 50 years, your final stack becomes:

✅ $445,081,564

Yes.

Four hundred forty five million dollars.

Off the mortgage-payment difference.

This is why the 50-year mortgage discourse is hysterical.

Boomers see “more interest to the bank,” you see “half a billion in BTC.”

Is the 20% terminal CAGR too high?

Perhaps, but a lot of people think it's going to be even higher at 30-40% over the next decade or so.

Saylor himself thinks the terminal CAGR will be around 20% after the next two decades are up.

Crazy numbers, but that's what the math says.

Take it or leave it.

4zhuu retweeted

The 5.5-year Liquidity Cycle is approaching a turning point.

What potential effects could this have on financial assets?

My complimentary eBook, "1-Year US Stock Market Outlook," provides an in-depth analysis of stock market cycles, valuation metrics, investor sentiment, and Elliott Wave patterns, illustrated with 75 comprehensive charts.

You may download the eBook at the following link:👇

bravocycles-newsletter-marke…

----------------

4zhuu retweeted

these polymarket traders have avg 90% winrate.

pure insideкs, government officials, and analysts.

mentioned best 5 here:

I. Gambler1968

~$190k overall pnl.

this guy literally making thousands of x predicting the right outcomes on politics, crypto and mention markets.

seem like a genius or lucky degen?

perfect for (geo)politics: polymarket.com/@Gambler1968?…

II. GoldenFinger

fresh registered wallet, one from potential insiders on 'will stable launch a token in 2025' market.

predicting yes with ~$40k payout.

ideal for markets around stable launch: polymarket.com/@GoldenFinger…

III. Euan

over >$220k overall pnl. one from top searched traders atm.

sharp predictor found an edge trading on insider activity.

also was the first to discover Lord Miles was trading against himself on his own market.

perfect for copying: polymarket.com/@Euan?via=kyl…

IV. ilovecircle

insane trader with parabolic $2million pnl in 2 months.

trading across sports, politics and crypto.

83% accuracy.

profile: polymarket.com/@ilovecircle?…

V. kcnyekchno

potential government employee made $570k in 4 months.

politics and techs.

113 predictions.

84 wins.

rare and precise trades: polymarket.com/@kcnyekchno?v…

set my alerts for these 5, looking forward at their new trades.

4zhuu retweeted

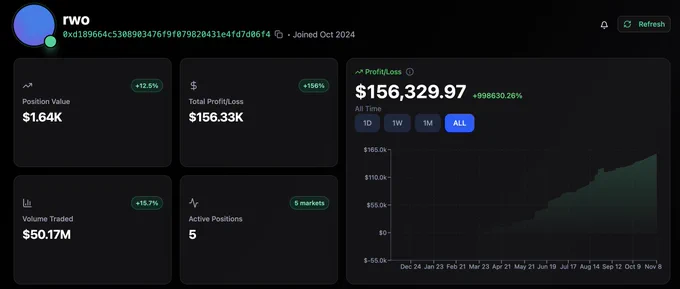

This trader has a 95.7% win rate on Polymarket

I've spent 48h to find someone good for copy trading, and finally found

This wallet created in October already has $156,329 profit

He bets absolutely on everything, without a specific niche

His profile: polymarket.com/@rwo?via=lord…

4zhuu retweeted

You have less than 10 years left. Get ready for 2035 or suffer when the breakdown of our current financial system starts.

The task is simple to describe but hard to execute: Use the time left to maximize your wealth and move it into valuable assets classes, that survive system resets. Look into scarce assets that are not easily manipulated and can not be multiplied out of thin air. Put at least part of your wealth out of reach of the government (do not put Gold into bank deposit boxes, do not put everything in real estate even after the bubble bursted, diversfy, spread across and keep access and full control at all times).

Sit on your hands while the crash plays out. Reduce your costs of living to the minimum to get through it without wasting your wealth.

Take everything you have and reinvest, when a new system has been put in place.

Avoid FIAT at all costs the closer we come to 2035. Only use it for your daily expenses and do not hold it longterm or create saving accounts with FIAT money. It will get worthless very fast.

I am here to share data, insights and analysis to my best abilities and I will clearly communicate what I do, when I do it.

Most people ignore what is coming and are bored, when I share it or call me crazy. Reality is, that 100 years ago most people had no chance to prepare for what was coming, because only a small elite had early access to the relevant information and data.

Today everybody with a smartphone and internet access has all the information and data they need. Do not expect pity and help when it gets serious if you decided that it is more important to scroll through Instagram instead of doing your best to prepare for what is about to come.

4zhuu retweeted

This trader never loses on Polymarket?

I’ve never seen this much green in my life. And what's crazy is he doesn’t even have a specific niche - he bets on literally everything, from sports to geopolitics.

His profile: polymarket.com/@Gambler1968?…

4zhuu retweeted

A guy just used @AnthropicAI Claude to turn a $195,000 hospital bill into $33,000.

Not with a lawyer. Not with a hospital admin insider.

With a $20/month Claude Plus subscription.

He uploaded the itemized bill. Claude spotted duplicate procedure codes, illegal “double billing,” and charges that Medicare rules explicitly forbid. Then it helped him write a letter citing every violation.

The hospital dropped their demand by 83%.

This isn’t just a feel-good story. It’s a preview of what AI will really do next: flatten systems built on opacity.

Hospitals, insurance companies, legal firms—all rely on asymmetry. They win because you don’t have access to the same data, code books, or language.

Claude gave one person the same leverage as a compliance department. That’s a revolution.

We thought AI would replace jobs. Turns out, it’s replacing excuses.

4zhuu retweeted

A simple, lightweight PowerShell script to remove pre-installed apps, disable telemetry.

4zhuu retweeted

332 days ago, I posted the chart below, showing a Bitcoin peak the week of Oct 6, 2025.

So far, it's been spot on.

Whether that holds as the ATH, we’ll find out.

If BTC starts closing weekly below the 50W MA, odds of the top being in go up.

If the 4-year cycle continues to play out, the buy zone between $55K–$75K will be glorious, just a 40–55% drawdown from the highs. I don't think we see as deep of a bear market, thanks to diminishing returns.

Could we go lower? Sure.

But I’ll be plenty happy filling orders there.

Long-term: Bullish.

Short-term: Respecting the cycle.

#Bitcoin Cycles Timeline. I don't make the rules.

2016-2020

Halving to Peak: 525 days

Peak to Bottom: 364 days

Bottom to Halving 518 days

2020-2024

Halving to Peak: 532 days

Peak to Bottom: 371 days

Bottom to Halving: 532 Days

The next halving date is March 26, 2028. Look how accurately the above timeline would put us at the halving...

Will the pattern continue?

I know no one wants to hear bullish ideas and everyone is scared and wants to fling poo at each other... but the Road to Valhalla is getting very close.

If global liquidity is the single most dominant macro factor then we MUST focus on that.

REMEMBER - THE ONLY GAME IN TOWN IS ROLLING $10TRN IN DEBT. EVERYTHING ELSE IS A SIDESHOW. THIS IS THE GAME OF THE NEXT 12 MONTHS.

Currently the gov shutdown has forced a sharp tightening of liquidity as the TGA builds up with no where to spend it.

This is not offset by the ability to drain the Reverse Repo (it is drained). And QT drains it further.

This is hitting markets and in particular crypto which is the most liquidity driven. TradiFi asset managers have had one of their worst years of performance vs benchmark and are now having to chase markets and that is allowing tech to be more stable than crypto. 401K flows help too. If this liquidity drain keeps going longer, stocks will get hit hard too.

However...

As soon as the gov shutdown ends, the Treasury begins spending $250bn to $350bn in a couple of months. QT ends and the balance sheet technically expands.

The Dollar will likely begin to weaken again as liquidity begins to flow. Tariff negiotiations will have largely been completed, removing uncertainty

Ongoing bill issuance increases, adding more liquidity via bank balance sheets and money market funds (and stable coins).

Ongoing rate cuts (we will have economic weakness from the shutdown that will add to the evidence that rates need to come lower but no, there is no recession)..

SLR changes free up more of the banks balance sheets allowing for credit expansion.

The CLARITY ACT will get passed, giving the crypto regs so deserately needed for large scale adoption by banks, asset managers and businesses overall.

The Big Beautiful Bill then kicks in to goose the economy into the midterms. The entire system is now being geared toward a strong economy and strong market in 2026 for these elections.

China will continue to expand its balance sheet. Japan will work to strenghten the Yen, and also fiscally stimulate.

The ISM will rise as rates fall and tarrif uncertainty drops away.

You just need to get through the Window of Pain and The Liquidity Flood lies ahead.

Always remember the Dont Fuck This Up rules...and wait out the volatility. Drawdowns like this are common place in bull markets and their job is to test your faith.

BTFD if you can.

td:dr - When this number goes up, all number go up.

4zhuu retweeted

YouTube is now censoring videos that show you how to bypass the Windows 11 login with a new system setup. This is because Microsoft wants to force everybody to log in, which allows Microsoft to:

- Read all your documents

- Scan all your photos

- Report you to law enforcement if they find any documents or photos they don't like

Windows 11 isn't an operating system, it's spyware.

On top of that, Windows 11 sucks for other reasons:

- It keeps auto-updating and restarting without permission, and there's no way to turn it off

- It keeps nagging you to back up all your files on Windows servers where Microsoft can monitor them more easily

- It's bloated and slow and saps the performance of your hardware

I use Linux on my workstations that crunch content data, and Linux is far more reliable and more private. Even better, most flavors of Linux are free and open source.

You should migrate from Windows to Linux. By far the EASIEST Linux variety to choose, that looks almost exactly like windows, and that works intuitively and almost seamlessly, is "Linux Mint" that you can download for free at LinuxMint.com (the "cinnamon" flavor of the most common variety).

Download it, flash it to a USB drive, boot to USB, install Linux Mint with a dual boot, and you can always boot back to your old Windows, or boot to the new Linux Mint (your choice). Once you have Linux Mint installed, Microsoft can no longer spy on you and your photos and documents, activities, browser logs, etc.

Make the switch. Give Bill Gates the finger. Use Linux instead of Windows.

Here's my podcast explaining this:

DITCH Windows and SHIFT to Linux Mint instead

rumble.com/v715unc-ditch-win…

4zhuu retweeted

$BTC – Cycle Tops

There are many ways to spot a cycle top, technicals, liquidity, or in this case, macro.

One of the cleanest signals is ISM Composite PMI.

Historically, Bitcoin tops align with ISM peaking and rolling into contraction.

Now here’s the twist.

Despite BTC sitting at $107K ATH, the ISM PMI is actually at cycle lows, and looks like it’s about to re-expand.

So ask yourself: Does this look like the end of a cycle or the beginning of something much bigger?

4zhuu retweeted

18-year real estate cycle says 2026=CYCLE PEAK 🚨

200 year old farmer chart says 2026=CYCLE PEAK 🚨

4zhuu retweeted

''I have small depo, so I can’t make money on Polymarket''

→ @25usdc flipped $25 into nearly $60K in under a year

→ @GreekGamblerPM (been tracking him for 3 months) turned $150 into $20K+, all while working full-time in IT

→ @mango_lassi_2 ran $5K into $115K, mostly betting on Trump speeches

→ @holy_moses7 went from $1 to $86K in a year and now on track to hit $1M

Polymarket has the wildest upside for low-depo degens

4zhuu retweeted

I will slowly Copytrade this Trump Insider to Valhalla

They’re currently up $29 Million in 30 days

Gonna to see how much I can run up a $10k account on @GainsNetwork_io trading competition using this strategy lol

4zhuu retweeted

Smartest Brains in Bitcoin. Follow these people:

- @JoshMandell6

- @saylor

- @tadtweets

- @tomyoungjr

- @1basemoney

- @maxkeiser

- @SimonDixonTwitt

- @bensig

- @A5T3R0lD

- @ProofOfMoney

- @TheRealPlanC

- @moneyordebt

- @JoeCarlasare

- @LawrenceLepard

- @Rob79049439

- @btcjvs

- @LukeGromen

- @bigmagicdao

- @IndiaBitcoinMan

- @TheSamsPodcast

- @david_eng_mba

- @xultulpeper

- @LuckyMrRai

- @BitPetro

- @MatthewRyanCase

- @MacroMinutes

- @jvisserlabs

- @Macronaut_

- @alanknit