Escaped the Vampire Squid, surviving in the wasteland. Investing in bottlecaps, US UK EU & global assets. Also, jokes. Liking is not endorsing. Do your own DD.

London

Joined March 2012

- Tweets 33,601

- Following 396

- Followers 124,478

- Likes 105,086

Pinned Tweet

H1 21 came to a close, and the #WastelandCapStash portfolio is now up 179.4% since last summer’s start and 42.2% YTD. The portfolio added 7.2 percentage points in June on a YTD basis.

Open positions below. (1/3)

Milestone: I’ve reached the 1-year anniversary of the #WastelandCapStash portfolio! 🥳 It’s up $165.3% in USD since start a year ago. The starting $1m is now $2.65m. It’s +35.0% YTD.

You can click through these tweets to see it from the start. Open positions below (1/4)

Rather than the AI-driven efficiency savings we were promised, many (or even most) tech and non-tech companies reporting this quarter have announced major increases in expenses due to “AI investments”…

Great for shareholders of the cloud vendors, not so great for everyone else!

Square / Block now back at $60 after these earnings… same level as early 2018.

In the meantime, Dorsey has paid out $7.6bn in stock compensation.

If you worked there, you’ve done extremely well. If you owned it… not so much. Workers 1, Capitalists 0.

Guess why?

I’m basically lost for words here. Considering costs are largely fixed and rising, this SSS collapse has led to margins dramatically deteriorating at every level. They opened a few new stores, but can those stores ever even break even? They burned -$87m in cash this quarter!

$SG Sweetgreen? More like Sh*tgreen! Collapse in same store sales -9.5% in Q3, more than the -7.6% in Q2. Salad barf!🤮

Stock down -88% from exactly a year ago. Fund managers were buying this at $45+ per share for this then… and it now fell to $5.26.

$25 slop salads are OUT!

$DASH When you knew something didn’t smell right.

If you own a stock, you want to 100% understand what’s important for it. The 1-3 things that truly matter.

If you don’t, then you’re just flipping coins on faith, irrelevant data, or delusion.

Opinions are cheap, your hard-earned money is not.

The slowdown in user metrics didn’t match what management was saying about investing in user growth rather than monetisation. If you’re “investing” in more users, user metrics should be accelerating, not slowing down.

The whole story simply doesn’t mesh.

As a secondary issue, every other single financial and operational metric deteriorated sharply this quarter vs Q2. It painted a picture of an Owl running out of mice. Temporary or not? Who knows.

In a growth stock you want to be in the acceleration phase, not the slowdown.

Here’s what happened at $DUOL: A Bookings guide miss (Q4E +22% vs +33% Q3 and +41% in Q2) and and a Revenue guide which implied a slowdown to only +1.2% sequential growth in Q4. This is what mattered.

That’s bad news for a “growth” co trading at 78.5x ‘25 consensus earnings.

The OpenAI CFO implying she’s just an airhead because she doesn’t know when to use “backstop” is the funniest excuse for a blowback that I’ve seen for a while.

But let’s trust her with $1.3 trillion, and taxpayers subsidise it, why not. Word use is hard!

Bad vibes all around.

$NVO back at August lows and the real bear case hasn’t even happened yet.

Here’s some news: A dead cat bounce isn’t a turnaround. A turnaround is a turnaround.

If this business ever does better, we will see it.

Why not just buy businesses that are doing better, not worse?

AI-fatigue is setting after we had most of the Mag 7 reporting. People are in digestive mode after pigging out at the AI-stock buffet. Competing old and new narratives, product & earnings trends are fighting for precious space in the digestive system.

May get choppy for a while.

Most of these Restaurant stocks were trading at 35-100x+ forward P/E (!) just recently. Many still are.

They were valued at a massive premium to the Mag 7 and any comparable-growth stocks in tech & AI.

This is just a bubble deflating. Bubbles can’t be sustained indefinitely.

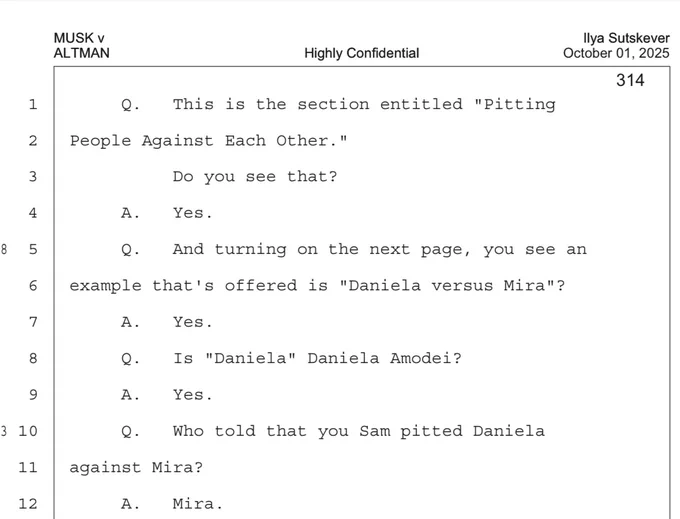

Some real Game of Thrones sh*t going on in the AI world.