Joined May 2008

- Tweets 4,287

- Following 1,194

- Followers 383

- Likes 49,553

🔋Nicky🔋 retweeted

Looking at $EOSE you wouldn't even know the market was pulling back...

Relative strength through the roof.

🔋Nicky🔋 retweeted

My initial thoughts on Eos Energy’s Q3 results and earnings call: 🔋🚀 $EOSE

If we follow the breadcrumbs we can see that - EOS IS ALREADY AT ~$400M ANNUAL REVENUE RUN-RATE

My main takeaways are:

- Management: Proven bench—Joe owns product & systems; Nathan, finance & customers; John Mahaz, ops & production.

- Revenue: High confidence in $150M+ FY25 and $90M+ in Q4.

- Utilization/Capacity: Running 75%+ now (vs. <15% in Q3); tracking toward 90%+, ~2 GWh/yr and $500M+revenue run-rate.

- Demand: Pipeline and data-center interest at all-time highs.

- Performance: Product exceeding even the most bullish expectations.

- Expansion: Timeline pulled forward; ~90 days to add additional lines after Line 2.

During the video I’ll cover:

00:00 Introduction

2:02 Product Performance

4:48 Introduction of John Mahaz

6:57 Operations, costs out and production expansion

13:00 My estimate Eos' actual monthly production and expectations going forward.

20:10 Commercial Progress

21:35 Data Center Commercial Activity

27:20 Funding Expansion + Growth Capital

29:26 Conclusions.

Eos is executing toward an unprecedented hyperscaler energy demand: U.S.-made, non-lithium storage, ramping for 24/7 data centers, military bases, supply-chain resilient, and addressing key national energy security issues... I believe significant orders should be coming very soon.

Eos Energy [Full Investment Thesis]: Everything You Need to Know About $EOSE

$EOSE 🔋has been my biggest position since 2023 - studying it has been a part/full-time job in itself.🔋

Here’s my 119-page, ~two-hour presentation on Eos Energy. Many have reached out wanting to learn more about the company reshaping America’s grid. I did this video and tried including everything I know in here, hopefully helping speed up the learning curve for anyone interested.

This isn’t meant to be flawless; it’s meant to be done. I hope it helps you grasp the company’s story, the team driving it and the potential they have (at least how I see it…).

During the video I’ll cover:

00:00 Introduction

3:49 Global Energy Market

8:15 Why Energy Storage is Key

25:21 Choosing the Right Battery Company

27:15 EOS’ Background and Timeline

38:35 The Product

1:01:56 Production at Scale

1:11:56 Unit of Economics and Financials

1:18:26 Team

1:26:59 Risks

1:29:03 What Comes Next - “Best-In-Class” US Battery and It’s Demand

1:45:52 Boots On the Ground

$EOSE is executing toward an unprecedented hyperscaler energy demand:

U.S.-made, non-lithium storage, ramping for 24/7 data centers, military bases, supply-chain resilient, and addressing key national energy security issues... I believe significant orders should be coming very soon.

Please feel free to share your thoughts, feedback, questions, things I left out, etc. 🔋🔋

The reason government programs are so inefficient is that, unlike a commercial company, the feedback loop for improvement is broken, because they have a state-mandated monopoly and can’t go out of business if customers are unhappy.

No matter how bad the service is at your DMV (sorry to pick on DMVs), you still have to use your DMV, because it’s a monopoly.

You are a taker, not a maker. All you’ve done your whole life is take from the makers of the world.

The zero-sum mindset you have is at the root of so much evil. Once you realize that civilization is not zero-sum and that it is about making far more than one consumes, then it becomes obvious that the path to prosperity for all is just let the makers make.

Regarding Tesla, the reality is that I have been given nothing.

However, if I lead Tesla to become the most valuable company in the world by far and it stays that way for 5 years, shareholders voted to award me 12% of what is built. Anyone who wants to come along for the ride can buy Tesla stock.

If Tesla “merely” becomes a $1.999 trillion dollar company, I get nothing. This is a great deal for shareholders, which is why they voted so overwhelmingly to approve this, for which I am immensely grateful.

And they did so by a margin far more than you won your political seat.

🔋Nicky🔋 retweeted

BREAKING: Tesla shareholders have officially approved Elon Musk’s 2025 CEO Performance Award Plan with 75% voting in favor!

Full steam ahead into a future of autonomy, robotaxis, Optimus and sustainable abundance!

🔋Nicky🔋 retweeted

Initial takes from Jefferies, Guggenheim, and Steiffel $EOSE

🔋Nicky🔋 retweeted

Electron has successfully launched its 16th mission of the year to deploy the latest @QPS_Inc satellite to orbit – our sixth mission for its QPS-SAR Earth-imaging constellation. Congratulations and welcome back to space, iQPS!

🔋Nicky🔋 retweeted

This is great for NASA and I would love to see 10 x $100 million missions like this a year...accepting more risk but with the aim of getting to the science faster and at lower cost. Best of luck to the ESCAPADE, Berkley, Rocket Lab and Blue Origin teams.

🔋Nicky🔋 retweeted

100% mission success

🚀 Join us LIVE for Electron’s 74th mission and 6th launch for @QPS_inc, “The Nation God Navigates.” x.com/i/broadcasts/1mnGeNWOY…

🔋Nicky🔋 retweeted

MISSION SUCCESS for our 74th Electron launch, with successful payload deployment confirmed for the QPS-SAR-14/YACHIHOKO-I satellite for @QPS_inc.

🔋Nicky🔋 retweeted

Thank you, Mr. President @POTUS, for this opportunity. It will be an honor to serve my country under your leadership. I am also very grateful to @SecDuffy, who skillfully oversees @NASA alongside his many other responsibilities.

The support from the space-loving community has been overwhelming. I am not sure how I earned the trust of so many, but I will do everything I can to live up to those expectations.

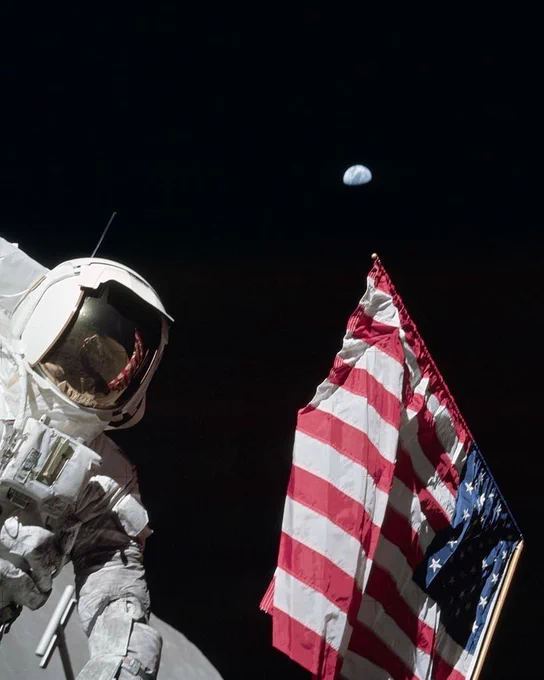

To the innovators building the orbital economy, to the scientists pursuing breakthrough discoveries and to dreamers across the world eager for a return to the Moon and the grand journey beyond--these are the most exciting times since the dawn of the space age-- and I truly believe the future we have all been waiting for will soon become reality.

And to the best and brightest at NASA, and to all the commercial and international partners, we have an extraordinary responsibility--but the clock is running. The journey is never easy, but it is time to inspire the world once again to achieve the near-impossible--to undertake and accomplish big, bold endeavors in space...and when we do, we will make life better here at home and challenge the next generation to go even further.

NASA will never be a caretaker of history--but will forever make history.

Godspeed, President Donald J. Trump, and Godspeed NASA, as America leads the greatest adventure in human history 🇺🇸

🔋Nicky🔋 retweeted

We got Schwab, well done.

The way bigger issue is State Street.

Do TSLA investors also hold big amounts of

- SPY

- SPYM

- SPLG

- SPYG or

- XLY

We only have 24h left, so if you do, tell them NOW that you will sell your ETF if they don't vote with the Board.

@SawyerMerritt @jasondebolt @CuriousPejjy

🔋Nicky🔋 retweeted

NEWS: Schwab has just released a public statement saying it is voting FOR Elon Musk's 2025 CEO Performance Award.

"We appreciate your patience and understanding as we await the conclusion of the voting process for the Tesla shareholder meeting being held later this week. Schwab Asset Management’s approach to voting on proxy matters is thorough and deliberate. We utilize a structured process that focuses on protecting and promoting shareholder value. We apply our own internal guidelines and do not rely solely on recommendations from Glass Lewis or ISS. In accordance with this process, Schwab Asset Management intends to vote in favor of the 2025 CEO performance award proposal. We firmly believe that supporting this proposal aligns both management and shareholder interests, ensuring the best outcome for all parties involved.

Schwab Asset Management uses a structured approach for deciding how to vote that is rooted in a singular goal – promoting shareholder value. Our Proxy Voting Policy focuses on: 1) board composition and quality; 2) actions a board has taken to drive strategy, deliver performance and manage relevant risks; and 3) clarity and accessibility of reporting on key issues. In assessing and making decisions consistent with our Proxy Voting Policy, data and insights are gathered from multiple sources, including through our strategic engagement program, and are all considered when making voting decisions."

Link: aboutschwab.com/schwab-asset…

🔋Nicky🔋 retweeted

Schwab does not typically disclose their proxy vote in advance, but all the noise the @Tesla community made in the past 24 hours changed that.

NEWS: Schwab has just released a public statement saying it is voting FOR Elon Musk's 2025 CEO Performance Award.

"We appreciate your patience and understanding as we await the conclusion of the voting process for the Tesla shareholder meeting being held later this week. Schwab Asset Management’s approach to voting on proxy matters is thorough and deliberate. We utilize a structured process that focuses on protecting and promoting shareholder value. We apply our own internal guidelines and do not rely solely on recommendations from Glass Lewis or ISS. In accordance with this process, Schwab Asset Management intends to vote in favor of the 2025 CEO performance award proposal. We firmly believe that supporting this proposal aligns both management and shareholder interests, ensuring the best outcome for all parties involved.

Schwab Asset Management uses a structured approach for deciding how to vote that is rooted in a singular goal – promoting shareholder value. Our Proxy Voting Policy focuses on: 1) board composition and quality; 2) actions a board has taken to drive strategy, deliver performance and manage relevant risks; and 3) clarity and accessibility of reporting on key issues. In assessing and making decisions consistent with our Proxy Voting Policy, data and insights are gathered from multiple sources, including through our strategic engagement program, and are all considered when making voting decisions."

Link: aboutschwab.com/schwab-asset…

🔋Nicky🔋 retweeted

American University’s Kogod School of Business confirmed with their own study that @Tesla made the #1 most American-Made cars in 2025.

Rankings & percentage of domestic content:

1) Tesla Model 3 LR AWD: 75%

2 (tie) Tesla Model 3 Performance: 70%

2 (tie) Tesla Model Y Long Range AWD: 70%

2 (tie) Tesla Model Y Performance: 70%

3 (tie) Tesla Cybertruck: 65%

3 (tie) Tesla Model S: 65%

6) Tesla Model X: 60%

Tune in to @FoxBusiness at 2:20pm ET today to catch @danroberts0101 discussing $IREN's recent AI Cloud contract with @Microsoft

🔋Nicky🔋 retweeted

$MSFT CEO Satya just made one of the most revealing comments of the entire AI cycle when he said Microsoft has $NVDA GPUs sitting in racks that cannot be turned on because there is not enough energy to feed them. The real constraint is not compute but power & data center space.

This is exactly why access to powered data centers has become the new leverage point.

If compute is easy to buy but power is hard to get, the leverage moves to whoever controls energy & infrastructure. Every new data center that $MSFT, $GOOGL, $AMZN, $META & $ORCL are trying to build needs hundreds of megawatts of steady power. Getting that energy online now takes years which means the players who locked in power early & built vertically across the stack are the ones with real control.

Hyperscaler growth is no longer defined by how many GPUs they can buy but by how quickly they can energize new capacity.

Satya’s other point about not wanting to overbuy one generation of GPUs matters just as much. The refresh cycle is shortening as Nvidia releases faster chips every year which means the useful life of a GPU now depends on how quickly it can be deployed into production. When power & space are delayed then that GPU loses value before it ever produces a dollar of compute revenue.

Satya just validated why my DCA plan remains overweight in the AI Utility theme. The AI economy will scale at the rate power comes online, not at the rate chips improve. The next phase of AI infrastructure growth will belong to whoever can energize capacity faster than demand expands.

Power has become the pricing layer of intelligence: $IREN, $CIFR, $NBIS, $APLD, $WULF, $EOSE, $CRWV

$IREN is pleased to announce the signing of a $9.7bn AI Cloud contract with @Microsoft

Key details of the transaction:

- $9.7bn AI Cloud contract value

- 5-year average term

- 20% prepayment

- 200MW (IT load) data centers

- NVIDIA GB300 GPU deployments

Refer to the press release and accompanying presentation below for further information

Press Release: iren.gcs-web.com/static-file…

Presentation: iren.gcs-web.com/static-file…

🔋Nicky🔋 retweeted

It is often overlooked that there is a 1.4T AI company with positive net income, operating multiple giga 🏭 in 🇺🇸, in-house chip design team, owning one of the largest and densest computing clusters backed by its 🔋, best in class AI team, iterating models faster than most frontier labs that has been deployed on actual 🤖 you could buy today.

Most importantly, it is led by a CEO that is not afraid to answer questions, cares about retail shareholders and deeply love this country and humanity.

Plus, it has the coolest annual shareholder meeting 😎, and you can vote!