Official X account for The Kobeissi Letter, an industry leading commentary on the global capital markets. Email us: support@thekobeissiletter.com

United States

Joined June 2015

- Tweets 27,274

- Following 578

- Followers 1,095,568

- Likes 18,540

Pinned Tweet

ANNOUNCEMENT:

We are excited to present The Kobeissi Letter’s 2024 performance report.

Our setups have returned +371.7% since 2020, significantly outperforming the S&P 500’s +83.0% return over the same period.

Our S&P 500 setups provided a net return of +38.1% in 2024, also outperforming the S&P 500's 2024 return of +23.8%.

The net return on our calls across all sections was +8.1%, building on +15.5% in 2023, +92.8% in 2022, +35.3% in 2021, and +44.8% in 2020.

Since 2020, we have returned +39.3% per year on average, well ahead of the S&P 500’s +14.4% average annual return since 2020.

Read the full annual report here:

thekobeissiletter.com/perfor…

CPI inflation data quality continues to decline:

In September, 40% of CPI items were estimated, up from 36% in August.

When price data is unavailable, the BLS "fills the gaps" with estimated values, which typically account for ~10% of all CPI entries.

The percentage has now QUADRUPLED over the last 7 months.

This all means ~40% of price quotes across 200 product and service categories were calculated using substitute pricing, where data collectors filled in missing figures with values from other categories or regions.

CPI numbers are becoming less accurate and less reflective of real consumer costs every month.

What is happening here?

We now live in a society where more debt is the “solution” to everything:

Can’t afford basic necessities? Take on more debt.

Can’t pay your tuition? Take on more debt.

Can’t afford to buy a home? Take on more debt.

Can’t keep inflation under control? Take on more debt.

Can’t run the government efficiently? Take on more debt.

There’s a reason why consumer sentiment is now below 2008 levels.

Our society is drowning in debt.

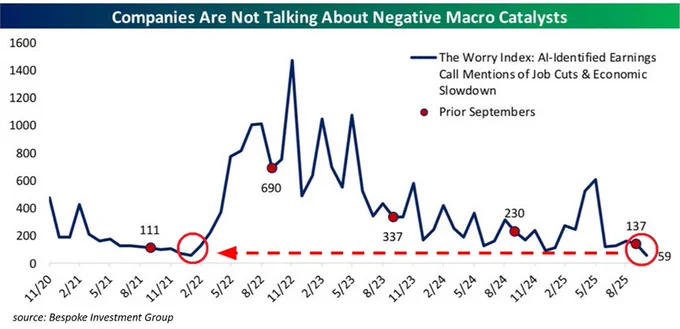

US companies are becoming less concerned about the economy:

The number of mentions of job cuts and economic slowdown during earnings calls fell to 59 in October, the lowest since February 2022.

In September, there were 137 such mentions, the fewest for any September since 2021.

Since April, mentions of negative macroeconomic headwinds have declined -90%.

By comparison, the 2022 peak saw ~1,500 mentions, or 24 times higher than current levels.

This is in sharp contrast to the recent slowdown in job market hiring.

Is the US economy set to pick up?

On a $400K Mortgage at 7% Interest:

1. 30Y Mortgage: $558,000 in lifetime interest

2. 50Y Mortgage: $1,116,000 in lifetime interest

With a 50Y mortgage, you pay DOUBLE the amount of interest compared to a 30Y mortgage.

We are in a crisis.

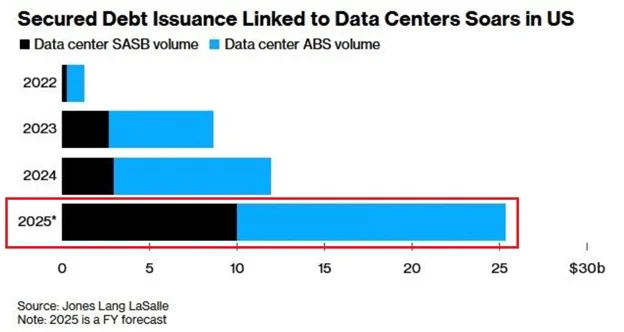

Data center-related debt issuances is exploding:

US secured debt issuance tied to data centers is projected to reach a record $25.4 billion in 2025.

This would represent a +112% jump from the $12.0 billion issued in 2024.

Since 2022, data center debt issuances have skyrocketed +1,854%.

Meanwhile, BofA estimates there is already ~$49 billion in data center Asset-Backed and Commercial Mortgage-Backed Securities (CMBS) outstanding.

The AI investment boom is spurring widespread borrowing.

Institutional investors are increasing their stock exposure:

Funding spreads jumped +8 basis points over the last week, nearing the highest since December 2024.

This metric tracks institutional demand for long stock exposure through futures, options, and swaps.

Rising spreads mean institutional investors are willing to pay higher costs to hold equity positions, signaling stronger risk appetite.

Since May 2025, funding spreads have risen a massive +40 basis points.

This has also helped push the S&P 500 to all-time highs, similar to 2024.

Institutional risk appetite is growing.

BREAKING: Foreign official US Treasuries held in Fed custody fell to $2.78 trillion in October, the lowest since 2012.

These are Treasury securities held by foreign governments, central banks, and other official international institutions through accounts at the Fed.

Foreign official holdings in Fed custody have declined -$166 billion since March.

Since the 2021 peak, securities in custody have dropped -$356 billion.

This signals weakening foreign demand for US debt and growing diversification away from US Dollar assets.

Gold has been one of the main beneficiaries of this trend.

The world is diversifying away from US debt.

BREAKING: The FAA issues a ground stop at New York’s JFK airport and Chicago’s O’Hare airport due to staffing shortages.

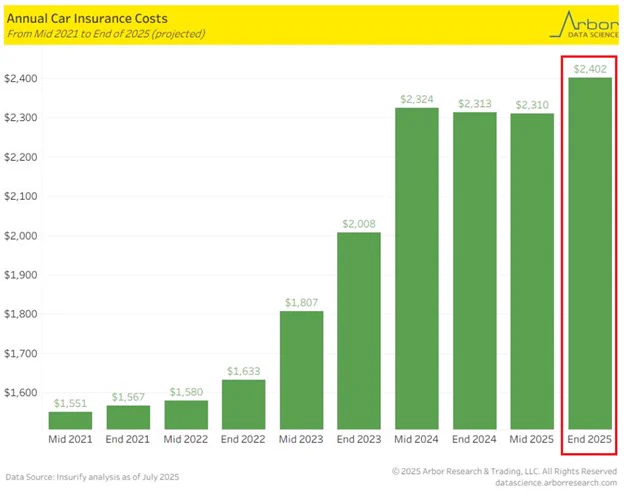

US car insurance costs are set to hit another record:

Average annual premiums are expected to rise +4% by the end of 2025 to a record $2,402.

The national average cost of full-coverage car insurance could climb as much as +7%, to $2,472.

Premiums are projected to surge at least +12% in Rhode Island, Michigan, Maine, Washington, D.C., and Delaware.

Meanwhile, Maryland holds the highest average premium at $4,093, up +20% YoY.

Nationwide, car insurance costs have already risen +$759, or +49%, since 2021.

Car ownership costs have never been higher.

Money supply is way larger than most major world economies:

The global broad money supply-to-GDP ratio hit a record 121% in Q3 2025.

This means there is now $1.21 in money circulating for every $1 of economic output.

The ratio has risen significantly following aggressive central bank and government policies, particularly following 2008 and 2020.

Money supply is out of control.

US consumer sentiment is collapsing:

The University of Michigan's Consumer Sentiment Index fell -3.3 points in November, to 50.3, the 2nd-lowest in history.

This significantly missed expectations of 53.0 points and marks the 4th consecutive monthly decline.

Current conditions dropped -6.3 points, to 52.3, also the lowest in history.

Consumer expectations fell -1.3 points, to 49.0, the 3rd-lowest since July 2022.

Consumer sentiment is now sitting lower than all previous recessions, including 2008.

US consumers feel like we are in a recession.

Investors are still piling into gold funds:

World physical-backed gold ETFs saw +$8.2 billion in net inflows last month, the 5th-largest in at least 2 years.

This follows +$17.3 billion in September and marks the 5th consecutive monthly inflow.

Asian investors led the October move with +$6.1 billion of inflows, the 2nd-strongest month on record.

China alone reflected +$4.5 billion of the total Asian inflows.

Year-to-date, gold ETFs have attracted +$72.3 billion, on track for their strongest year on record.

The gold rush shows no signs of slowing.

Shocking stat of the day:

A record ~14% of student loans transitioned into 90+ days delinquency in Q3 2025, the highest share since data began in 2003.

Delinquencies have spiked since Q4 2024 as the student loan relief period expired and missed payments started appearing on credit reports.

Borrowers aged 50+ saw serious delinquencies surge to ~20%, meaning 1 in 5 of these borrowers is effectively in default.

For borrowers aged 40-49, transitions into serious delinquency hit ~15%, while those aged 30-39 reached ~12%, both the highest on record.

Even younger borrowers aged 18-29 saw delinquencies jump to ~9%, the highest in at least 11 years.

Student loan debt is a major issue.

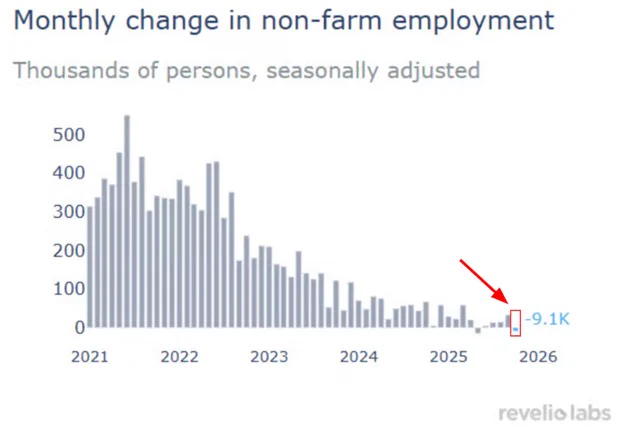

Alternative data confirms growing US job market deterioration:

Revelio estimates US nonfarm employment declined by -9,100 in October, the 2nd-largest drop in at least 5 years.

Revelio aggregates data from company career sites, LinkedIn, Indeed, and staffing firms.

October’s decline was driven by government job losses, which outweighed modest private-sector gains.

Meanwhile, September figures were revised sharply lower by -27,100, to +33,000.

This brings the total downward revisions for June, July, August, and September to -142,500.

The cracks in the labor market are spreading.

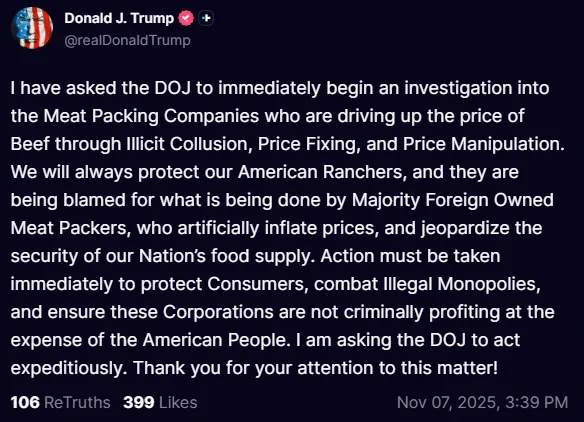

BREAKING: President Trump tells the Department of Justice to "immediately" begin investigating meat packing companies who are "driving up the price of beef."

BREAKING: The Dow turns green amid massive intra-day reversal.

Ignore the noise, we are 3% away from record highs.

Crypto market leverage is through the roof:

Total crypto loans jumped +35% in Q3 2025, to a record $73.6 billion.

This surpasses the previous record of $69.4 billion set in Q4 2021.

Crypto lending has nearly TRIPLED since Q1 2024, when the sector began to recover following the approval of US spot Bitcoin ETFs.

As a result, we are seeing violent downswings across the board in crypto as liquidations accelerate.

Leverage is proliferating volatility.

BREAKING: Global broad money supply surged +6.7% YoY in September, reaching a record $142 trillion.

This measure covers 169 economies, representing 99% of global GDP.

Year-to-date, money supply has jumped +9.1%, driven by China and the US.

Since 2000, global money supply has risen +446%, or $116 trillion, a compounded annual growth rate of +7.0%.

China now makes up the largest proportion, at $47 trillion, or 33% of global liquidity.

The European Union follows at $22.3 trillion, or 16%, and the US at $22.2 trillion, or 16%.

Money supply is through the roof.