At Heylows, we're more than just a company; we're a community of innovators, thinkers, and doers committed to making a difference.

Remote

Joined March 2022

- Tweets 21

- Following 296

- Followers 38

- Likes 0

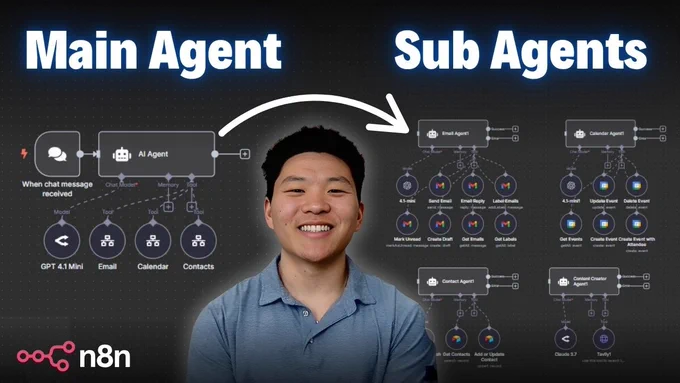

Have you tried using a multi agent system yet?

In this video, @nateherk shows how an orchestrator agent can coordinate multiple AI agents inside n8n to handle complex tasks. Each agent focuses on a specific job while the orchestrator figures out what to run and when.

Smarter, faster, and easier to manage. 👉🏻 bit.ly/4qKreLQ

🚀 Introducing AI Workflow Builder (Beta) - Turn prompts into living workflows.

Generate nodes, logic, and structure from text, then shape and ship your vision faster. Rolling out this week to n8n Cloud (Trial, Starter, Pro).

Update to v.1.116.0 to try it.

Learn more: bit.ly/4nL2kcJ

Heylows retweeted

Enoki 2.0 is here.

New site. New pricing (we heard you).

💧 Portable zkLogin wallets

💧 SuiNS for all teams

💧 Basic RPC + Enoki Connect

💧 Seal access mgmt (free for now)

1400+ teams already building. Your app’s next.

Jump in 👇

enoki.mystenlabs.com

Heylows retweeted

Introducing Tongyi Fun – Alibaba’s enterprise-grade audio foundation model.

Powered by Fun-ASR and Fun-CosyVoice it advances voice AI beyond “hearing and speaking” to truly understand context, transcribe with high accuracy, and speak with natural expressiveness—even in complex enterprise environments.

✅ Understands deeply: Trained on tens of millions of hours of real-world audio, with industry-specific terminology across finance, tech, manufacturing, and more.

✅ Transcribes accurately: A context-enhanced architecture with RAG minimizes errors, hallucinations, and cross-language interference.

✅ Speaks expressively: Delivers natural, stable, multilingual speech synthesis with cross-lingual voice cloning.

Heylows retweeted

Introducing VaultGemma, the largest open model trained from scratch with differential privacy. Read about our new research on scaling laws for differentially private language models, download the weights, & check out the technical report on the blog →goo.gle/46fUSiq

APIs are evolving into context aware services.

Model Context Protocol and microservices together enable persistent memory, semantic context, and coordinated interactions.

Key ideas:

• Context aware tools instead of stateless APIs

• Memory that agents and services can share

• Extending existing microservices with context layers

Read more: heylows.com/post/from-apis-t…

📣 It’s a very special day here at Replit- we are proud to introduce Agent 3, our most autonomous Agent yet 🔥

What's new with Agent 3:

⚡️Tests & fixes the App it builds automatically using a browser- checking buttons, forms, links and APIs.

⏲️Runs for 200+ mins autonomously as it is building, testing and fixing your app- eliminating the need for manual oversight.

⚙️Builds Agents and automations to automate complex & repetitive tasks. You can now build Slack or Telegram bots or workflow automations integrated with Notion, Linear, Sharepoint, Dropbox & more in plain English.

Agent 3 starts rolling out to all users today. More details on whats launching today below 👇

Heylows retweeted

You can now use custom commands in Cursor! We’ve seen these work particularly well for reusable prompts within our team.

Cursor 1.6 also includes a faster and more reliable Agent terminal, support for MCP Resources, and a /summarize command.

We’re releasing GPT-5-Codex — a version of GPT-5 further optimized for agentic coding in Codex.

Available in the Codex CLI, IDE Extension, web, mobile, and for code reviews in Github. openai.com/index/introducing…

Heylows retweeted

AI on Sui: Ecosystem Showcase x.com/i/broadcasts/1lPJqvgpA…

Heylows retweeted

3 sponsors walking into Sui Builder House: APAC with gold-tier swagger 🥇

@WalrusProtocol: the global data layer for AI, media, DeFi, and beyond - full control, full composability.

@Scallop_io: the next-gen money market on Sui, built for security, speed, and serious scale.

@bluefinapp: the pro-grade onchain exchange making orderbooks click for everyone.

Sept 25. Seoul. Be there.

luma.com/BuilderHouseAPAC

Heylows retweeted

SuiFest doesn’t run on vibes alone 🌀

It runs on real-time oracles, lightning-fast swaps, and DeFi magic.

💎 Diamond sponsors

@AlphaFiSUI - innovating DeFi on Sui

@PythNetwork - market data onchain, straight from the source

❇️ Platinum sponsor

@DipCoinOfficial - a high-performance DEX on Sui

Heylows retweeted

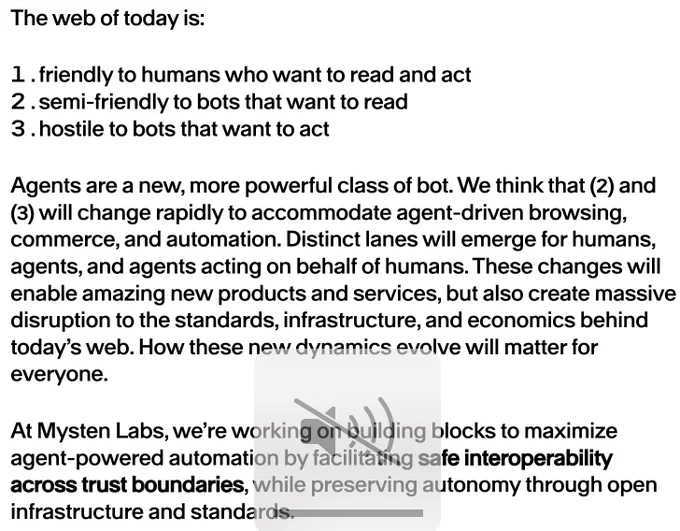

This is what the future of Web(3) looks like.

@b1ackd0g’s piece explains how we’ll be approaching agent payments with @Google and the other launch partners.

What's next for crypto? @aeyakovenko live at the All-In Summit on quantum, AI, and the future of money

(0:55) Stablecoin supercycle? Why the internet may become the largest holder of U.S. treasuries

(3:09) Solana executes, and execution is where the money’s made

(5:56) Regulated exchanges like NASDAQ vs. Solana

(10:02) Emerging crypto verticals: social, IP, and real-world assets

(13:41) Founding a crypto company in America and the CLARITY Act

(15:57) Quantum computing and AI's impact on crypto

(18:49) Bitcoin’s growth, resiliency, and potential risks

(22:45) Ethereum, Visa, Mastercard vs. Solana

Old Wealth vs. New Wealth: The Crypto Age Transformation

The global economy is undergoing a profound transformation, driven by the rise of cryptocurrencies and blockchain technology. Traditionally, wealth has been concentrated in physical assets like real estate, precious metals, and stocks, held and managed by centralized institutions. This 'old wealth' has been the bedrock of the financial landscape for centuries, with a focus on stability and gradual growth. However, the emergence of 'new wealth' built on cryptocurrencies, decentralized finance (DeFi), and digital assets is disrupting this status quo, offering a radically different approach to wealth creation and management. This new approach, in stark contrast to the old, emphasizes accessibility, innovation, and transparency.

Here are some thoughts on how the crypto age is reshaping wealth, transferring value from old systems to new ones, and reevaluating how wealth is accumulated, preserved, and shared.

The Foundations of Old Wealth

For generations, wealth accumulation revolved around tangible assets and traditional investment vehicles:

•Real Estate: A cornerstone of stability, offering long-term appreciation and generational security.

•Precious Metals: Gold and silver have been historical symbols of wealth and financial safety nets.

•Stocks and Bonds: Investments in public and private markets provided steady returns, often managed by trusted financial institutions.

Old wealth relied heavily on centralized systems, including banks, investment firms, and governments, to facilitate transactions, enforce contracts, and manage risks. These institutions served as gatekeepers, controlling access to capital and investment opportunities.

The Rise of New Wealth

In stark contrast, new wealth is generated in decentralized, technology-driven ecosystems. Cryptocurrencies like Bitcoin and Ethereum, tokenized assets, and blockchain platforms have introduced a new paradigm:

•Decentralization: Wealth is no longer tied to centralized entities. Blockchain enables peer-to-peer transactions without intermediaries.

•Borderless Finance: Cryptocurrencies operate globally, removing geographical barriers and democratizing access to financial systems.

•Rapid Wealth Creation: Early adopters of Bitcoin and Ethereum and innovators in DeFi and NFTs (non-fungible tokens) have generated significant wealth quickly.

This new form of wealth challenges traditional systems, often bypassing the institutions that have historically controlled financial transactions.

The Democratization of Wealth

One of the most significant shifts in the crypto age is the democratization of financial systems. Previously, wealth creation required access to capital, connections, and institutional support. Cryptocurrencies and DeFi platforms, on the other hand, empower anyone with internet access to participate in global financial markets, inspiring a sense of hope and possibility.

Breaking Barriers

DeFi platforms like Uniswap, Aave, and Compound enable users to lend, borrow, and trade assets without relying on banks. Smart contracts automate transactions, ensuring transparency and reducing costs.

This accessibility is particularly transformative for individuals in emerging markets where traditional banking infrastructure may be underdeveloped. Cryptocurrencies provide a way to store and transfer wealth, participate in the global economy, and protect against currency devaluation.

Intergenerational Wealth Transfer

The transfer of wealth from one generation to the next has always been a complex process. In the crypto age, this dynamic becomes even more intricate, presenting challenges and opportunities that must be carefully navigated.

Challenges in Crypto Inheritance

1.Private Key Management: Cryptocurrencies rely on private keys for access. Losing these keys means losing access to the assets, posing a significant risk in inheritance planning.

2.Volatility: Crypto assets can experience dramatic price fluctuations, complicating valuation and estate planning.

3.Regulatory Uncertainty: Laws governing digital assets vary across jurisdictions, challenging creating a unified inheritance strategy.

Opportunities for Integration

Many high-net-worth individuals are beginning to include cryptocurrencies in their estate plans. Tools such as digital safes, hardware wallets, and blockchain-based wills are becoming more common, ensuring that digital assets are securely transferred to heirs.

The Rise of New Wealth Creators

Cryptocurrency has enabled the rise of a new class of wealthy individuals:

•Early Adopters: Those who invested in Bitcoin or Ethereum in their early days have seen exponential returns.

•DeFi Entrepreneurs: Innovators creating decentralized platforms build immense wealth by disrupting traditional financial systems.

•NFT Creators and Collectors: Artists, developers, and investors in the NFT space have found lucrative opportunities by leveraging blockchain technology for art, music, and digital collectibles.

These new wealth creators often prioritize innovation, high-risk investments, and global impact over the conservative strategies typical of old wealth.

The Role of Regulation

Regulation is critical in the transition from old wealth to new wealth. Governments worldwide are working to establish rules for cryptocurrencies and blockchain systems. While regulation can provide stability and legitimacy, it also poses challenges:

•Old Wealth's Caution: Many traditional investors hesitate to embrace crypto due to its regulatory uncertainty.

•New Wealth's Advantage: Crypto enthusiasts often thrive in regulatory gray areas, leveraging their agility and tech-savvy to navigate evolving landscapes.

As governments introduce clearer frameworks, crypto integration into traditional wealth systems will likely accelerate.

Collaboration and Coexistence

While old and new wealth may appear to be at odds, the reality is that collaboration is becoming increasingly common. Traditional financial institutions are incorporating blockchain technology into their operations, offering crypto investment products and tokenized assets. At the same time, crypto entrepreneurs diversify their portfolios by investing in traditional assets, such as real estate and equities. This trend underscores the evolving nature of the financial landscape, where old and new wealth can coexist and even complement each other.

A Future of Blended Wealth

Transferring wealth from old systems to new ones is not a zero-sum game. Instead, it represents an evolution in how wealth is created, managed, and distributed. As cryptocurrencies gain mainstream acceptance and regulatory clarity, the lines between old and new wealth will continue to blur.

In the crypto age, the future of wealth is being rewritten. The combination of traditional financial stability and blockchain technology innovation offers the potential for a more inclusive, efficient, and dynamic global economy.

The question isn't whether old wealth will adapt to the crypto age; it's how quickly and effectively this transformation will unfold. One thing is certain: the future belongs to those who embrace change and leverage the best of both worlds.