Tech professional in BFSI | Investor & learner | Mutual funds, stocks, global business models | Insights on wealth creation, financial planning and markets |

Pune, India

Joined July 2020

- Tweets 5,677

- Following 852

- Followers 14,384

- Likes 6,310

Thank you so much to @vivbajaj for giving me the opportunity to share my approach and insights on investing in small/micro-cap stocks on the #face2face platform. It was a truly valuable experience conversing with Mr. Vivek Bajaj.

Hope this video helps our fellow investors.

Here is the link to the video:

piped.video/1bqZAzUAsvY?si=X6Y9…

Do people even know that this fund house (Quantum Mutual Fund) exists in India?

Quantum has lost a big opportunity even after being one of the first players in the mutual fund offerings.

No one even mentions the schemes of this fund house these days.

It was interesting to see @LarissaFernand mention this fund house for something.

Which is the best performing emerging market?

Check performance of Taiwan (last 20 years) and that of Korea & South Africa (Last 5 years).

USA S&P 500 returns have been better than that of India.

Courtesy - @WhiteOakCap

A dash of foreign equity in the portfolio is a must.

Google to offer Gemini Pro AI model to Reliance Jio users: How to get Google’s AI Pro plan worth Rs 35,100 for Free

#google

#reliance

#jio

#Gemini

#AI

timesofindia.indiatimes.com/… via @timesofindia

Look at the top holdings of JioBlackrock Felxicap fund. What is different in the top holdings? Nothing beyond Nifty Top 15.

Somehow most of the flexicap schemes are just picking 6-7 stocks from the nifty top15 universe and make them their top holdings.

And that is where Parag Parikh Felxicap and Helios Felxicap differentiate their top holdings and stay away from the commonality.

Motilal Flexicap is a complete exception with all midcaps as its top holdings.

GPT healthcare - Latest Results & Management quality

DISC - No recommendation, only tracking the company as the business model appears promising

#smallcapable

Positives:

1. Operational Resilience: All 4 hospitals scaled efficiently, with ARPOB growth signaling premiumization (e.g., higher realizations in cardiology, ortho). Volume uptick from walk-ins and insurance ties reflects strong regional moat in West Bengal/Tripura.

2. Margin Stability: EBITDA margins held at 19-20%, better than industry avg. (~15-18% for mid-sized chains), thanks to low fixed costs and diversified specialties (no single one >20% revenue).

3. Strategic Moves: Earnings call (Oct 2024) emphasized tech integration (mobile app launch) and dividend claims drive, boosting investor relations. Debt reduction post-IPO supports RoCE (~15-18%, est.).

4. Market Context: Aligns with India's healthcare tailwinds (market to ₹9.2-9.3 Tn by FY28); GPT's mid-sized model avoids overcapacity risks seen in larger peers.

Concerns:

1. Growth Moderation: YoY revenue 12-15% lags Q1 FY26 (18%) and FY25 (~20% CAGR), possibly from monsoon-related elective procedure dips. PAT growth muted due to one-offs (e.g., higher provisions).

2. No Major Expansion: No new beds added in Q2; focus on organic ramp-up limits top-line upside. Competition from Apollo/Fortis in Eastern India could pressure ARPOB if pricing wars intensify.

3. Valuation Check: At current price (~₹151, Nov 2025), trades at ~25-28x FY26 EPS – reasonable vs. peers

Overall View: Nothing wrong in the Results or negatively surprising. Results underscore steady execution in a defensive sector, with healthy cash flows (OPCF ~₹150 Mn est.) funding growth without dilution. Expect FY26 revenue ~₹420-440 Cr (+15% YoY), PAT ~₹50 Cr.

Monitor Q3 for expansion cues.

A small comment on the management quality as inquired by fellow members of the community -

These are strong operational promoters with a proven healthcare build-out in a fragmented Eastern India market. The family's diversified GPT Group backing adds resilience, but adding more independent expertise could elevate governance. No red flags on ethics or value destruction; they've focused on sustainable growth over aggressive expansion.

GPT Healthcare : A nimble hospital company at low valuations (with a reason)

Worth Investing or not?

#smallcapable

Disc: Not a recommendation

Business Overview

GPT runs a compact network of mid-sized multi-specialty hospitals: 3 in Kolkata, 1 each in Agartala and newly launched Raipur (total 561 beds in FY25). FY25 revenue: ₹407 crore; occupancy 53%; ARPOB ₹37,180. Largely cash-driven (private/insurance patients), low debtor days, high cash conversion (~80% of EBITDA).

Why the Valuation Discount?

Smaller scale leads to volatile metrics (occupancy/ARPOB fluctuations during ramp-ups) vs. larger peers like Yatharth (mid-60s occupancy). Market prices in this lumpiness, resulting in lower multiples.

Structural Opportunity

Eastern India underpenetrated by corporate chains; rising incomes/populations in Kolkata/Raipur but limited organized supply. GPT's asset-light, mid-sized model targets Tier-2/3 cities, serving local and referral patients lacking quality care.

Expansion Strategy

Raipur (158 beds) operational; Jamshedpur (150 beds) signed.

Target: 1,000 beds in 2–2.5 years.

Asset-light: Lease buildings + ₹65 crore fit-out (vs. ₹100 crore owned); negligible net debt; fund internally via strong cash flows (equity only for extras).

Key Operational Levers

ARPOB Growth: Up to ₹38,900 in Q1 FY26 via high-value upgrades (robotics, cardiology, neurosurgery, oncology in Agartala).

ALOS Reduction: From 5.6 days (FY21) to 3.5 days (FY25)/3.46 (Q1 FY26) → boosts throughput/revenue efficiency.

Flexible Doctors: All contracted (revenue-share/per-case); higher payouts early (mid-30s%) but normalize with volume; enables quick specialty additions without fixed costs.

Growth Potential & Risks

Conservative: 1,000 beds @ 50% occupancy, ₹36,000 ARPOB → ~₹657 crore revenue by FY27 (mid-teens CAGR from ₹407 crore).

Risks: Raipur/Jamshedpur ramp-up delays, no further sites, consultant churn. Mitigations: Faster oncology/robotics rollout, referral expansion, asset-light replication.

Investment Thesis

At ~25x earnings, priced for a cash-efficient regional operator, not perfection. Breakeven ~35% occupancy; economics improve sharply toward 50–60%. Execution on utilization/case-mix could drive re-rating and market-beating returns. A unglamorous but credible Eastern India play with mid-teens growth if delivered.

Please study the company, not a recommendation for investment.

Superb analysis by @StableInvestor

How 1 year of non performance can impact XIRR?

How a single year of poor/subdued market performance, dramatically reduce your SIP returns?

This table illustrates this: How a single year of poor market performance reduces the overall longer-term SIP returns (XIRR), even when preceded by four years of exceptional gains.

For a monthly SIP of Rs 10,000 in Smallcap funds, the 4-year XIRR from November 2020 to November 2024 (total investment: Rs 4.8 lakh) shows top-3 performers delivering 40.6%, 38.0% and 37.3%.

However, extending the period by just one year to November 2025 (total investment: Rs 6.0 lakh), which captures a subdued (downturn) market, slashes the 5-year XIRR for the same performers to 27.4%, 23.1% and 20.0% respectively. Still great, but not as it was just a year back (and may disappoint new investors who started around 2020).

This erosion occurs because XIRR is highly sensitive to the timing and magnitude of returns in a compounding sequence. So, a recent 12 months of negative or muted performance dilutes the earlier outsized gains disproportionately, as the larger accumulated corpus suffers absolute losses, pulling down the rate proportionally.

Note - Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

Disclaimer - The funds/indices shown above are for illustration only. It is not a recommendation to buy/sell/hold. Please get in touch with your investment advisor for customised investment advice based on your risk profile and unique requirements.

This is must for India's urban development.

Thread 🧵: Why India MUST shift to large integrated townships

1/

Our cities are choking; congestion, pollution, chaos.

One core reason; fragmented real estate development.

Every 2-acre builder wants to build a tower, sell flats, and exit.

People live in one place, work elsewhere, shop elsewhere; more traffic.

Mounjaro is the top selling drug in India now

perplexity.ai/page/eli-lilly…

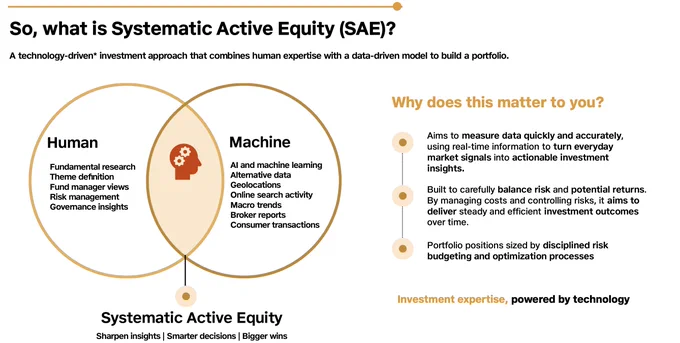

No disrespect to Jio Blackrock but @BaluGorade bhai this appears to be just Marketing gimmick -Old wine in new bottle. Many other existing mutual fund houses are already using analytics and AI for stock selection.

Blackrock was already in India with Dsp earlier and their Aladdin is being used globally at many places but no major outperformance.

Only time will tell, how Jio BR performs here.

Funny

#IPO

Unfortunate event at CSMT

At least 2 killed after being hit by train in Mumbai, agitation by rail staff adds to rush at stations

www-deccanherald-com.cdn.amp…

One smallcap stock that was beaten up unnecessarily post the results today

Even after superb numbers delivered by Shriram Pistons and Rings, the stock was trading lower. It went to 2500 levels today, where it was a nobrainer pick.

Consistent company with consistent results.

Shriram Pistons and Rings

#smallcapable