The SEC’s decentralization framework has been corrupted and used to persecute builders —incentivizing rug pulls over value creation.

It’s time to fix it.

Decentralization should mean the absence of control, not the suppression of ongoing efforts.

Here’s how and why👇

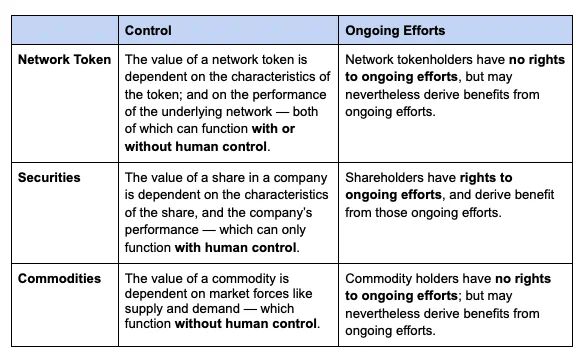

Network tokens — tokens that derive substantial value from the operation of a blockchain (eg BTC, ETH, SOL) — can have embedded trust dependencies that result in information asymmetries.

Where those trust dependencies are minimized, network tokens look like commodities with low information asymmetry risk.

Where those trust dependencies are significant, network tokens can look like securities with high information asymmetry risk — supporting the use of disclosures requirements under securities laws.

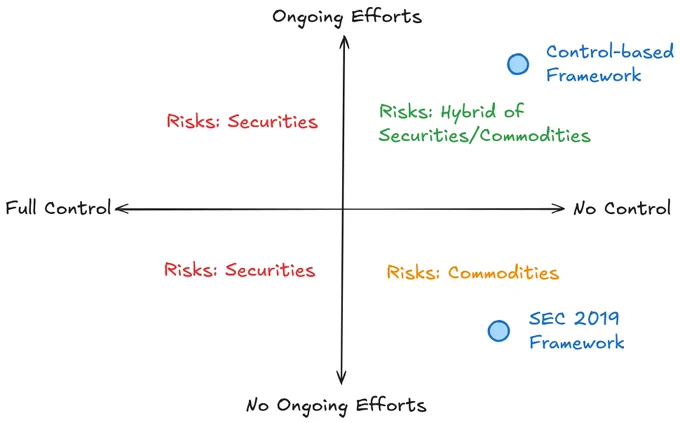

The two primary trust dependencies relating to network tokens are: (1) control and (2) ongoing efforts.

The SEC’s 2019 Decentralization Framework sought to eliminate the risk of information asymmetries by defining decentralization to mean the absence of BOTH control and ongoing efforts. Their reasoning was clear — where network tokens were “sufficiently decentralized” tokens functioned more like commodities.

But this is the wrong approach!

It’s created significant perverse incentives — builders can actually reduce their regulatory risk by abandoning their projects or by masking their ongoing efforts (“decentralization theater”).

Builders HATE this conception of decentralization.

We need to incentivize builders, not hinder them. A better two-pronged approach can achieve this:

1⃣Decentralization should be redefined as “the absence of control.” This eliminates significant risk and preserves one of the core features of blockchains – they can function without human control.

2⃣A targeted and light touch disclosure framework can be used to eliminate information asymmetries that might arise from ongoing efforts.

Collectively, this approach would foster innovation and protect users – ensuring decentralization empowers builders rather than being weaponized against them.

Full article linked below.

Feb 13, 2025 · 6:56 PM UTC