Defi Pools || Rugs XX || Funds flow || On chain analysis #DEFI

Joined July 2024

- Tweets 2,396

- Following 108

- Followers 72

- Likes 5,068

Metre retweeted

Could we be getting to a new ATH for the token of @TrustWallet?

$TWT has actually been close to a new ATH in the past few weeks

And the fundamentals behind it are something yuki has taken a deep look at ↓

🍓 So many wallets, which one to choose? Yuki HALP!

Obviously, the wallet you're going to use highly depends on what you need to do with it

But in the general good-for-all wallet market, there are very few names that have been as long-standing as Trust Wallet

Rabby's rising and still needs to prove itself, while MetaMask has been on a never-ending decline

What about Trust?

TrustWallet was probably one of the first crypto apps yuki installed in her Web3 journey (maybe the second after Binance?)

UI and UX were miles above the competitor's M*taMask, especially in the mobile space

It has grown so much since then!

It now has:

- More than 100 blockchains supported

- An entire set of features dedicated to privacy

- Both mobile and Desktop

- Trending and Discovery tabs

- FlexGas support to pay gas with stables when you're lacking it (on Arbitrum, Base, and Optimism)

IMO, MC should be above $1B minimum

Metre retweeted

Talus x Sentient is bigger than you might think!

To me, this feels like the moment onchain agent infrastructure meets real mass distribution.

→ @Talus_Labs (Nexus, onchain workflows, AvA logic) is now plugged directly into AgentHub / SentientChat and @SentientAGI's GRID economy.

Nexus turns AI agents into onchain entities that can act → settle → earn.

While Sentient brings them straight to millions of users who can try, remix, and use agents every day.

This move solves Talus’s biggest bottleneck: distribution.

Agents no longer “build and wait”. They’re deployed into live user flows, earning GRID points and real revenue instead of relying on emissions.

Personally, I always pay attention when a pre-TGE project already connects usage rails.

This could easily evolve into an “App Store for AI Agents"...

and both users and builders should probably take advantage of the early edge 💎

Metre retweeted

➥ @thrustdotcom is rebuilding the fan economy on Solana!

Instead of extractive “celeb coins,” these are culture coins where real fans own a stake and grow alongside creators 👇

Launch framework:

– Presale with vesting, no insider allocations, no bonding curves → fair distribution and reduced sell pressure

– Fully on-chain transparency, no snipers or whale handshakes

– Aligned incentives: creators earn from fees as the community grows, not by dumping their own bags

– Fan-first: early access opens to real supporters before trading goes live

$N3ON Early Access just wrapped Phase 1 with $500k+ pledged (thousands of holders), and Phase 2 is live.

Plus, @xeetdotai x Thrust kicked off a tournament with rewards from 1% of the token supply 👀

If you believe culture can be a fair marketplace → create an account, connect your X, and jump into the future of Creator Capital Markets 💎

The first official culture coin.

The new model is here.

Early access for $N3ON starts now.

app.thrust.com

Metre retweeted

Tron & BNB still dominate in active users with 4.7M & 3.3M avg weekly users.

Solana leads L1 growth, Polygon & Base holding steady, while Ethereum continues to lag in daily activity.

The shift to low-fee chains is clear.

But are users actually sticking around?

Metre retweeted

Do you remember my first post on @spectra_finance?

x.com/0xyukiyuki/status/1977…

It was mainly revolving around finding great yields on @base to farm the $BASE token while being +EV during that part

What if we did that...

With $HYPE? 🤯

A grand S3 airdrop from $HYPE is being passed around as a legend on CT

But the chances for it to happen are extremely high:

- 38% of the supply to go to the community in a way or another

- $2M daily buybacks of HYPE

- Team so rich they use banknotes like toilet paper, no need for extra cashouts

And the two biggest ways to be eligible are probably deploying your own perp (HIP-3 galore) or using HyperEVM

🍓 Let's start from the most degen HEVM yield possible

A 200%+ APY on the stablecoin issued by @ParallelMoney

Feeling wary of such a high APY?

It's normal, don't worry, and it's mostly due to the TVL being so low right now (~$17k)

Another big boost here comes from the fact that you're also receiving $SPECTRA token incentives if you LP

That means that you can potentially get three yields in one here 👇

🍓 Possible $HYPE airdrop

🍓 Base APY for the vault

🍓 Extra $SPECTRA rewards

Will have to DYOR more, but yuki thinks it's crazy that the TVL is still below $20K ^^

the play is simpe:

Get the best yield possible on @spectra_finance on the Base side

Get nice farming profits and possibly a gud $BASE airdrop

yuki help me out! I have no idea what a yield is 😭

don't worry fren, I'm here exactly for this reason!

🍓 Let's start by seeing what Spectra is 🍓

Spectra is a permissionless yield protocol

That means that anyone can use their platform to create a pool with different strategies to earn yields from your idle assets

Spectra is live on 9 more chains btw, it's not just base

Some very interesting ones too, like HyperEVM, Katana, Sonic and BSC, in case you're just looking for yield and don't care about BASE airdrop farming

Let's focus on that for this post though 👇

There are many different things you can do here

We want to maximize base activity, get the best yield possible, minimize risk, speedrun richness

The three main products of Spectra are

- LP Pools

- Fixed Rates (like Pendle's PTs)

- Yield Leverage (like Pendle's YTs)

If you want to minimize risks but still get a decent yield, what you should do is go for the PTs

There's one on $USDC from the Arcadia vault giving out around 10% in APY and one for $jEURx by Jarvis network with the same APY in case you want to switch to Europe's side

🍓 The YTs are for those trying to get as much yields AND Poitns from airdrop programs

The LP is usually a balanced version of the two

❗ Remember that this is a permissionless protocol ❗

That means you have to DYOR every vault you intend to use as some different protocol/deployers is operating it

That said, ignoring the amount of good yields you can find here is pure madness

maybe I should make another post with the best yield from other chains???

Metre retweeted

Solana dominates throughput, but Ethereum still earns the rent.

BNB flows deep while zkSync moves fast.

Traction is loud but retention, alignment and developer mindshare are where power compounds.

Which ecosystem is actually converting attention into retained, aligned users?

Metre retweeted

Sei GIGA is the next big thing on @SeiNetwork ⭕️

With a target of 200K TPS, <400ms finality, and 5 gigagas/sec of throughput, this will mark a massive leap in EVM performance.

Let me break it down in simple terms:

Now: Twin-Turbo = a radically optimized version of Tendermint.

– Intelligent Block Propagation: proposers only send transaction hashes (since validators already have ~99.9% of them in mempool) → reconstruct blocks locally → higher throughput

– Optimistic Block Processing: starts executing blocks in parallel with the voting phase → cuts total latency.

→ Result: finality under 400ms, fastest in the industry

Next: Autobahn → the engine powering Sei GIGA (multi-proposer EVM L1).

– Target: <400ms finality, ~5 gigagas/sec throughput, fully decentralized validator set

– New stack: custom EVM execution client, asynchronous execution, and reimagined storage layer

Architectural shift:

– Democratizes data availability, reducing worst-case network bit complexity

– Fully separates dissemination, ordering, and execution, removing bottlenecks

– Non-sequential batching spreads proposer load across validators → stable even under high demand

This is Wall Street-grade speed and safety, brought on-chain.

I can't wait to see it unlock new real-time use cases: trading, enterprise-grade data, and next-gen EVM infra on @SeiNetwork.

Markets move faster on Sei. ($/acc)

Metre retweeted

How to Earn USDT in TON Wallet and Win a Plush Pepe!

@tonwallet_tg just made earning on your USDT easier than ever, with up to 4% APY and a chance to win a legendary Plush Pepe worth $10K.

Here’s how to join the campaign 👇

Metre retweeted

Holding USDT? You’re missing yield and a Pepe 🐸

@tonwallet_tg Earn lets you stake from 4% APY and maybe walk away with a Swiss watch or a Plush Pepe.

This Plush Pepe is worth up to $10K. I’ve tried my luck with a $500+ USDT deposit.

👇👇

🎁 We’re giving away a Plush Pepe and other Telegram gifts!

🎉 To celebrate our recent @AffluentOrg integration, we’re giving away several Telegram gifts — including a legendary Plush Pepe!

💎 To join, deposit at least 100 USDT into the USDT Earn campaign in TON Wallet before November 14, and keep your deposit there until November 25. We’ll randomly select winners from these three groups, depending on your deposit amount 👇

● 4 Swiss Watches — for deposits from 100 to 250 USDT ⌚️

● 2 Artisan Bricks — for deposits from 251 to 500 USDT 🧱

● 1 Plush Pepe — for deposits from 501 USDT and above 🧸

⚙️ We’ll randomly select 7 winners on November 26 and share the draw recording in our Telegram channel.

👉 Details: t.me/tonwallet_news_en/76

Metre retweeted

$STBL posted a sharp +25% intraday

Its spike from $0.061 to $0.08 broke a multi-day compression range on surging volume

MCap still <$40M, but FDV sits at $736M: a clear signs of asymmetric positioning

If this is the accumulation breakout, what’s fueling it under the hood?

The Age of Money as a Service (MaaS) has begun.

STBL is pioneering the infrastructure that lets every ecosystem design, issue, and scale its own programmable, yield-sharing Ecosystem Specific Stablecoins (ESS).

Built on transparency and powered by USST, the universal stablecoin, MaaS grants organizations true monetary sovereignty, yield capture, and full control over how value moves within their economies.

Explore more blog.stbl.com/stbl-money-as-…

Metre retweeted

➥ @SeiNetwork is dominating EVM L1

From Q2-2024 to Q3-2025 = 519 active days

→ Active users exploded from under 5M to 36.9M

→ Total txns crossed 442M

→ Daily tx average above 850K

That’s network effect kicking in

$SEI is quietly turning into a DeFi-native execution layer

Metre retweeted

Everyone stares at TVL.

But TVL alone doesn’t tell you if a protocol survives the next cycle.

3 hidden metrics that decide whether a DeFi protocol survives the next cycle 🧵👇🏻

Metre retweeted

Give it up with all this Doom and Gloom on CT

Want a quick fix on how to face the never-ending red candles (they always end eventually btw)?

Start. Farming.

Use stables if you're afraid of big dump energy

Don't get trapped in the choppy choppy of the market, just farm

You lot would say October ended quietly...maybe a bit too quietly.

There was no blow-off top, no hysteria, no “this is it” moment.

It was just $BTC sitting above $100K because losing that level would throw the markets off.

If $126K was truly the top, then where’s the collapse?

Where’s the 40% drop that ends the cycle? It never came.

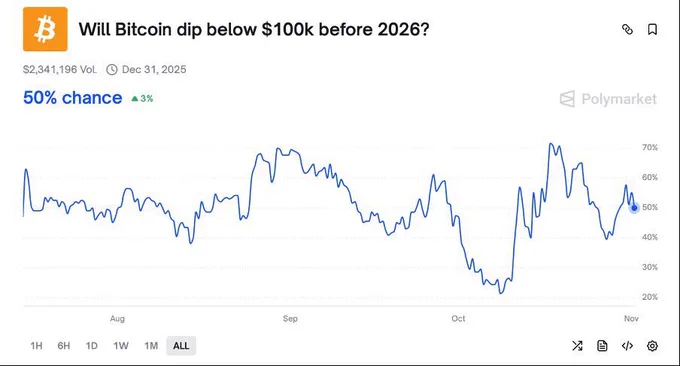

Even Polymarket has it 50/50 that BTC stays above $100K this year.

That’s how confused the entire market is and that’s exactly how $BTC likes it.

Some could say $ETH was very disappointing last month because it actually was.

ALTs didn't do good because just like the previous cycles, money was supposed to rotate from ETH to ALTs.

But the money stayed with the boring guys, the ones who bought and held just $BTC.

Think about that...only 29% of the top 50 alts outperformed BTC this year.

Not even 40% for half a year straight.

If we put previous cycles into context, $BTC always moves at this specific time.

Alts are more like a sniper market. You aim, fire and get out.

For this month, the story could be either of the two...

+ a catalyst for the next bull run

+ a graveyard for the complacent

There is no neutral position here. You either hedge or you double down.

It's not written yet but the next few weeks will decide what goes down in the history books.

Metre retweeted

DeFi looks like AMMs everywhere right??

But under the surface is a hidden network of “shadow order books”.

Liquidity that moves size off-chart, invisible to most traders until the effects spill into public pools.

Let’s pull the curtain back 🧵👇🏻

Metre retweeted

November is $BTC's strongest month...sounds very bullish until you look at the data.

Yes, the average November return since 2013 is ~42%.

But that number is heavily skewed at 2013, when BTC went up +449% in a single month.

The median November return is actually closer to 8.8%.

So “Moonvember” is more of history, not a forecast.

Smart traders now are looking for confirmation at:

+ key resistance breaks

+ stronger volume

+ broader market strength

If the tape doesn’t confirm, the calendar shouldn’t drive the trade.

Metre retweeted

GMonday! Markets might dip sometimes, but TGEs and reward campaigns are still cooking.

I'm sharing some quick alpha for this week:

– Month 2 of @arbitrum szn 2 just kicked off

– @SeiNetwork keeps building RWA momentum

– MMT Token Airdrop Wave 1 subscriptions are now live

– USDT Smart Vault Phase 2 is live on @RiverdotInc, offering 42% APR

– @billions_ntwk Rewards just dropped, early access to the next Billions phase released

– Keep farming Flare points on @solsticefi and make sure you have >100 @Theo_Network pts

– Grind for roles on @SentientAGI Discord

Can’t cover the whole market... so drop your own alpha below and let’s discuss 👇

That valuation difference between OpenAI and $TAO really puts its massive growth potential into perspective.

Over 4x for all $AVICI believers!

@AviciMoney has proven to be the most complete and only actual Neobank.

Currently at a nice dip for sideliners to take advantage of.

We going higher ✨

Loading up on all $AVICI dips moving forward❕

▪️ Non-custodial neobank on Solana with a Visa card for spending crypto as fiat.

▪️ Private keys can be exported to personal wallets.

▪️ App live on iOS and Android with thousands of beta users.

▪️ On-chain credit scoring, DAO governance for treasury and upcoming business accounts, SEPA transfers, GBP support, and mortgages.

▪️ 8.5M Mcap