XR @mind_port Also Generative AI, Bitcoin & Open Blockchain, Games, Hiking, Cycling, Ultimate Frisbee and Proud Father

Germany

Joined March 2010

- Tweets 913

- Following 291

- Followers 200

- Likes 849

Markus Wellmann retweeted

As a developer, you're not paid to code

You're paid to solve problems

The earlier you get it, the better for you

When you get the problem, try to solve it without coding

If you must code, then do it

It took me many years to learn this

Don't make my mistake

Markus Wellmann retweeted

There’s going to be split between two types of teams or companies for the foreseeable future.

Those that re-engineer their processes to take full advantage of AI agents with their given limitations, and those that wait until they’re good enough to not re-engineer anything.

To take full advantage of AI agents today, your workflows must be designed around the idea that AI agents need a lot context to be effective. By default you have a super-intelligent worker but they have no idea who they work for, what their job is, what the best practices are, what the guidelines are, how to work with the right data, and so on.

Most AI agent failures are just wishing this wasn’t true, and imagining AI will just figure all of these things out on its own. This won’t happen anytime soon for a variety of reasons.

The companies and teams that retool their workflows to get agents the right context will be ones that actually can get the most gains from agents right now.

But this will look very different from how most teams work right now. It will mean having well documented processes, data that is set up to actually get to an agent easily, hyper precise goals and prompts, and ultimately mindset that the new human in the loop element is not being involved in every single step of an agent, but editing and reviewing its final output.

The companies and teams that started thinking this way will be able to take advantage of agents right away, and they’ll blow past the ones that don’t.

Short film that details exactly how Superintelligence, once created, would be likely to destroy humanity and cannot be stoppen. I must say the people who made this did their research very well, and it was very well acted!

piped.video/xfMQ7hzyFW4?si=Hmhr… #AI #ASI

When developing with a Meta Quest headset, you get a black screen and the hourglass loading icon when leaving the play mode?

I had this issue for a while and was searching a lot for a solution. This is how I fixed it for me gist.github.com/mrwellmann/a…

#UnityTips #Unity3D #DevLive

Markus Wellmann retweeted

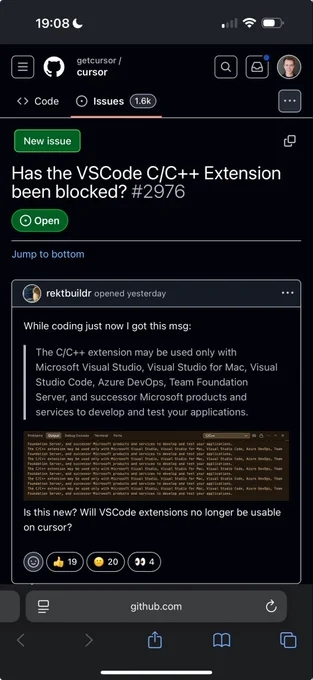

I used to think @GitHub Codespaces would help popularise @Gitpod but now realize it is the other way around. Microsoft can step in at any moment to create legal crises ghuntley.com/fracture/

Markus Wellmann retweeted

Comparing the answers of o1 pro and o3 mini high is interesting.

O3 mini is a talented young dev - get it done and move on type of energy

O1 pro is the methodical and wise older dev, who carefully weighs options and presents a very clean output

Both work - o1 pro code is nicer

Markus Wellmann retweeted

Woow a fully open source reasoning model on par with OpenAI o1 just released

Deepseek R1 even outperforms Claude 3.5 Sonnet and o1-mini in almost all benchmarks.

You can already use it for free (see below)

Markus Wellmann retweeted

Code dropped: github.com/weijielyu/Gaga

Gaga : Group Any Gaussians via 3D-aware Memory Bank

Paper (link): gaga.gallery/static/pdf/Gaga…

Project: gaga.gallery/

Youtube: piped.video/rqs5BuVFOok

Method 1 | 2 ⬇️

Markus Wellmann retweeted

Throughout history, whenever the United States perceived a threat to its dominance in the global economy, gold prices surged, and debates around the gold standard gained traction.

In the late 1990s, Peter Schiff championed gold as the true form of money, much like today’s Bitcoin maximalists advocate for Bitcoin. Dubbed “gold bugs,” these proponents hoped for a return to the gold standard. Yet, despite recurring interest during economic crises, the U.S. consistently avoided such a shift, relying instead on creative solutions to maintain growth. Over the past 50 years, the gold standard has remained a relic of the past. Now, Bitcoin seems to be filling the ideological space once occupied by gold.

I personally support the idea of #Bitcoin Standard. However, I question whether the U.S., while continuing to grow as other economies stagnate, would adopt Bitcoin as a strategic asset. For the debate to gain serious momentum, the U.S. would need to see its global economic dominance genuinely threatened. At present, market sentiment suggests confidence in the U.S.’s continued supremacy.

While it’s conceivable that the U.S. govt could purchase Bitcoin for risk management or economic leverage, its motivations would likely differ greatly from what Bitcoiners imagine. The notion of buying Bitcoin to prepare for a Bitcoin Standard or as a tool to defend the dollar system seems far removed from the current reality. With global capital flowing into the U.S., many still believe the dollar’s dominance is secure.

Even before his inauguration, Trump consistently warned other world leaders of the power gap between the U.S. and other nations. This rhetoric, combined with increased capital inflows to the dollar, could renew confidence in its supremacy. Around me, many Koreans are choosing U.S. dollars as a safe haven over gold or Bitcoin, particularly as the Korean won weakens.

If Trump succeeds in showcasing U.S. economic resilience, reinforcing the dollar’s supremacy, and boosting his approval ratings, it’s unclear if he would maintain the strong pro-Bitcoin stance he demonstrated during his campaign. He could easily step back from his Bitcoin advocacy, citing changing priorities, without alienating his voter base.

Trump is undeniably a skilled politician capable of strengthening America’s position. However, it remains uncertain how much of his campaign rhetoric on Bitcoin he intends to fulfill. At the BTC Conference, was his mention of Bitcoin as a strategic asset a genuine step toward preparing for a Bitcoin Standard, or merely a calculated move to secure votes?

Correct me if I'm wrong.

Markus Wellmann retweeted

Day 25 out of 100 wearing A.I. glasses designed to help you find happiness.

Do the tragedies we go through define us? When can it be turned into something good? And wtf am I doing inside of a prison in Lithuania?

These were the questions running through my head when my A.I. told me to visit Lukiškės Prison - a penitentiary at the center of Lithuania’s capital.

For 100 years, this prison was run by dictatorships - from Germany’s secret police during WW2 all the way to the Soviets during their occupation. For virtually all of its life, this prison has been synonymous with repression.

But now... it's a haven for self-expression.

In 2019 the prison shut down - only to be reopened in 2022 as a center for the arts. Now, interrogation rooms have been converted into art studios. Prison yards, into stages. Cell blocks, into Christmas Markets. Darkness has been replaced by light. Censorship has been replaced by art. Hopelessness has been replaced by dance.

Being here was a wonderful surprise - and what I think is most beautiful about this place is what its transformation represents. All of us will face a lot of tragedy in life - and while we all must grieve, we all get to make a choice about what to do with it afterwards.

Do you become its prisoner, letting yourself be defined by the pain that you've been exposed to?

Or do you become its liberator, letting yourself be defined by the story of how you overcame it - using that pain to grow or to make something beautiful?

The choice is up to you.

Built with @brilliantlabsAR, the awesome open source AR glasses that are making all of this possible, as well as OpenAI + Flutter!

Doing these videos has been the most fun I’ve ever had in my life. Mixing world-class innovation with world-class documentary filmmaking is what I love, and I want to continue doing these pieces not just to show people what’s possible, but to transmit very important wisdom to the youth of today.

But I need your support to make it happen! If you are interested in supporting my work, please comment “I want to support you” below and I’ll reach out via a DM.

Thank you and a happy new year to everyone. And if you are going through a hard time, just remember: all darkness is temporary :)

Markus Wellmann retweeted

The death of Bitcoin gaslighting in the mainstream media

Using litmaps, we can see that the origin of all junk science on Bitcoin's environmental impact was a single commentary (not even a full length paper) by Alex de Vries

The method he used to claim that Bitcoin's environmental damage was a growing concern was his fundamentally flawed "energy use per transactions" method (Bitcoin energy use does not come from its transactions, therefore it can scale transaction volume exponentially without increasing emissions).

de Vries' metric has now been debunked in 4 academic journals

*Masanet et al 2019

researchgate.net/publication…

*Dittmar et al. 2019

nature.com/articles/s41558-0…

*Sedlmeir et al, 2020

link.springer.com/article/10…

*Sai and Vraken 2023

sciencedirect.com/science/ar…

The entirety of de Vries' work was systematically debunked by Sai and Vranken in late 2023

source:sciencedirect.com/science/ar…

That's why 96% of mainstream media outlets (everyone except laggards @Verge and @Wired) are no longer gaslighting Bitcoin's environmental impact. In many cases, they've even started covering Bitcoin's environmental benefits

source for 12 mainstream media outlets:

x.com/DSBatten/status/186702…

source for 7 sustainability periodicals:

x.com/DSBatten/status/186665…

There is much re-education work to do though.

Much of the population was misinformed over many years, and as a result many investment committees, regulators and policymakers still do not know that 13 of the last 15 papers support the environmental benefits of Bitcoin.

source: x.com/DSBatten/status/186394…

Once they do, we will see mainstream adoption of Bitcoin, and mainstream adoption of Bitcoin mining as part of climate action (aka: what the peer reviewed research tells us it is)

source: pubs.acs.org/doi/10.1021/acs…

Social VR ist more and more conquered by kids. If the time is limited by the parents I would encourage it over e.g. Fortnight.

wired.com/story/meta-horizon…

This is awesome!!

Niantic has open-sourced .SPZ – the JPEG equivalent for Gaussian Splats! 👏

#3DGraphics #OpenSource #AR #SpatialComputing #GaussianSplats

This tweet is unavailable

Copilot for Unity 😲

2/ CoPlay - 🥇1st place

Cursor for Blender

AI copilot for designing 3d meshes, entities, and game objects

@JosvdWest