Senior Investment Advisor and Portfolio Manager at Wellington-Altus. Tweets are not investment advice. DM with your financial planning and investment questions.

Toronto

Joined September 2011

- Tweets 8,841

- Following 71

- Followers 9,649

- Likes 2,008

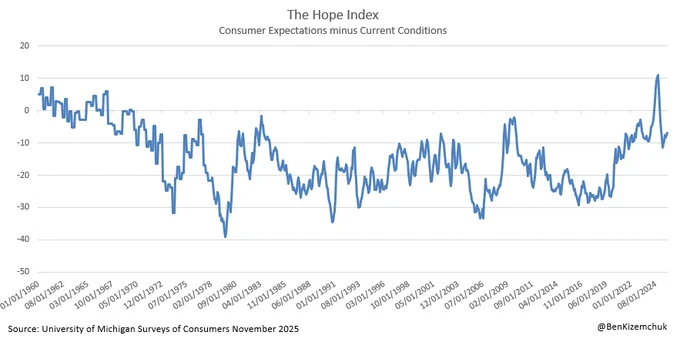

Noticing more likes on this one from last year, so updating to current data Oct 2025.

Mood shift to say the least over the year.

My view is that policy turned a massive tailwind into a generational own-goal.

@profplum99 re your note today, measuring Hope as expectations minus current conditions

Sauna sesh

Brendan Eder Ensemble - Therapy

open.spotify.com/album/1f6VO…

"Its not a donut hole, its a different kind of pastry"

-Quote of the day from SCOTUS oral arguments 🤣

My November 2025 Update, including market commentary and portfolio highlights:

advisor.wellington-altus.ca/…

Fed seeing signs of cyclical weakness in part-time employment

"Together, the developments captured by the transition rates to and from involuntary part-time work signal some weakening in the labor market over the past two years. Increasing numbers of part-time workers are finding themselves stuck in part-time employment. Though current levels of involuntary part-time work are relatively low, these developments are consistent with the rising unemployment rate over the same period, with both suggesting that labor market slack is increasing. "

frbsf.org/wp-content/uploads…

🇺🇸🛍️🚚"Taken altogether it seems likely that inventories are dropping as holiday sales begin, easing the prior tightness in warehousing and leading to a greater utilization of transportation due to the increased movement of goods. Essentially, supply chains have gone from being somewhat static and weighted down by inventory, to moving in a more dynamic, seasonally consistent manner."

October LMI

🇺🇸🛍️Fiserv Small Business Index slowing

Sales y/y +1.5%, foot traffic +1.1% -- a slower pace of growth compared to the September y/y.

Adjusted for inflation, sales -1.4% y/y

In this scenario, SRF can act as a pressure release valve that allows counterparties to borrow cash from the Fed against tbills etc at a fixed rate, which would help cap repo rates and stabilize SOFR.

However, treasuries pledged to SRF are temporarily "locked up" and unavailable for use in derivatives or other repo transactions.

So in the scenario above, SRF does provide liquidity relief, but could possibly also exacerbate collateral shortages for margining and clearing in derivatives transactions. Potentially not great for asset prices that depend on growing amounts of leverage, despite everything you hear about liquidity.

The great irony of too many tbills creating a scarcity of collateral.

Too early to make a call, but something to keep an eye on:

If the Fed begins buying tbills, it injects cash into the system while removing high quality collateral.

This can potentially create a scarcity of tbills in repo markets, where they’re widely used for secured lending.

As a result, the cost of borrowing against remaining collateral rises, which can push up repo rates. Since SOFR generally reflects these rates, it could potentially keep increasing.

So despite the reserve boost, technical pressures from collateral withdrawal can still drive SOFR higher.

Vince touches on a key point here.

Reserves don’t grow the economy, fiscal spending does. Likewise, shrinking reserves don’t contract the economy, because reserves aren’t a source of credit or demand. They’re simply the liquidity that banks use to settle payments within the central bank’s system.

However, reserves are operationally necessary. They anchor the central bank’s ability to maintain its target interest rate. As the economy expands and payment volumes rise, the demand for reserves typically increases.

If reserve balances aren’t in line with that demand, lending rates can rise as banks compete for scarce settlement balances, creating unnecessary upward pressure in funding markets. A version of this has been underway since mid Sept.

Broadly, the solution isn’t to “use reserves to stimulate growth,” but to manage them to stabilize the policy rate as fiscal policy drives real economic expansion.

Explicitly linking reserve supply to nominal GDP growth (as in establishing an explicit GDP-targeting framework) would ensure that monetary operations remain aligned with fiscal capacity.

So, the Fed can create all the reserves it wants, and that can have an affect on asset markets via the channel Vince describes. But if it’s real economic growth that’s desired, you can’t put the cart before the horse.

More “money printing” occurs from QT than QE as rates are usually higher during QT.

Let me try and set up the foundation. There’s the gov (public sector) and then the non gov (private sector). Commercial banks are weird quasi entities that exist inbetween. They act as agents of the government but are also private companies. When the fed (who is another agent of the gov) swaps assets with commercial banks and those assets stay on bank balance sheets nothing happens. Banks cannot lend reserves. So the government loading banks up with reserves doesn’t mean much. It’s a critical error that even highly respected economists make. Short story, Bernanke is on record saying he conducted QE in 2008 to increase bank lending. He was the chairman of the Fed, and didn’t know that banks don’t lend reserves. Back to the point. So, so far we’ve got gov/Fed swapping assets with commercial banks. Now, a commercial bank cant do much with a reserve they can’t lend it they can’t spend it, but they can swap it for a treasury from a qualified entity in the private sector (pension fund). This is why for a short period, QE juices risk assets. When a commercial bank buys a treasury from a pension fund, the only legally allowable thing that pension fund can do with it is use it to buy a risk asset.

Note: all of this was just swapping, no new increase in net financial assets occurred.

Ben Kizemchuk retweeted

LIQUIDATION NATION 10/27/25: "SHOW ME THE... MONEY!!"

*china goldilocks (for now)

**QCOM enters the arena

***systematic scramble all day (wow last 10 min)

****Precious Medals deflate ....blahhhh

- HF INDEX +160bp today (first up day in big index up day this month)

- Bad Balance Sheetz +170bp

- AI vs Software: +170bp (BL & OS the only movers on soft)

- Big Divergence between Mag7 & Small caps today (interesting)

- Retail "flattish" on the day

LIQUIDATION NATION 10/24/25: "don't let yo mouth get your a$$ in trouble"

*VOL RIPPAH on "shutdown" CPI (supercore still > 3.1)

**QUANTS hurling -> see BBG article post close ... "mild" compared to what I am hearing

***China talks this weekend and next week -> anyone care?

*Major update to LIQUIDATION NATION... I think everyone will like what's coming early next week -> stay tuned

- HF Index -135bp today and -12.5% on the month

- Shorted Stocks +210bp today

- Quality -125bp today -> no surprise here

- Tech & Industrials HIGH BETA +325/+330 today (!!)