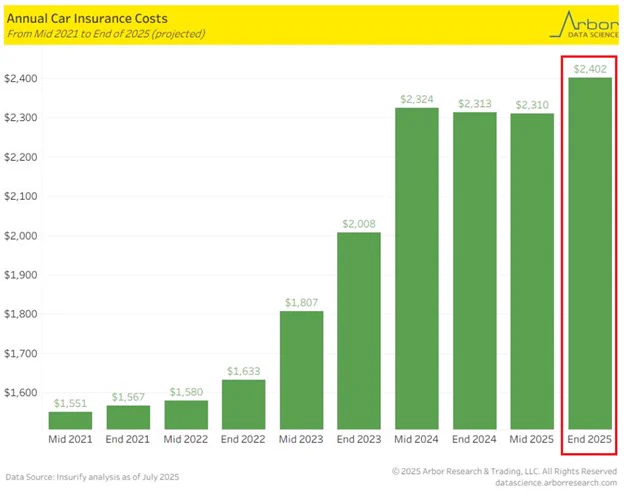

US car insurance costs are set to hit another record:

Average annual premiums are expected to rise +4% by the end of 2025 to a record $2,402.

The national average cost of full-coverage car insurance could climb as much as +7%, to $2,472.

Premiums are projected to surge at least +12% in Rhode Island, Michigan, Maine, Washington, D.C., and Delaware.

Meanwhile, Maryland holds the highest average premium at $4,093, up +20% YoY.

Nationwide, car insurance costs have already risen +$759, or +49%, since 2021.

Car ownership costs have never been higher.

Nov 8, 2025 · 5:44 PM UTC