The US government shutdown is expanding:

Today, the FAA officially began cutting 700 flights PER DAY across 40 airports.

Airports are now facing a shortage of 3,500 air traffic controllers with 4+ MILLION passengers impacted.

What happens next?

Let us explain.

Nov 7, 2025 · 2:58 PM UTC

Today, the US government shutdown officially enters day 38.

This marks the longest shutdown in US history and nearly 5 TIMES the average.

But, today also marks the first day that the shutdown has gone "mainstream."

The FAA has announced flight cancellations beginning today.

Below is a map of the 40 airports impacted.

More than 700 US flights were canceled as of 9 AM ET today.

The FAA announced that 10% of flights may be canceled until the end of the shutdown.

So far, 4 MILLION travelers have been impacted by cancellations and delays.

As the shutdown drags on, the economic impact is compounding.

Moody's estimates that the shutdown is now costing the US $30 billion PER WEEK.

If the shutdown lasts until the end of this month, the total cost could exceed $250 billion.

Never in history has this happened.

On top of this, SNAP benefits are being delayed.

SNAP is the largest federal food assistance program in the US.

Currently, 42 million Americans are still waiting on aid from the federal government.

The average monthly benefit is ~$250 per person for a total of $100B/year.

The question becomes, will the government shutdown last until Thanksgiving?

If so, as many as 30% of the ~5.8 million travelers could be impacted by delays and cancellations.

This could impact up to ~2 million travelers with the total nearing 10 million by December 1st.

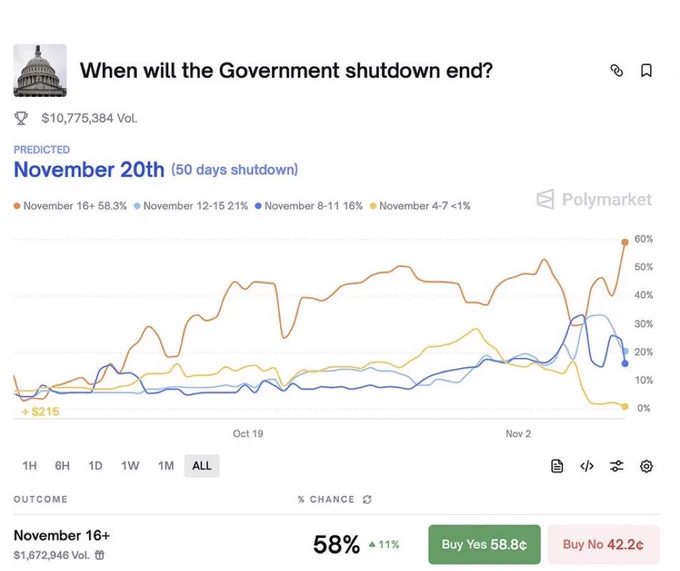

The US government shutdown is now expected to last through November 18th.

This has moved up from the December 1st expectations seen at the beginning of this week.

However, multiple attempts to reopen the government have failed.

We believe November 18th is optimistic.

The stock market is beginning to react.

Currently the S&P 500 is on track to fall -3% this week.

This marks a -$1.7 trillion drawdown in market cap as concerns over the shutdown are growing.

Markets are pricing-in a prolonged disruption of commerce in the US.

Meanwhile, total US debt is rising by an average of +$17 billion PER DAY during the shutdown.

Yesterday ALONE, US debt surged +$45 billion in a single day.

We are officially less than 5% away from hitting a record $40 trillion in US debt.

Deficit spending is out of control.

This week, volatility has returned as uncertainty continues to grow.

The macroeconomy is shifting and stocks, commodities, bonds, and crypto are investable.

Want to receive our premium analysis?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscr…

Multiple large cap technology stocks are now down over 10% on the week.

Nvidia has erased -$550 billion of market cap as trade uncertainty returns.

We must end the shutdown and restore stability.

Follow us @KobeissiLetter for real time analysis as this develops.