veteran, dad, husband, cybertruck owner and long term TSLA shareholder (2019). In Musk we Trust!

Pensacola, FL

Joined December 2017

- Tweets 11,598

- Following 187

- Followers 778

- Likes 86,759

Pinned Tweet

If loving @elonmusk is wrong, I don’t want to be right.

How are there adults living lives and also incapable of cause and effect thinking? How do you think and rationalize decisions? Is it solely from the heart and gut?

You are a taker, not a maker. All you’ve done your whole life is take from the makers of the world.

The zero-sum mindset you have is at the root of so much evil. Once you realize that civilization is not zero-sum and that it is about making far more than one consumes, then it becomes obvious that the path to prosperity for all is just let the makers make.

Regarding Tesla, the reality is that I have been given nothing.

However, if I lead Tesla to become the most valuable company in the world by far and it stays that way for 5 years, shareholders voted to award me 12% of what is built. Anyone who wants to come along for the ride can buy Tesla stock.

If Tesla “merely” becomes a $1.999 trillion dollar company, I get nothing. This is a great deal for shareholders, which is why they voted so overwhelmingly to approve this, for which I am immensely grateful.

And they did so by a margin far more than you won your political seat.

$TSLA Tom, MBA retweeted

Elon musk has now 1 trillion dollars in his bank account

That’s a thousand times $1 billion dollars!

He could give every single human on earth $1B and still be left with $992B!

Let that sink in

$TSLA Tom, MBA retweeted

My roadtrip down to Austin, TX on FSD 14 is officially complete!

1,665 miles driven on FSD V14 without a single intervention. My car drove me across the across the country all by itself.

Tesla AI is absolutely insane. 🔥

$TSLA Tom, MBA retweeted

Poll results are in. We’re giving an uncapped 2% bonus on taxable and retirement transfers for portfolios with at least 1 $TSLA whole share.

Offer ends 11/19. Terms and limitations apply.

$TSLA Tom, MBA retweeted

I’ve just arrived in Austin, Texas.

And my Tesla brought me here from Los Angeles without any human ever touching the steering wheel. @Tesla_AI team is absolutely cooking.

That’s 1,420 miles driven entirely by the car’s AI. The future is here.

$TSLA Tom, MBA retweeted

Everyone is missing the real story here.

Burry made one legendary trade in 2008 and has been catastrophically wrong about literally everything since. He's called 15 of the last 2 crashes. This is the guy who has been screaming about imminent collapse for 17 years straight while the S&P tripled.

$1.1B in puts sounds scary until you realize he's had massive short positions on basically everything for the past decade. He shorted Tesla at $180. It went to $1,200. He shorted the market in 2010, 2013, 2017, 2019, 2021. Wrong every single time. His fund has underperformed SPY by 40% since 2015.

The Big Short made him immortal but it also broke his brain. He found God once and has been searching for the Second Coming ever since. When your entire identity is built on one apocalypse trade, you see apocalypse everywhere. Confirmation bias doesn't just set in, it becomes your entire investment philosophy.

Here's the thing about Burry: he's not early, he's perpetually wrong. Being early and being wrong are only separated by time if you're eventually right. But when you've been calling for collapse every single quarter for 15 years, you're not early. You're a broken clock that thinks being right twice a day proves something.

Nvidia at 54x? Amazon traded at 100x for years and 10x'd from there. High multiples aren't crashes waiting to happen, they're the market pricing in asymmetric outcomes. Palantir at 449x is insane until you realize the entire defense and intelligence apparatus is getting rebuilt on their stack.

The energy math everyone's freaking out about? Data centers consuming 1% of global electricity? The internet consumed 10% at peak buildout. We built more power. We always build more power. Energy constraints are just infrastructure problems with a timeline.

His 2008 trade worked because he identified systematic fraud in loan underwriting. There's no fraud here. There's just expensive infrastructure for something that might actually work. Those are not the same trade.

The market dropped 2% when his position leaked then recovered by close. That's not validation. That's algos reacting to headlines before realizing Burry's been wrong about everything for 15 years.

He might be right this time. Broken clocks and all that.

But his track record says the real trade is fading the guy who's been wrong for a decade straight.

THE RECKONING

Michael Burry just bet $1.1 billion that the AI revolution is a lie.

Not the technology. The valuation.

Eighty percent of his entire portfolio now sits in put options against Nvidia and Palantir … the twin gods of the machine age. This is not hedging. This is conviction. The same conviction that made him $700 million when he shorted the housing bubble while the world called him insane.

Burry sees it again. The same fever. The same math that doesn’t work.

Nvidia trades at 54 times earnings. Historical baseline: 20. Palantir at 449 times. These are numbers that require perfection forever. Numbers that have never survived reality.

In 1999, tech stocks drove 80% of market gains before surrendering 78% in the crash. Today, AI commands 75% of S&P 500 returns. The script hasn’t changed. Only the costume.

Global AI spending has exploded to $200 billion annually … up 120% … yet productivity gains crawl below 20%. We are building cathedrals before we’ve proven the god exists. Fifty-four percent of fund managers now call this a bubble. Not pessimists. The people managing the money.

The energy math alone is apocalyptic. AI will consume 1% of global electricity by 2027. That’s $100 billion in costs against $200 billion in spending … before a single dollar of proven return.

Michael Burry isn’t betting against artificial intelligence. He’s betting against human nature … our willingness to mistake momentum for permanence, narrative for numbers, revolution for immunity from gravity.

Every transformative technology reaches this moment: where promise becomes price, where believers stop calculating and start crusading. Electricity was real. The market crash of 1929 was real. Both were true.

Palantir’s CEO calls Burry’s position “batshit crazy.” Of course he does. When you’re the priest, the skeptic is always the heretic. But Burry has already been the heretic once. He bought credit default swaps when Wall Street laughed. He walked out with generational wealth when Wall Street walked out with nothing.

This is $5 trillion in AI market value balanced on one assumption: that exponential curves never flatten, that competition never arrives, that margins never compress, that reversion to the mean died with the old economy.

It didn’t.

If Q4 earnings crack, if Nvidia’s 75% margins slip, if adoption stalls or chips supplies fracture … the unwind will reshape markets for a generation. Not because AI fails. Because math finally matters again.

Burry may be early. He usually is. But early and wrong are separated only by time.

And time has never lost.

The machine gods will endure. The question is whether their disciples will survive the fall.

Watch the margins. Watch the energy. Watch what happens when faith collides with physics.

History doesn’t repeat. But it rhymes.

And this verse sounds disturbingly familiar.

$TSLA Tom, MBA retweeted

When the extraction camper gets a taste of instant karma

#ArcRaiders

🎥u/getaloaf

$TSLA Tom, MBA retweeted

Just completed my longest single drive ever on Tesla FSD.

3 hours, and 171 miles from the Dallas, TX area to Austin with zero interventions. Absolutely incredible— video is coming.

Tesla has solved autonomy.

$TSLA Tom, MBA retweeted

Tesla Self-Driving 14.1.4 drives from Los Angeles, California to Scottsdale, Arizona with zero human intervention.

From California to Arizona, I didn't touch the steering wheel once. My car did everything for me.

$TSLA Tom, MBA retweeted

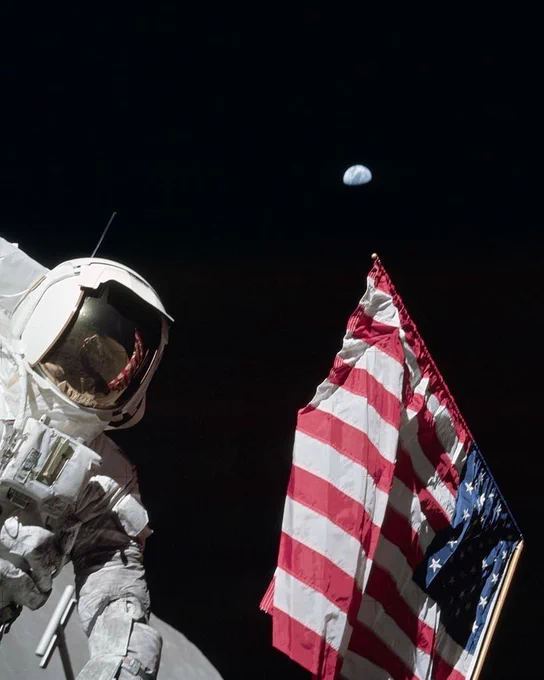

Thank you, Mr. President @POTUS, for this opportunity. It will be an honor to serve my country under your leadership. I am also very grateful to @SecDuffy, who skillfully oversees @NASA alongside his many other responsibilities.

The support from the space-loving community has been overwhelming. I am not sure how I earned the trust of so many, but I will do everything I can to live up to those expectations.

To the innovators building the orbital economy, to the scientists pursuing breakthrough discoveries and to dreamers across the world eager for a return to the Moon and the grand journey beyond--these are the most exciting times since the dawn of the space age-- and I truly believe the future we have all been waiting for will soon become reality.

And to the best and brightest at NASA, and to all the commercial and international partners, we have an extraordinary responsibility--but the clock is running. The journey is never easy, but it is time to inspire the world once again to achieve the near-impossible--to undertake and accomplish big, bold endeavors in space...and when we do, we will make life better here at home and challenge the next generation to go even further.

NASA will never be a caretaker of history--but will forever make history.

Godspeed, President Donald J. Trump, and Godspeed NASA, as America leads the greatest adventure in human history 🇺🇸

$TSLA Tom, MBA retweeted

NEWS: Trump has just officially announced that he has again selected Jared Isaacman as the next NASA Administrator.

Congrats @rookisaacman!

$TSLA Tom, MBA retweeted

Tesla Self Driving deftly maneuvers around a box-truck that cuts in front of me while I’m at 45mph. Most humans would have slammed the brakes because they can’t check the blind spot fast enough, potentially causing a rear-end crash. Not this car. It’s always alert and watching.

$TSLA Tom, MBA retweeted

What kind of joke is THIS?!?

Tesla has it all. Huge datacenters, world class coders, paying customers, and more.

What's more? What's missing from this list?

It's factories. Tesla has factories.

$TSLA Tom, MBA retweeted

Let’s be real… we were all waiting to see how Tesla FSD 14.1.2 would handle NYC (Manhattan).

@01Ananto and I went on a 2-hour drive in his 2026 HW4 Model Y and wow did it not disappoint.

There are some insane moments in this 46-minute condensed video that blew both of our minds.

Honestly shocking that Tesla is waiting for 14.2 to push wide, because this drive on Mad Max already felt incredible.

Huge thanks to Ananto for making this video with me. Please check out the extended cut with extra Insta360 angles which he posted. He absolutely deserves a follow as well!

$TSLA Tom, MBA retweeted

1,000 miles in a SINGLE DAY on FSD V14!

My Tesla Model 3 drove me for 18 hours straight today without requiring me to ever touch the steering wheel.

Never in a million years could I drive 18 hours straight in a day without FSD. This technology is literally a cheat code.

Giga Texas-bound — another 11 hours straight tomorrow!