investment research & market insights ————— former portfolio manager

Not Financial Advice

Joined January 2025

- Tweets 4,754

- Following 312

- Followers 1,368

- Likes 8,518

Except Shake Shack $SHAK

Noble Investing retweeted

The longer this government shutdown lasts for, the more people will realize A MUCH smaller Federal government is what we need. Ironic.

$BMNR

No quarterly earnings releases.

No replies from Investor Relations.

No disclosure of shares outstanding.

No plan as mNAV premium disappeared.

BREAKING: Tom Lee revises his year-end $ETH target downward by 30-40% during a CNBC Interview this morning.

After initially suggesting $ETH would rise to $10,000 - $12,000 by year-end, this morning he said he thinks it can still rise to $7,000 by 12/31.

$BMNR $SBET $ETHZ

“I think the market has a lot of walls of worry,” says Tom Lee of @fundstrat. “But this is healthy. We do expect the S&P to reach maybe 7,100 in November.”

cnbc.com/video/2025/11/03/th…

$ETH with another casual -5% drop in 4 hours

It’s actually become quite clear what’s going on

🤓🤓🤓

I’ve been using ChatGPT & Claude A TON

My honest opinion in comparing the two…

Claude is a Straight-A student that is always helpful and can be trusted

ChatGPT is a struggling student that needs all of its work thoroughly reviewed

I’d probably short OpenAI the second I could

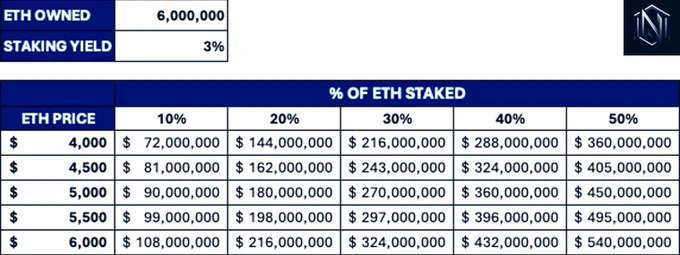

What does staking mean for $BMNR?

My modeling assigns $1.00 of EPS if they were to stake half of their target holdings (6M $ETH) at a 3% yield, assuming a $5,500 price & 500M shares outstanding.

If you assign a 10x P/E multiple to the stock, that’s $10 of share value above the NAV of its $ETH holdings.

Why such a conservative P/E multiple?

Because staking yield is stable and not expected to compound annually at 30-40% like tech earnings do. I see it more as the earnings of a mature value business.

Staking will help with price discovery and all signs point to additional value creation for $BMNR shareholders in my view.

Take a look at how much $BMNR could earn under various staking scenarios 👇

$OPEN

Part II of The Noble Report published last night!

Thank you to all that have subscribed and supported already 🙏

The market punishes you for chasing

Figma, $FIG, IPO’d at $33/share in July.

Stock went parabolic to $140+ week 1.

It’s now -63% from the highs and +40% from the IPO price.

Much better risk/reward here.

“Good morning, sir. I accidentally closed out your $AMZN calls before the earnings release yesterday.”