Selective contrarian investor | The writer of the Capitalist-Letters newsletter read in +180 countries & Co-Founder @biggr_ai

Join +21,000 Readers →

Joined June 2023

- Tweets 24,305

- Following 473

- Followers 102,077

- Likes 34,265

Pinned Tweet

Premium subscription to my newsletter gets you:

- Over 50 equity research reports per year

- Membership to our Discord community

- Access to our outperforming portfolio

- Live support

- Q&A

Join with the link below:

capitalist-letters.com/

I have just published a deep dive on Duolingo.

The company is dominating its market, and it won't be disrupted by AI anytime soon.

Price? Not expensive, but not too cheap either.

Read it below, it’s free 👇

capitalist-letters.com/p/duo…

This is why $LMND is a $100 billion company in the making.

Legacy providers have no choice but to increase prices to keep up with rising costs due to their human-driven onboarding and claims processing. Their workforce is bloated and inefficient.

$LMND, on the other hand, processes 55% of all claims through AI, without any human supervision.

It will only increase as the models get better.

This delivers significant cost savings, allowing $LMND to charge way cheaper premiums than the competitors.

$LMND is coming for the whole market.

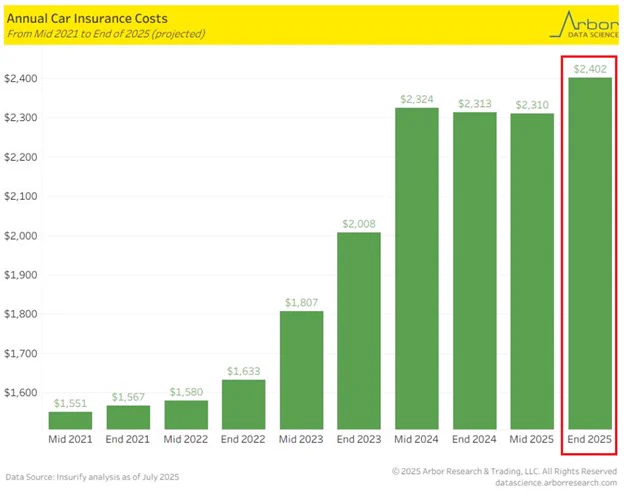

US car insurance costs are set to hit another record:

Average annual premiums are expected to rise +4% by the end of 2025 to a record $2,402.

The national average cost of full-coverage car insurance could climb as much as +7%, to $2,472.

Premiums are projected to surge at least +12% in Rhode Island, Michigan, Maine, Washington, D.C., and Delaware.

Meanwhile, Maryland holds the highest average premium at $4,093, up +20% YoY.

Nationwide, car insurance costs have already risen +$759, or +49%, since 2021.

Car ownership costs have never been higher.

Oguz O. | 𝕏 Capitalist 💸 retweeted

Charlie Munger: "If you're not willing to react with equanimity to a market price decline of 50%, you're not fit to be a common shareholder."

This is why everybody should hold $AXP in their portfolio.

Consumer sentiment dropped to the lowest level since 2008, but there is an exception..

It rose by 11% for the upper-class consumer with large stock portfolios.

$AXP customer base is largely made up of these people.

This is why it’s both recession and inflation proof.

In recession, upper-class people cut their spending less than the broader public. In inflation, basket size grows so do Amex’s commission dollars.

This is why Buffett isn’t touching $AXP, even though he’s reduced his other big positions over the past twelve months.

This is not good..

Unemployment jumps while the market is trading at historically high multiples, margin debt is at all-time highs, and affordability has dipped.

The government is ridiculously closed at this critical time.

Better to be defensive now rather than aggressive.

If this passes, $OSCR will print money next year.

Management said in the earnings call that they may have to pay rebates to members if ACA passes because they’ll be too profitable.

NEW: Schumer says Dems would vote to end the shutdown in exchange for a one-year extension of expiring ACA tax credits

GOP sens plan to huddle at 3:30pm, sources tell me

axios.com/2025/11/07/senate-…

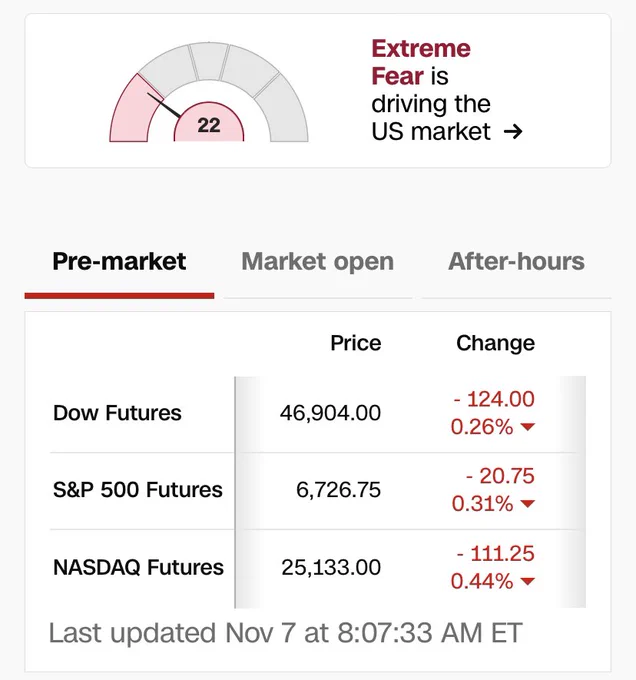

Buffett built the largest cash pile ever, and you thought the market would just keep shooting up?

Never doubt the old goat.

Futures are red again and extreme fear is controlling the market.

The market sentiment literally turned negative since people turned skeptical of AI spending.

I guess AI optimism was really what kept the rally alive so long.

OpenAI CFO:

> Compute grew 20x in 2 years

> It’ll grow 20x again in the next 2 years

> We need $2 trillion to grow it by 20x

> If it happens we’ll make $100 billion

Great pitch, if you want to lose money faster than Cathie Wood.

$SG

I was wrong thinking that it could pull off a turnaround story.

When you think you see an opportunity in a restaurant business, think twice.

They are simple businesses, easy to evaluate and predict.

So, if the market dislikes one of them, it’s probably for a good reason.

$NUAI just announced a $100 billion data center project.

Company’s market cap? $150 million.

Are we still not in a bubble?

New Era has secured a land option for 3,500 acres in NM to build a 7GW #AI data center hub - combining >2GW natural gas with 5+GW planned nuclear.

This is New Era’s first wholly owned development. Initial power delivery expected in 2028.

Read more: businesswire.com/news/home/2…

Bro, you are the CEO of the company.

Why are you trying to convince people on social media that you’ll make hundreds of billions in a few years?

Just execute and make us eat our words.

I guess he really has a habit of manipulation.

I would like to clarify a few things.

First, the obvious one: we do not have or want government guarantees for OpenAI datacenters. We believe that governments should not pick winners or losers, and that taxpayers should not bail out companies that make bad business decisions or otherwise lose in the market. If one company fails, other companies will do good work.

What we do think might make sense is governments building (and owning) their own AI infrastructure, but then the upside of that should flow to the government as well. We can imagine a world where governments decide to offtake a lot of computing power and get to decide how to use it, and it may make sense to provide lower cost of capital to do so. Building a strategic national reserve of computing power makes a lot of sense. But this should be for the government’s benefit, not the benefit of private companies.

The one area where we have discussed loan guarantees is as part of supporting the buildout of semiconductor fabs in the US, where we and other companies have responded to the government’s call and where we would be happy to help (though we did not formally apply). The basic idea there has been ensuring that the sourcing of the chip supply chain is as American as possible in order to bring jobs and industrialization back to the US, and to enhance the strategic position of the US with an independent supply chain, for the benefit of all American companies. This is of course different from governments guaranteeing private-benefit datacenter buildouts.

There are at least 3 “questions behind the question” here that are understandably causing concern.

First, “How is OpenAI going to pay for all this infrastructure it is signing up for?” We expect to end this year above $20 billion in annualized revenue run rate and grow to hundreds of billion by 2030. We are looking at commitments of about $1.4 trillion over the next 8 years. Obviously this requires continued revenue growth, and each doubling is a lot of work! But we are feeling good about our prospects there; we are quite excited about our upcoming enterprise offering for example, and there are categories like new consumer devices and robotics that we also expect to be very significant. But there are also new categories we have a hard time putting specifics on like AI that can do scientific discovery, which we will touch on later.

We are also looking at ways to more directly sell compute capacity to other companies (and people); we are pretty sure the world is going to need a lot of “AI cloud”, and we are excited to offer this. We may also raise more equity or debt capital in the future.

But everything we currently see suggests that the world is going to need a great deal more computing power than what we are already planning for.

Second, “Is OpenAI trying to become too big to fail, and should the government pick winners and losers?” Our answer on this is an unequivocal no. If we screw up and can’t fix it, we should fail, and other companies will continue on doing good work and servicing customers. That’s how capitalism works and the ecosystem and economy would be fine. We plan to be a wildly successful company, but if we get it wrong, that’s on us.

Our CFO talked about government financing yesterday, and then later clarified her point underscoring that she could have phrased things more clearly. As mentioned above, we think that the US government should have a national strategy for its own AI infrastructure.

Tyler Cowen asked me a few weeks ago about the federal government becoming the insurer of last resort for AI, in the sense of risks (like nuclear power) not about overbuild. I said “I do think the government ends up as the insurer of last resort, but I think I mean that in a different way than you mean that, and I don’t expect them to actually be writing the policies in the way that maybe they do for nuclear”. Again, this was in a totally different context than datacenter buildout, and not about bailing out a company. What we were talking about is something going catastrophically wrong—say, a rogue actor using an AI to coordinate a large-scale cyberattack that disrupts critical infrastructure—and how intentional misuse of AI could cause harm at a scale that only the government could deal with. I do not think the government should be writing insurance policies for AI companies.

Third, “Why do you need to spend so much now, instead of growing more slowly?”. We are trying to build the infrastructure for a future economy powered by AI, and given everything we see on the horizon in our research program, this is the time to invest to be really scaling up our technology. Massive infrastructure projects take quite awhile to build, so we have to start now.

Based on the trends we are seeing of how people are using AI and how much of it they would like to use, we believe the risk to OpenAI of not having enough computing power is more significant and more likely than the risk of having too much. Even today, we and others have to rate limit our products and not offer new features and models because we face such a severe compute constraint.

In a world where AI can make important scientific breakthroughs but at the cost of tremendous amounts of computing power, we want to be ready to meet that moment. And we no longer think it’s in the distant future. Our mission requires us to do what we can to not wait many more years to apply AI to hard problems, like contributing to curing deadly diseases, and to bring the benefits of AGI to people as soon as possible.

Also, we want a world of abundant and cheap AI. We expect massive demand for this technology, and for it to improve people’s lives in many ways.

It is a great privilege to get to be in the arena, and to have the conviction to take a run at building infrastructure at such scale for something so important. This is the bet we are making, and given our vantage point, we feel good about it. But we of course could be wrong, and the market—not the government—will deal with it if we are.

If you want to avoid catastrophic losses in the market, here is my two cents:

Don’t follow people who use buzzwords to describe companies:

- AI Operating System

- Not Dying As a Business

- SuperApp/Everything App

That’s a salesman’s habit, nothing a serious investor does.

$DUOL

When your sequential growth drops from 10% to 1% in a year, that’s a problem.

It’s an even bigger problem if your business may be disrupted by AI.

Of course, it can reaccelerate from here, but this profile doesn’t deserve 50x fwd earnings.

I’ll be interested under $160.

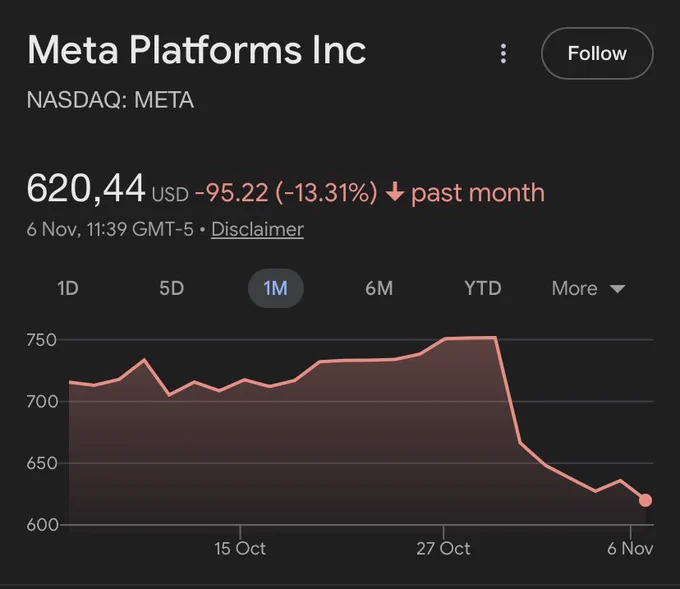

$META

There will be pain.

You can’t just use all your cash, take a $30 billion off–balance-sheet loan, and get away with it.

Zuck is great but he has a habit of reckless spending on what he sees as an opportunity.

Remember metaverse?

We’ll wait and buy below $570.

🚨JUST IN: $OSCR EARNINGS

Revenue: $2.98bn vs. $3.08bn est. ❌

EPS = -$0.53 vs. -$0.58 est. ✅

FY 2025 guidance reaffirmed.

Revenue miss is inconsequential, it’s just 3% lower.

What’s important is narrower than expected loss.

This will be a $30 stock soon!