Crypto Investor | Learning | The moon you all been waiting for will come

Joined May 2024

- Tweets 946

- Following 249

- Followers 223

- Likes 53

Pinned Tweet

With @solsticefi reaching the 250mil USD milestone, the team increase the allocation from 7.5% to 8% of total supply

With My current flares at 385,358.97 Flares, I am expected to gain $5,582.86

Based on my calc, My airdrop if FDV at TGE is:

1 Times TVL = $1,240.63

2 Times TVL = $2,481.27

3 Times TVL = $3,721.9

4 Times TVL = $4,962.54

4.5 Times TVL (Like Ethena) = $5,582.86

At the current pace of the TVL growth, the amount of Airdrops expected will be greater

Make sure to use my referal Code to get as many flares as possible

U3goqh42rb

I Think this is happening because AI and Tariffs which causes companies to think of streamlining their workforce.

With many people getting laid off, inflation probably will slow. I am really expecting the Fed, looking at these data, will have choose to lower rates by 25.

With this, Powell still have slow descent and add the fact QT is ending, the liquidity in the market might rise up rapidly.

As long as we keep unemployment low (Those laid off will find another job), the markets will boom. If those laid off can't find new jobs because the fed doesn't cut rates fast enough, we might see a recession I wouldn't want to be in Powell's seat atm.

🚨US job cuts are SKYROCKETING:

US firms announced 154,600 job cuts, according to @MacroEdgeRes tracker, the highest monthly count in at least 2 YEARS.

This marks a WHOPPING +84% jump from the 84,000 recorded in September.

The US labor market is deteriorating FAST.

Gonna keep climbing through those rankings. Honestly, YT-eUSX is just the way to go. Due to the flare inflation, unless you have a huge amount of capital, it is a no brainer

DYOR though. I accepted the risk.

@solsticefi

Nic take is quite interesting and I think it make sense if you think about it.

Hedge funds and arbitrage traders often do delta neutral spot buys and future shorts, capturing the funding fee as profit.

The de-leveraging at October causes their short position to be liquidated, losing some money in the process (liquidation has a penalty).

This meant they are underwater and needing to recover their funds by selling their spots to repay creditors.

The problem is, due to many people experiencing the same, many people starts selling their spot longs to cover their ass. This makes the market tanks, causing long liquidation which crash the market hard.

Now the funds need to sell more of their spots position, tanking the price even more.

Judging from the price movements, it seems to be stabilizing, meaning the funds might stop selling their spots. Problem is, one single bad news from trump, could cause a massive issue for the market

I think $BTC is the best hold for now. If there is another pump in Nov or Dec, BTC will pump first

The ongoing alt capitulation you are seeing could still be as a result of the 10/10 liquidation event.

Traders & funds that weren't smoked on the day may have been slowly exiting positions since.

This is especially true of those that were running delta-neutral strategies with long spot & opposing long perps.

Given that the ADL systems closed out their perp shorts, they took big losses on their spots.

The poor price action since then could have been selling their spot positions.

We will reach seller exhaustion, but then we are going to need new buyers to step in to bid.

Will they come?

The $DXY is now back at 100 showing signs of strength. It is in the resistance zone that makes or breaks the current crypto slump. This meant the Dollar is strengthening.

This is probably in light with Jerome Powell's bearish outlook for the December rate cut making investors prices in the chance of a rate cut drastically.

Judging from the chart we can conclude 2 things:

- $DXY might climb higher into the resistance zone near the 101 level before in my opinion, plumeting down again.

- Crypto might experience more pain as Dollars strengthens

What do I think personally?

- The US government will need to issue more debt

- US debt becomes more risky for players to engage with causing a lower in demand

- The fed will buy the bonds

- Money Printing in the form of lending government money

- $BTC is well positioned in the next $DXY downtrend

Target for top for $BTC (My opinion and I could change it anytime): 160.000 USD in Q1 2026)

The Tria Cards now support other Stables as Deposits making people able to transact and deposit in their local currency which is huge

It helps:

- Users less friction when doing payments

- Intuitively know how much they are paying

Many in the US probably didn't know but for other people, pricing in USD can sometimes disillusioned the user into thinking it is cheaper than it actually is.

gTria #Tria

app.tria.so?accessCode=U545I…

The @useTria is a Neobank making it possible to off-ramp your crypto with the Tria Card. The card is accepted in millions of merchants all over the world, and you get cashbacks up to 6% using it.

The best bang for the buck using my calculation is to get the signiture card. Their cashback at 4.5% at only 90 USD is good

Join with my referral

app.tria.so?accessCode=U545I…

With the new algorithm from cookie dao, the chance for a small account winning is increased. Make sure you go and sign up to cookie dao for snaps in @useTria

Cookie dao referral: cookie.fun/6r7KQyo5

You asked for more. We went all in.

We’re presenting [drums] an entirely new Cookie Snaps & our future roadmap.

This is a full system reset - smarter & fairer algo, better UX, and bigger than ever rewards.

Here’s what’s happening:

→ SNAPS become mindshare

→ cSNAPS become capital mindshare

→ Algo just got smarter & stricter, slashing kicked in

→ New UX & cleaner profile page

→ New rewards claiming portal in partnership with Sign

→ Bigger, better rewards for top snappers as seen in Recall & LAB

→ Cookie Alpha, Token Station, Cookie Launchpad, and Global SNAPS on the new Q4 roadmap

Q4 is the biggest quarter yet. Everybody says so.

Need more info? We broke it all down for you in threads 👇

And the cost isn't taking into account YT yield which will help offset some of the cost, although most will be like -70%. 30% cut to your cost is still massive

The De-basement trade is here

- The Fed is cutting rates while ending QT soon

- The Fed will buy more US treasury bills essentially lending money to the government, but the government didn't need to repay it, the Fed just need to write off the debt and voila, money printing

- Trumps target of making the Dollars cheap so that US exports will be price competitive against others

- Low-ish inflation making the Fed more dovish

In conclusion, Asset prices will rise, because people know USD is being devalued and run towords asset. Expect Real Estate, Precious Metal, Stocks, and Crypto to rise hard.

I feel we really will have a slightly extended cycle, perhaps until Q1 or Q2 2026. I don't see us in 2027 still in the bull run

BREAKING: Global stock markets reached a record $148 TRILLION in market cap in October.

This marks a +19.3% YoY increase, well above the historical average.

Since the 2020 low, world stock markets have added +$75 trillion in market cap, or +97%.

Over the last 20 years, global market cap has grown at a +7.3% compound annual growth rate, more than QUADRUPLING from ~$35 trillion in 2005.

The recent tech boom has driven the steepest acceleration, with markets adding +$40 trillion in value over the last 2 years.

We are witnessing one of the greatest global rallies in history.

Make sure if you have a Sui wallet, connect your wallet and X account to be elligible for the wave 1 of the Momentum Airdrop.

airdrop.mmt.finance/

I am super bullish on the markets right now, planning to deploy more capital into the market. The reason is

- My local currency will get debased as hell

- $BTC at a fair proce IMO

- Lending and borrowing on Morpho is still cheap for $CBBTC and $EURC pair.

- Fed will rate cut in december if inflation is under control.

- Many players have been washed and liquidated on the crypto space making sellers exhausted, it might not be peak exhaustion but it is close.

I am going to eat less to save as much money to put into market

I have been seeing a lot of post about the current market. 80% is bearish. I am like bro there is so many bullish catalyst that makes me feel these people are not real.

- the fed is pivoting

- ECB needs to cut rate as well

- China and US de-escalation

- Dollar debasement

- Tech sector is growing, some will trickle to ETFs

- Many altcoin ETF will be listed after the government decides to go back to work

- good inflation data with labour market still growing

- German Government and others who faded crypto before is beginning making laws to accumulate BTC

- Hongkong opening trading for crypto making it possible for Chinese to transact more easily

- No major player in the crypto space went bankrupt

- Pro Crypto SEC

I think this red candle period is what happens when an immature market is given no parents oversight or oppression (SEC) because things like Memes, Massive people taking on massive amounts of debt through perps trading, people ape-ing into prediction markets without real plan. This is not investing, it is GAMBLING with fancy charts.

I think leverage is a good thing, it brings liquidity to the market. But people need to learn what the f*ck they are doing, at least put stop loss bro, and risk only 1-3% of portofolio every trade.

Remember, constant gains is better than instant 100x. Why?, constant gains are predictable, easily replicable, and sustainable making you to not play chase the chicken with the next meta of the crypto space.

Honestly, I thought that with institutional entry to the market, we won’t have these massive swings in proce but it turns out, some people in crypto doesn’t understand risk management.

Come on, people say that crypto investors take drops like a normal day, where is the energy now? Man up and re-learn and re-plan your strategy, what doesn’t kill you make you stronger

Hman Mk. II retweeted

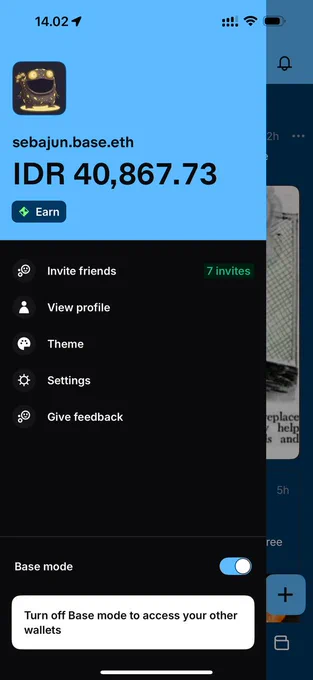

Looks like my timeline is flooded with Base App lately.

Big thanks to @greenshit333 from Bael Calls for sharing the codes with us.

Giving away 3 @baseapp invite codes to 3 based mfers.

Rules:

👣 Follow me and @greenshit333

❤️ Like and coment

🔁 Retweet

Winners announced in 24 hours ⏳

Got my first cashback from Tria. Sure it is tiny, but I only spend a little.

If you want bigger cashbacks, makesure to check out the premium cards which offers a 6% cashback for your purchase with no fees

To join click on this link

app.tria.so/?accessCode=U545…

I think this is insane. Based on Paul, we can expect a bubble forming in the future due to the current market is similar to the 1999-2000 era but the current time has rate cuts instead of rate hikes

This meant that potentially, the bubble is still growing and if we want to profit from it, we need to look at the fast horses, Nasdaq gold and $BTC. But prepare for a massive correction when it bursts

The day has ended and as a Human we need to sleep. But before I go I just want to say

gTria

gSolstice

Let they be my Christmas gift

Gn

@KaitoAI @useTria @solsticefi

You want to flex your wealth? Flex your portfolio? now you can flex easily with @useTria Premium tier Card with it's 6% cashback and metal body.

Show your friends how peasant they look when you tap your metal card on the merchant's EDC machine.

Join the beta now

app.tria.so?accessCode=U545I…

Posted My First Video on YT, please come and check it out... Thanks in Advance

piped.video/1Ws7pmIp36c

I look at the MEXC saga in 2 ways. The great thing is that they immediately admitted their mistake and credited TWW with the money. The bad thing is, it is due to community pressure meaning if TWW is not as influential as he is, probably he wouldn’t be able to withdraw it. Maybe somebody out there is still stuck.

Honestly, I prefer to be on the safe side and withdraw. I have withdrawn all my assets from the exchange, not risking a 0.1% chance they are insolvent. But then again, if they are try backed 1:1 customers deposit, it shouldn’t be a problem even if everybody withdraws. But due to the FUD, an increase in withdrawal volume, MEXC might freeze withdrawals by saying their servers crash or something and we would just have to believe their word

I have been caught with my pants down in celsius before. I still believe the founders when the FUDs coming. But remember, in crypto, lower your risk as much as possible for the reward. It is just ain’t worth it to keep your funds there. Wait until things settle down and plan from there.

Let’s hope MEXC won’t go under, we ill afford another bad news for moonvember

Here's what happened with @MEXC_Official

So the guy named The White Whale made a tweet saying smth like:

"My account was suspended for trading with my hands, no bots, no api, nothing. I had $3M (or $5M) there which I can't withdraw and support doesn't help.

Cecilia (new MEXC CSO) tried to help, we had a dialog, I was offered to admit that I broke the rules and then my funds will be released, but I didn't brake any rules so I am not going to tell that.

Then she said wait, we will take a look and answer you and there was no answer for week or 2"

Cecilia answered smth like:

"This conversation should have stayed private, you are mixing the facts, etc."

Mexc also added, from their official page, that they will take legal actions against TWW for misinformation.

Then the whole CT + ZachXBT started supporting The White Whale, since many had simillar problems with MEXC,

some lil guy tweeted to withdraw your funds from MEXC immediately, because they are planning to freeze withdrawals and the flywheel started spinning even faster

Today, Cecilia apologized, released the withdrawal for TWW and MEXC reposted this apology.

People are still FUDing mexc and withdrawing funds, because many had problems with RK and withdrawing is never the worst option (Hi, FTX!)

So imo MEXC really has problems to fix, because blocking winning accs that overplay your market maker is the last thing to do. It's your problem, not the user problem. Everyone here is to make money and if your cex has inefficiencies that let other people make money, while you lose money, fix them instead of blocking accounts

Taking about Cecilia, I wouldn't FUD her tbh, she joined as CSO 2 months ago, and is trying to fix many things which are super hard to fix when we talk about huge complex structure as CEX (at least she tells she is trying to fix it)

So imo, withdraw your funds anyway, because if everything is good, then it will have no impact on Mexc (user total balance should be < total platform balance), and if all is good, you can deposit there again

Mexc is a kind of CEX that have to exist, so I hope they won't go bankrupt and will fix all the shit they had been doing

If you liked this post - send it to ur friend and follow me